SiGene, Samsung Electronics, and Other Blue-Chip Large-Cap Stocks See Increased Investment Proportion

Stock Price Rise Impact, Ratio of Low-Soundness Accounts Drops from 35% to 26%

[Asia Economy Reporter Minji Lee] The Financial Supervisory Service announced on the 25th that the proportion of accounts with a high risk of forced liquidation has decreased as the index has shown a recovery trend since March. However, as the tendency to invest in stocks using margin loans is spreading, it advised that trading should be conducted within a manageable range considering repayment ability and expenditure plans.

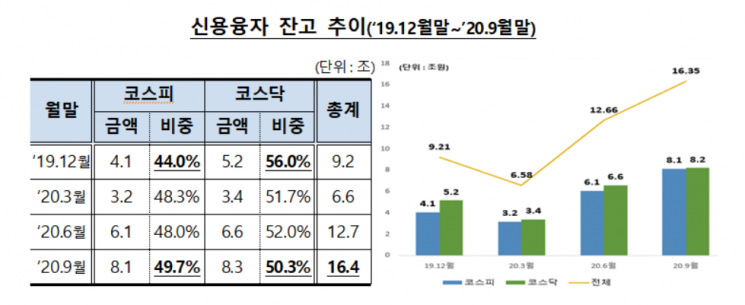

As of the end of last month, the outstanding balance of margin loans for individual investors' stock investments was 16.4 trillion KRW, marking the highest level of the year since the sharp stock price drop in March. Margin loan balance refers to loans provided to individual investors for stock purchase funds.

The proportion of margin loan balances related to KOSPI increased from 44% at the end of last year to 49.7% last month. The proportion of margin loan balances for KOSDAQ stocks decreased from 56% to 50.3% during the same period.

Individuals tend to invest mainly in blue-chip and large-cap stocks when trading on margin, considering the risk of stock price declines. Among companies producing COVID-19 diagnostic kits, whose market capitalization and trading volume surged after the outbreak of the novel coronavirus (COVID-19), the net increase in margin loans was the largest. Seegene's margin loan balance increased by about 357.8 billion KRW from early this year to the end of last year. This was followed by Samsung Electronics (234.1 billion KRW), Celltrion Healthcare (202.0 billion KRW), Kakao (186.2 billion KRW), and LG Chem (168.8 billion KRW).

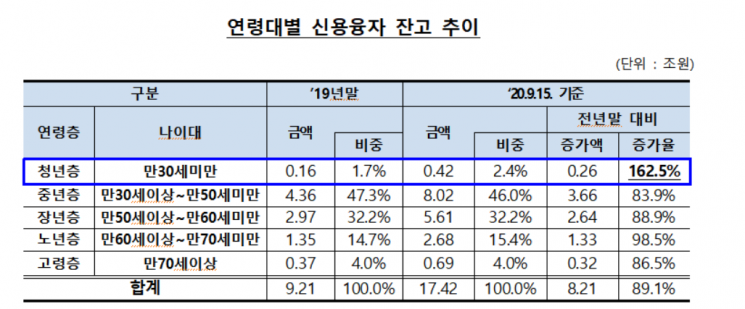

By age group, the scale of margin loans expanded across all age groups, with the youth group (under 30 years old) showing a high margin loan growth rate of 162.5%. The increase in margin loans for the youth group (260 billion KRW) accounted for about 3.2% of the total margin loan increase (8.21 trillion KRW).

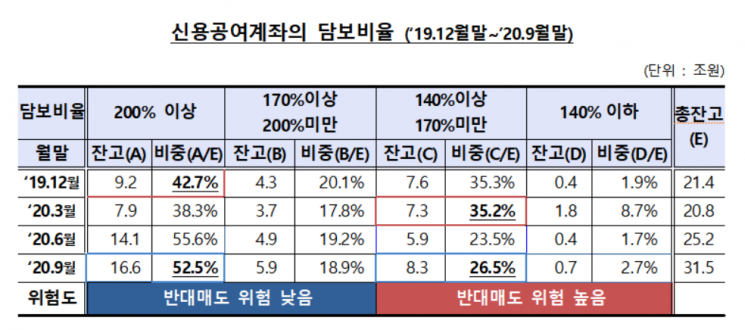

Regarding the soundness of margin loan accounts, the proportion of accounts with a collateral ratio of 200% or higher was about 52.5% at the end of last month, an increase of 9.75% compared to the end of last year (42.75%). The collateral ratio is calculated by dividing the evaluated value of collateral assets by the margin loan balance.

The proportion of accounts with a high possibility of forced liquidation decreased from 35.3% in March last year to 26.5% at the end of last month due to stock price increases. Accounts with a high possibility of forced liquidation are those with a collateral ratio of 170% or less, indicating a relatively high risk of forced liquidation execution (collateral maintenance ratio 140% or less).

Forced liquidation peaked in March with an average daily forced liquidation amount and number of accounts reaching 1,624 accounts and 17.9 billion KRW, respectively, after which it declined. However, since June, the amount and number of forced liquidations have been on the rise again.

As for the delinquency rate of margin loans, it recorded 0.44% as of the end of August, and the bad delinquency rate was 0.29%, slightly lower than last year. The margin loan delinquency rate refers to unpaid amounts arising when the margin loan amount exceeds the forced liquidation amount of held stocks and margin loans that have not been repaid by the due date without extension. The bad delinquency rate refers to non-performing assets that are difficult to recover and are treated as losses among delinquent balances.

In response, the Financial Supervisory Service stated that stock investment using loans carries significant risks and investors should exercise caution. The Financial Supervisory Service explained, “Investors using margin trading should frequently check the collateral maintenance ratio to prevent investment losses from the arbitrary disposal of held stocks in advance,” and “Since securities companies apply differentiated interest rates on margin loans compared to bank credit loans depending on the period, investors should carefully decide whether to invest in stocks.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.