Korea Insurance Research Institute

'Income Polarization Among Insurance Agents and Future Challenges' Report

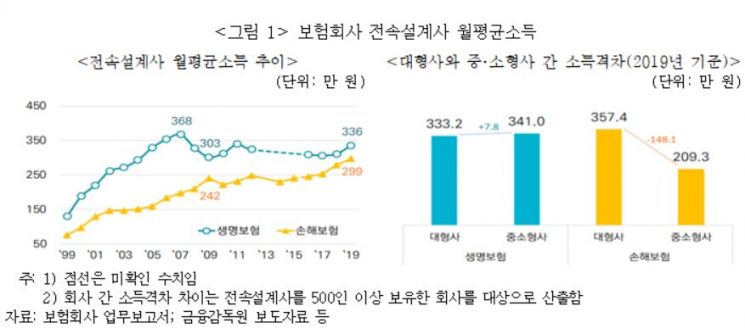

Average Monthly Income of Life Insurance Agents 3.36 Million KRW, Non-Life Insurance Agents 2.99 Million KRW

[Asia Economy Reporter Ki Ha-young] Income polarization among insurance planners is intensifying. With the growth of non-face-to-face channels and the impact of the novel coronavirus disease (COVID-19), the income gap between planners is expected to widen, highlighting the need for countermeasures.

According to the report "Income Polarization Phenomenon of Planners and Future Tasks" published on the 25th in the 'KIRI Report' by the Korea Insurance Research Institute, as of last year, the average monthly income of exclusive insurance planners in life insurance and non-life insurance companies was 3.36 million KRW and 2.99 million KRW, respectively. Over the past 10 years, the annual average growth rate was 1.0% for life insurance and 2.1% for non-life insurance, indicating that while life insurance planners' income has stagnated, the income gap between sectors is narrowing.

The income distribution of insurance planners shows a polarized "U-shaped" pattern with high proportions in both low-income and high-income brackets. This is because planners' income is determined by individual performance. Looking at the monthly income distribution of life insurance and non-life insurance planners, those earning over 5 million KRW accounted for 21.1% and 20.1%, respectively, the largest groups, while those earning less than 1 million KRW accounted for 26.4% and 26.2%, respectively.

The report analyzes that this polarized income distribution is due to a relationship-based sales method and an aging sales workforce. Most planners initially achieve a certain level of sales performance through acquaintance-based sales, but if they fail to secure additional customers over time, their income decreases, eventually leading them to leave the sales organization. Additionally, since most planners are composed of older age groups, there are limitations in establishing contact with younger customers and gaining their empathy.

The report points out concerns that due to social and environmental changes such as the growth of non-face-to-face channels and the deterioration of face-to-face sales environments caused by COVID-19, the income gap among planners may widen and income polarization may become entrenched. Under strengthened social distancing measures, planners face limitations in frequent face-to-face contact with customers as in the past, which may have a greater impact on new planners than on existing sales personnel.

Therefore, insurance companies are advised to change the way they train new planners and generate customers. Kim Dong-gyeom, a research fellow at the Korea Insurance Research Institute, said, "If insurance companies induce reorganization into high-efficiency organizations by supporting capacity building for new and low-efficiency planners, it will be possible to alleviate income polarization among planners and promote planner retention and productivity improvement." He added, "Furthermore, if the proportion of market pioneering sales based on consumer demand expands, it is expected to create a stable income flow for planners as well as build a positive image of the insurance industry and consumer trust."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.