Restaurant Franchise Listings Appear One After Another... Tous Les Jours, Coffee Bean, and Others in Search of New Owners

CJ Foodville Implements Voluntary Retirement for Survival... Approximately 400 Employees with Over 5 Years of Service Targeted

[Asia Economy Reporter Lee Seon-ae] The domestic dining industry is experiencing an unprecedented crisis. In a market saturated with fierce competition, prolonged consumption sluggishness due to the COVID-19 pandemic has left no room to endure. Large dining franchise businesses are flooding the market with sales listings, and voluntary retirements are being implemented. Self-employed restaurant owners are hit hard by declining sales and are being forced to close their businesses.

A Tous Les Jours store in Seoul.

A Tous Les Jours store in Seoul.

Collapsing Large Dining Franchises... Difficult Sale of Tous Les Jours

According to industry sources on the 24th, following Twosome Place, Hollys, and Tous Les Jours, Coffee Bean has also appeared on the merger and acquisition (M&A) market. Coffee Bean Korea, which holds the domestic master franchise rights for the coffee franchise 'Coffee Bean & Tea Leaf,' is operated by the imported brand distributor StarLux. The largest shareholder is Park Sang-bae, CEO of StarLux, holding 82.2% (16,445,000 shares). The second-largest shareholder is StarLux itself, holding 11.6% (2,330,000 shares). All StarLux shares are owned by CEO Park. The sales advisory firm, Samil PwC Accounting Firm, has begun marketing efforts starting with domestic strategic investors (SI), and the desired sale price for 100% of Coffee Bean Korea's shares is reported to be around 150 billion KRW.

The sale is expected to be challenging. Coffee Bean operates a total of 291 stores domestically, all 100% directly managed. Last year's sales were 165 billion KRW, a 1% decrease from the previous year. Operating profit dropped 98%, from 6.5 billion KRW to 140 million KRW. Especially this year, the operating environment has worsened, likely further deteriorating performance. Moreover, since Coffee Bean is a Korea-only master franchise rather than the headquarters, overseas expansion is impossible, which is also considered an obstacle.

Additionally, the flood of dining franchise sales listings due to COVID-19 is expected to have a negative impact. Currently, franchises on the market include Tous Les Jours, Popeyes, TGI Fridays, and Outback Steakhouse. An industry insider said, "As dining companies are hit hard by COVID-19, investors find it difficult to make investment decisions."

CJ Foodville, which is promoting the sale of Tous Les Jours, is conducting voluntary retirements. The target is about 400 employees with more than five years of service in support organizations. Those opting for voluntary retirement will receive about 80% of their annual salary. A CJ Foodville official explained, "Due to the prolonged COVID-19 situation, voluntary retirement is being implemented as part of self-help measures," adding, "It is one way to find a survival strategy."

CJ Foodville's sales in the first half of this year were only 291.5 billion KRW, a 32.7% decrease from the previous year. After the re-spread of COVID-19 and the implementation of social distancing level 2.5, buffet restaurants like VIPS and Seasonal Table faced operational restrictions, suffering severe sales damage. Accordingly, restructuring is ongoing. Following the sale of Twosome Place last year, in August, CJ Foodville sold the 'Bibigo' trademark, jointly owned with CJ CheilJedang, to CJ CheilJedang for 16.9 billion KRW. Last month, the Jincheon plant in Chungbuk, which produced home meal replacements (HMR) for VIPS and Seasonal Table, was transferred to CJ CheilJedang for 20.7 billion KRW. The sale of Tous Les Jours also appears to be a difficult task. Although the opposition from franchisees has decreased as CJ Foodville and franchisees reached an agreement, the overall domestic dining market is in decline, so industry consensus is that buyers will not easily appear.

Closures of large dining companies continue. E-Land Eats, operating Ashley, Jayeon Byeolgok, and Susa, closed 30 stores in the first half of this year alone. Shinsegae Food also closed three stores including Olban and Bonobono. Samyang Group's Samyang F&B ended Seven Springs operations in April, withdrawing from the dining industry after 14 years.

