[Asia Economy Reporter Park Sun-mi] The banking sector has entered the third-quarter earnings announcement season. Following the third-quarter earnings announcements by KB Financial and Hana Financial on the 22nd and 23rd respectively, Woori Financial is scheduled to announce its third-quarter earnings on the 26th, and Shinhan Financial on the 27th.

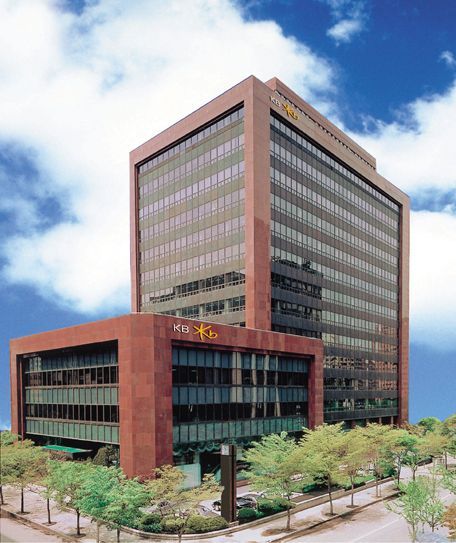

According to the banking sector on the 25th, KB Financial and Hana Financial, which announced their earnings earlier, greatly benefited from the strong performance of their non-banking divisions. KB Financial reported quarterly earnings exceeding 1 trillion won for the first time in history.

KB Financial's third-quarter net profit was 1.1666 trillion won, an 18.8% increase compared to the previous quarter. This was influenced by steady growth in net interest income and net fee income, a base effect from the proactive additional loan loss provisions made in the second quarter (approximately 149 billion won after tax), and a bargain purchase gain of 145 billion won related to the acquisition of Prudential Life Insurance.

Within KB Financial, KB Kookmin Bank's third-quarter net profit was 635.6 billion won, a 3.8% decrease from the previous quarter. The cumulative net profit also declined by 6.2% year-on-year to 1.8824 trillion won. Despite solid interest income growth based on loan growth and the acquisition of the Cambodian microfinance institution Prasac, the bank was affected by the additional loan loss provisions (approximately 115 billion won after tax) set aside in the second quarter reflecting a conservative future economic outlook.

However, during a period when declining interest rates burdened the profitability of banking operations, securities showed remarkable earnings growth.

KB Securities' third-quarter net profit was 209.7 billion won, a 39.6% increase from the previous quarter. The cumulative net profit for the first three quarters was 338.5 billion won, up 50.6% year-on-year. This was influenced by a significant increase in securities commission income, including an approximately 244 billion won increase in custody fees due to efforts to expand customer assets under custody, and an approximately 29 billion won increase in investment banking (IB) fees driven by active expansion and support of the IB business.

KB Kookmin Card recorded a third-quarter net profit of 91.4 billion won. The disappearance of special factors such as additional loan loss provisions (approximately 23 billion won after tax) made in the second quarter, along with improved asset quality due to declining delinquency rates on high-risk assets such as card loans, led to a decrease in credit loss provisions, resulting in an 11.9% increase compared to the previous quarter.

Hana Financial also posted notable third-quarter earnings, buoyed by the strong performance of its non-banking sector.

Hana Financial's third-quarter net profit was 760.1 billion won. Although this was a 9.1% decrease compared to the same period last year, it increased by 10.3% from the previous quarter. This result was achieved despite unfavorable external conditions such as the impact of COVID-19, thanks to the strong performance of the non-banking division (659.7 billion won) and the expansion of business foundations through non-face-to-face channels. The contribution of the non-banking division to Hana Financial's earnings reached 31.3%.

Hana Bank, a core affiliate, recorded a cumulative net profit of 1.6544 trillion won through the third quarter. This was a 7.6% decrease compared to the same period last year, affected by the disappearance of last year's major one-time gain from the sale of the Myeongdong building. The third-quarter net profit was 591.4 billion won, a 22.18% decrease year-on-year, but a 16.3% increase compared to the previous quarter.

On the other hand, the non-banking sector posted strong results.

Hana Financial Investment recorded a consolidated net profit of 288 billion won for the first three quarters, a 36.2% increase year-on-year, driven by increased fee income. This is attributed to the stock investment boom led by individual investors known as Donghak Ants. Hana Card also recorded a cumulative consolidated net profit of 114.4 billion won, a 129.6% increase year-on-year, due to increased credit card fees. Hana Capital achieved a cumulative consolidated net profit of 127.1 billion won, a 65.2% increase year-on-year, supported by growth in interest income from increased interest-bearing assets.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)