Despite Profitability Concerns, Interest Income 'Holds Up'

Portfolio Strengthened by Acquisition of Ajou Capital

Reference image=Yonhap News

Reference image=Yonhap News

[Asia Economy Reporters Kangwook Cho, Hyojin Kim] Woori Financial Group announced on the 26th that it achieved a net profit of 480 billion KRW in the third quarter of this year. This represents more than double the amount compared to the previous quarter. Woori Financial explained that this result was due to improved financial environment adaptability through efforts to enhance the revenue structure and manage soundness, combined with the outcomes of mergers and acquisitions (M&A) conducted after transitioning to a holding company.

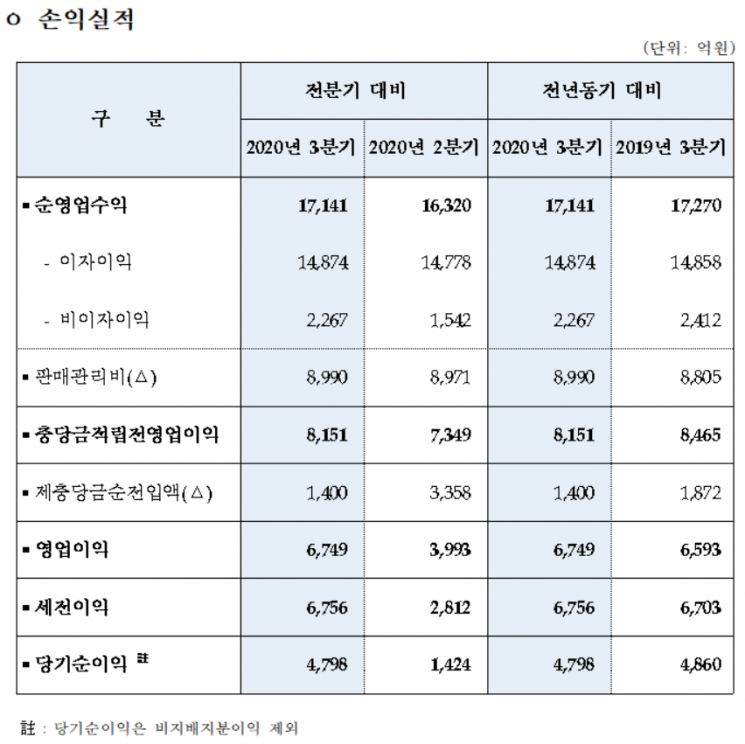

The net operating income, composed of interest income and non-interest income, reached 1.7141 trillion KRW, a 5.0% increase from the previous quarter. Despite concerns over profitability decline due to two base rate cuts in the first half of the year, interest income rose by 0.6% from the previous quarter to 1.4874 trillion KRW. The third-quarter consolidated net profits by major subsidiaries were 480.7 billion KRW for Woori Bank, 27.8 billion KRW for Woori Card, and 18.7 billion KRW for Woori Comprehensive Financial.

Woori Financial stated that this was the result of revenue structure improvement achieved through continued loan growth centered on small and medium-sized enterprises and an increase in core low-cost deposits. Additionally, non-interest income reached 226.7 billion KRW in the third quarter, recovering business capabilities despite the elevation of social distancing to level 2.5, with increases in foreign exchange/derivatives-related profits.

In terms of asset soundness, the non-performing loan (NPL) ratio was maintained at 0.40%, and the delinquency ratio at 0.32%, achieving industry-leading soundness indicators even amid the COVID-19 crisis.

In particular, the high-quality asset ratio of 86.9% and the NPL coverage ratio of 152.7% were also stably maintained. Considering the provisions accumulated in the first half of the year to strengthen future economic resilience, Woori Financial’s future soundness trend is expected to remain stable.

The Basel III capital adequacy ratio (BIS ratio) also improved to around 14% by early adoption of the final Basel III framework following the supervisory authority’s approval of the internal ratings-based approach in June, enhancing the capacity to cope with uncertain financial environments.

Interest Income Holds Up Despite Profitability Concerns

Portfolio Strengthened by Acquisition of Aju Capital

Woori Financial Group held a board meeting on the 23rd and resolved to acquire management rights of Aju Capital. Upon acquisition, Aju Savings Bank, a 100% subsidiary of Aju Capital, will be incorporated as a grandchild subsidiary.

Along with subsidiaries newly incorporated last year, the business portfolio lineup will be further strengthened, and Woori Financial expects that the contribution of non-bank sectors to profit and loss will expand through synergy among group subsidiaries. Furthermore, through portfolio expansion, it is anticipated that the group can enhance its social role in finance by providing broad financial services such as loans for vulnerable small businesses and low-income groups, in addition to financial performance.

Aju Capital is a company with a large proportion of automobile financing and ranks 8th in the industry. As of the end of June, based on consolidated financial statements, it recorded total assets of 7.5469 trillion KRW and net profit of 61.8 billion KRW. Woori Financial attempted to acquire Aju Capital in the first half of this year but was delayed due to reasons such as approval for changes in the internal ratings-based approach. Among the top five financial groups, Woori Financial was the only one without a capital company and a savings bank.

A Woori Financial official said, "Considering the ongoing uncertainty in the domestic financial environment due to COVID-19, we will focus on strengthening the group’s fundamentals by upgrading solid fundamentals and enhancing synergy among business portfolios within the group."

He added, "With the sense of crisis that 'digital innovation is a matter of survival for the group,' and with resources related to digital innovation being efficiently allocated within the group, and Chairman Sohn Tae-seung personally overseeing the group’s digital division, Woori Financial’s digital innovation will be promoted with greater speed going forward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)