Self-Employed Dining Operators Pushed to the Brink... Worsening Opening and Closing Indicators

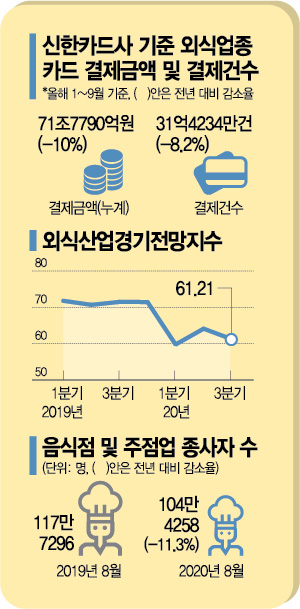

The situation for individual self-employed dining operators is even more severe. According to an analysis by the Korea Foodservice Industry Research Institute of the Korea Foodservice Industry Association based on statistics from the first to third quarters of this year, the impact of prolonged COVID-19 on the dining industry is evident in significant sales declines. From January to September this year, when COVID-19 persisted, card payment amounts (covering 22 dining and drinking business types among Shinhan Card merchants and five major dining delivery apps) decreased by 7.9655 trillion KRW (10.0%) year-on-year, and the number of transactions decreased by 281.51 million (8.2%) year-on-year.

By industry, payment amounts decreased in all sectors except 'bakery.' Especially, due to the restraint on gatherings including company dinners, the decrease rate in drinking establishments was higher than in restaurants. By detailed sector, 'general entertainment pubs' and 'other foreign food restaurants' showed the highest decrease rates (each △37.1%), followed by 'dance entertainment pubs' (△33.4%). In contrast, 'bakery' (0.2%), 'catering services' (△5.3%), and 'Korean general restaurants' (△8.8%) showed relatively lower decrease rates. Due to quarantine guidelines to prevent the 3Cs (closed spaces, crowded places, close-contact settings), dining out sharply declined, causing overall sales drops in the dining industry. However, as a reflective effect, dining consumption through delivery sharply increased (75.4%), partially offsetting the damage.

With the prolonged COVID-19, indicators for openings and closures in the dining industry are worsening. Analyzing the number of new and closed merchants among Shinhan Card merchants, in 2019, except for January, the number of merchants increased monthly (new > closed), but this year, except for three months (February, April, July) out of eight, the number decreased (new < closed). As a result, the dining industry business index for the third quarter was 61.21, worse than the second quarter's 64.11. The Foodservice Industry Research Institute stated, "According to the COVID-19 dining industry impact survey conducted in the first and third quarters this year, the proportion of businesses reporting sales decreases by dining service type showed that for 'dine-in,' 90.5% in Q1 and 89.0% in Q3 responded that sales decreased," adding, "The dining industry situation has reached a serious level."

As the economy worsens and more self-employed business owners are closing their doors, rental notice signs are posted throughout the streets of Myeongdong, Seoul. Photo by Moon Honam munonam@

As the economy worsens and more self-employed business owners are closing their doors, rental notice signs are posted throughout the streets of Myeongdong, Seoul. Photo by Moon Honam munonam@

Accommodation and Food Service Employment Hits Lowest in 7 Years and 6 Months

The dining employment market has also contracted. According to the Ministry of Employment and Labor's establishment labor force survey, as of August this year, the number of workers was 1,044,000, a decrease of 133,000 (11.3%) compared to the same month last year. This trend is consistent with figures from the Small and Medium Business Institute and Statistics Korea. Last month, the number of employees in wholesale, retail, accommodation, and food services was 5,515,000, down 432,000 from the same month last year. This is the lowest level in 7 years and 6 months since March 2013 (5,499,000). Employment in wholesale, retail, accommodation, and food services has decreased for nine consecutive months year-on-year, with the largest drop last month.

Employee layoffs have also surged. Last month, self-employed businesses with employees numbered 1,330,000, down 159,000 from the same month last year. Conversely, self-employed without employees increased by 81,000 to 4,222,000.

Due to strengthened social distancing measures following the resurgence of COVID-19, self-employed operators had to suspend operations or operate only during designated hours, suffering significant damage. In mid-August, social distancing level 2 was imposed in the metropolitan area, and on August 30, it was raised to level 2.5. Accordingly, general restaurants, cafes, and bakeries in the metropolitan area were restricted from operating from 9 p.m. to 5 a.m. the next day, and PC rooms, karaoke rooms, and buffets were completely closed, forcing self-employed operators to face sharp sales declines.

The Small and Medium Business Institute emphasized, "Although the government lowered social distancing to level 1 on the 12th, allowing self-employed operators some breathing room, optimism is limited due to concerns about resurgence," adding, "Support to stimulate consumption for self-employed operators is necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)