Despite Inflation Outlook... 10.25% Rate Freeze

"Loss of Central Bank Role, Reluctant to Raise Rates"

[Asia Economy Reporter Minji Lee] The Turkish central bank's decision to keep the benchmark interest rate unchanged has pushed the lira exchange rate to a record high. As monetary policy continues to diverge from market expectations, financial market instability is expected to worsen.

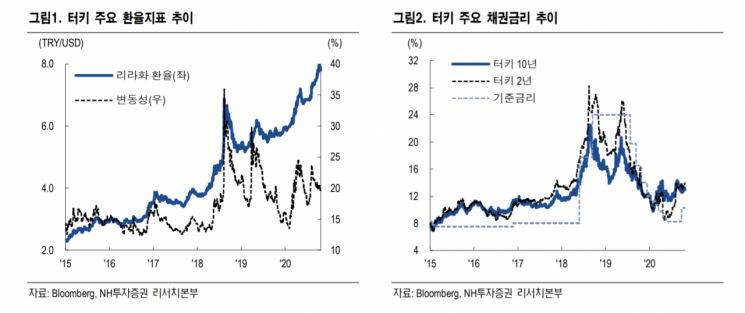

According to the financial investment industry and NH Investment & Securities on the 25th, despite the appropriateness of a benchmark interest rate hike, the Turkish central bank kept the rate at 10.25%. The liquidity window-call rate spread was also widened from the existing 150bp to 300bp. Initially, the market expected the Turkish central bank to raise the benchmark rate to 12%.

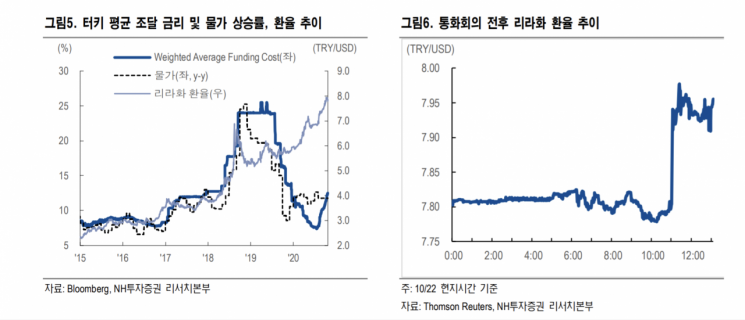

Seongsu Kim, a researcher at NH Investment & Securities, said, “The market expectation of a 100-200bp benchmark rate hike due to exchange rate and inflation increases was not met,” adding, “The exchange rate, which fluctuated around 7.78 lira against the dollar before the monetary policy meeting, rose to 7.97 lira after the meeting, setting a new record high.”

The recent statement included wording about adjusting the funding rate in addition to the benchmark interest rate. Since the beginning of the year, Turkey has partially replaced the role of the benchmark interest rate with the main funding rate. This aims to achieve indirect monetary policy effects through changes in the funding rate instead of the benchmark rate.

However, despite the sharp increase in the funding rate, it appears to have failed to stabilize the exchange rate. The central bank remains reluctant to raise the ‘benchmark interest rate’ due to loss of independence. Researcher Kim pointed out, “Considering the decline in market confidence, it is questionable whether this measure will be effective,” and added, “The response strategy continues to fall short of market expectations.”

With the lira exchange rate rising close to 8 lira against the dollar, the bleak investment environment is expected to persist. Despite the rising exchange rate, the central bank’s difficulty in taking appropriate measures, the government’s diplomatic disputes, the economic shock caused by the novel coronavirus disease (COVID-19), and still high approval ratings for the administration indicate no signs of improvement in Turkey’s situation. Researcher Kim analyzed, “Turkey’s unfavorable investment environment, which does not even show a short-term lull, will continue for the time being.”

In a report last August, Researcher Kim forecasted the Turkish lira outlook, stating, “As the breakthrough above 7 lira against the dollar has materialized, the possibility of breaking above 8 lira is high,” and diagnosed, “Since the central bank missed the appropriate timing for response, the financial market is entering an unknown territory rather than a forecastable one.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.