Samsung Securities Report

Q3 Net Profit of 5 Securities Firms Expected at 993.5 Billion KRW

Merits of Securities Stocks Highlighted... Kiwoom Securities Presented as Top Pick

[Asia Economy Reporter Minji Lee] As a structural money move trend is emerging in the financial market, there is an opinion that the possibility of a sharp decline in stock market trading volume is low. Given the highlighted undervaluation appeal, a buy recommendation for securities stocks was maintained.

According to Samsung Securities on the 24th, the combined net profit of five securities firms?Mirae Asset Daewoo, Korea Financial Group, NH Investment & Securities, Kiwoom Securities, and Meritz Securities?for the third quarter is expected to be 993.5 billion KRW. This is estimated to exceed the market expectation of 929.1 billion KRW.

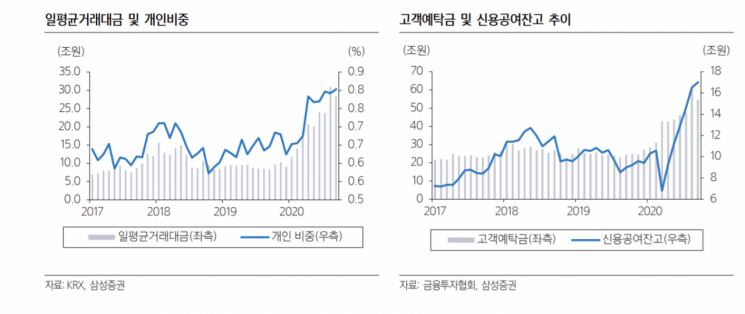

In the brokerage sector, the average daily trading volume in the third quarter recorded 27.6 trillion KRW, a 26.7% increase compared to the previous quarter. The credit loan balance also rose by 31.6% during the same period, reaching 17 trillion KRW. Customer deposits increased by 18.3% from the previous quarter to 54.8 trillion KRW, supported by the public offering subscription boom.

The WM (Wealth Management) sector, which had been sluggish in the first half due to the suspension of private fund redemptions and decreased sales, appears to have entered a recovery phase in the second quarter. The trading division is expected to experience a decline in profits due to the base effect compared to the second quarter, which recorded a large-scale operational surprise. With the stagnation of market interest rate declines in the third quarter, bond management income is also expected to decrease. Although the IB (Investment Banking) sector continues to suffer from poor performance in alternative investments due to overseas due diligence suspensions, it is expected to offset this with solid results in traditional sectors such as ECM and DCM, driven by increased funding demand.

Researcher Jang Hyoseon of Samsung Securities said, “The money move phenomenon into the stock market has continued, leading to growth in the brokerage sector. As funding demand increased, the traditional IB sector made strides, and trading performance was better than expected due to the recovery of early redemption volumes of ELS.”

The explosively increased stock market trading volume in the third quarter has recently turned downward, raising concerns. Researcher Jang said, “Due to changes in structural factors, the lower support level for average daily trading volume is estimated to be at least in the low 10 trillion KRW range, indicating that the trading volume scale has grown significantly compared to before.”

He cited structural stock market money move phenomena, short-term liquidity fund increases, and expanded coverage of listed stocks as reasons. The advent of an ultra-low interest rate era, re-recognition of risks in medium-risk, medium-return products, and changes in external factors surrounding the stock market such as strengthened real estate regulations appear to be causing a structural money move trend.

Short-term liquidity funds and listed stock coverage are also estimated to have expanded. Researcher Jang explained, “It is believed that the demand for short-term fund management has increased to respond quickly when new investment destinations appear,” adding, “The emergence of listed derivatives such as ETFs and ETNs has dramatically increased asset coverage in the stock market.” He also added, “The increase in market capitalization due to asset value appreciation is defending the downside of trading volume, so the decline in stock market trading volume will not be as large as expected.”

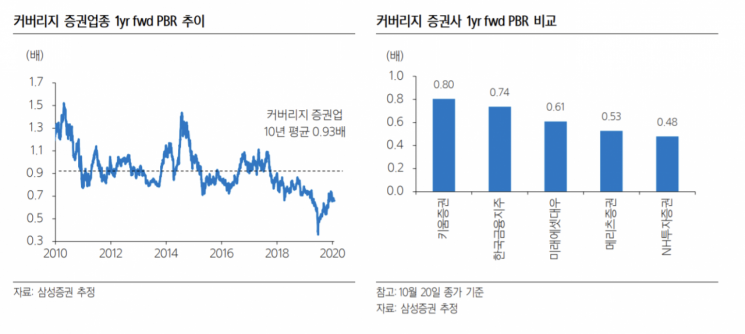

Considering the low possibility of a sharp decline in trading volume, a buy perspective on the securities sector is judged to be valid. Researcher Jang advised, “Except for the market crash in March, the sector’s average valuation remains at an all-time low level,” and recommended Kiwoom Securities as the top preferred stock within the sector, noting, “The valuation gap compared to profit growth driven by explosive retail growth is the largest for Kiwoom Securities.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)