Large-Scale Direct Purchase of Government Bonds in the Primary Market Continues

Increased Possibility of Government Officials Participating in Monetary Policy Decisions

"Government Intervention in Monetary Policy Returns to Pre-Foreign Exchange Crisis Era"

Currency Value Plummets Amid Uncertainty, Foreign Bond Investment Drops Sharply

[Asia Economy Reporter Kim Eunbyeol] In Indonesia, following the central bank's direct purchase of government bonds after the COVID-19 pandemic, controversy is growing as the country is now considering amending the central bank law. This is because the central bank is supporting the government's finances, which have become more burdensome since COVID-19, and government officials are participating in monetary policy meetings, raising concerns about a significant erosion of independence.

According to the International Finance Center and Bloomberg News on the 24th, Bank Indonesia (BI) agreed in July to a "debt-sharing" principle, under which the central bank would cover $40 billion (about 71 trillion KRW) of the additional $63 billion fiscal financing needs caused by COVID-19. Since then, the central bank has been conducting large-scale direct purchases of government bonds in the issuance market, amounting to 3.5% of the gross domestic product (GDP) and 64% of the second half's bond issuance volume. At the time, the central bank governor stated that this was a one-time measure in an emergency situation due to COVID-19, but uncertainty increased after President Joko Widodo mentioned that the central bank's financial support could continue until 2022.

To make matters worse, since last month, the Indonesian parliament has been reviewing a bill that includes expanding the central bank's role (from exchange rate stabilization to encompassing economic growth and employment support) and allowing officials from the Ministry of Finance and Ministry of Economy to participate in monetary policy meetings with voting rights. This effectively strengthens government control over monetary policy and the financial sector.

Bloomberg News reported, "Typically, amending the law takes one to two years, but there is a possibility of a rapid legislative order being issued under the speaker's authority."

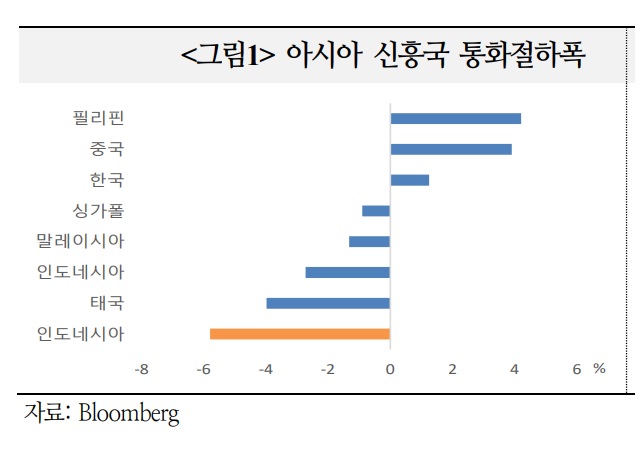

As the government intervenes in monetary policy and uncertainty grows, the Indonesian rupiah has depreciated by 5.4% this year, showing the weakest performance among Asian currencies. The proportion of foreign holdings in bonds has dropped to the lowest level since 2010 (27%), shrinking by more than 10 percentage points just this year.

The erosion of monetary policy independence could negatively impact foreign investment and credit ratings in Indonesia, where growth and fiscal soundness have weakened. Nomura Securities Japan stated, "The Indonesian government's intervention in monetary policy means a return to the pre-Asian financial crisis era," adding, "It is highly likely that the central bank's issuance power for fiscal support will continue and will directly affect capital flows." Fidelity also commented, "Indonesia's policy attempts appear to be a dangerous signal, and based on cases in emerging markets, these policies could lead to a loss of investor confidence."

The International Finance Center argued, "Indonesia's monetary policy is a very exceptional case among emerging markets, but if COVID-19 persists, other emerging countries cannot rule out the possibility of 'debt monetization,' so it is necessary to pay attention to related trends and side effects." 'Debt monetization' is a particularly taboo policy in emerging markets, but as COVID-19 prolongs, traditional monetary policy reaches its limits, and governments face situations where they must support finances, so other emerging countries cannot be complacent. Nomura pointed out that among Asian countries, India and Malaysia are likely candidates as followers behind Indonesia.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)