Annual Sales Expected to Surpass 3 Trillion Won... 50% Market Share

CL and Global Logistics Business Underperforming

Increased Burden of Borrowings and Contingent Liabilities

The mornings of city dwellers begin with delivery boxes. The domestic courier industry was born in 1992 when Hanjin started corporate express services. It grew rapidly in the early 2000s with the spread of internet shopping malls and TV home shopping. However, except for the initial growth phase, it has experienced continuous ups and downs. This was due to the extreme decline in profitability caused by the proliferation of competing companies and reckless price competition. Large-scale logistics investments to secure competitive advantage led to deterioration of financial structure. Struggling with a low-margin structure, the courier industry began to run on a second growth track with the activation of the mobile platform economy. Now, it has become like the veins of all industries, increasing its industrial importance. Even traditional manufacturing and agriculture cannot maintain competitiveness without fast delivery. After the outbreak of the novel coronavirus infection (COVID-19), untact consumption surged rapidly, accelerating the emergency speed of courier companies. Investments to secure economies of scale are also continuing. Along with rapid growth, social demands such as improving working conditions for courier workers have increased. Can the courier industry continue to flourish in the post-COVID era? We take a look at the management status of CJ Logistics and Hanjin, the leading domestic courier companies, to gauge their growth potential.

[Asia Economy Reporter Lim Jeong-su] COVID-19 has acted as a double-edged sword for CJ Logistics. While the courier business is growing sharply due to increased untact consumption, other businesses such as CL (contract logistics) and global logistics are somewhat sluggish.

If the stock swap and business partnership with Naver are finalized, the growth trend of the courier business is expected to accelerate further. On the other hand, financial burdens continue due to increased borrowings and contingent liabilities from large-scale logistics investments and support for overseas affiliates.

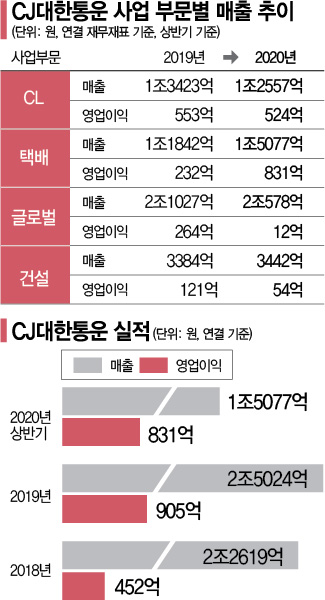

◇ Courier sales expected to surpass 3 trillion won due to untact consumption = CJ Logistics' courier business sales are showing a rapid growth trend. Sales in the first half of this year (January to June) reached 1.5077 trillion won, a 27% increase compared to the same period last year (1.1842 trillion won). Courier sales, which were less than 2 trillion won in 2017, are expected to exceed 3 trillion won this year. The sales proportion of the courier business also increased from about 24% last year to 30% this year.

Profitability has also improved. The operating profit margin was only around 3% on average over the past five years. It slightly improved to 3.6% last year due to the activation of the mobile platform economy and recorded the highest ever at 5.5% (operating profit of 83.1 billion won) in the first half of this year.

The growth trend of the courier business is expected to continue for some time. The COVID-19 situation shows signs of prolongation, and CJ Logistics has raised its market share to over 50% by leveraging superior large-scale logistics infrastructure compared to competitors. The dominant view is that if the stock swap with Naver is completed, the pace of sales growth will accelerate further.

However, responding to social demands such as deaths of courier workers, some deterioration in profitability seems inevitable. A securities analyst said, "The comprehensive measures to protect courier workers will cost about 50 billion won annually," adding, "It will be difficult to pass additional costs onto delivery fees, so profitability will be somewhat impaired."

◇ Sluggish CL and global divisions, recovery expected in the second half = Other business divisions besides the courier business are rather sluggish due to the COVID-19 situation. Sales in the CL division in the first half of this year were 1.2557 trillion won, down about 7% from 1.3423 trillion won in the same period last year. The global division also decreased by 2.1%, from 2.1027 trillion won to 2.0578 trillion won during the same period. The construction division slightly increased from 338.4 billion won to 344.2 billion won.

However, the global business as well as the courier business is expected to recover in the second half of this year. If the global business turns around after bottoming out following the courier business boom, the overall performance improvement of CJ Logistics will accelerate. An industry insider predicted, "Overseas subsidiaries such as CJ Darcl in India, CJ Century in Malaysia, and CJ ICM in the Middle East are also expected to normalize in the second half."

◇ Financial improvement unable to keep pace amid 'continuous investments' = Financial structure improvement is not progressing quickly. Borrowings have surged due to large-scale facility investments to expand logistics infrastructure such as the Gonjiam mega terminal and Dongtan Logistics Park.

As of the end of June this year, total borrowings stood at 3.67 trillion won, an increase of 1.43 trillion won from 2.24 trillion won in 2017. Net borrowings also increased by more than 1 trillion won during the same period. Although non-core asset sales were pursued to improve the financial structure, accounting standard changes led to about 1 trillion won of lease liabilities being recorded as borrowings, so the figures did not improve.

There is also an assessment that the actual borrowing burden is greater than the figures shown. An investment banking (IB) industry official said, "CJ Logistics issued 550 billion won worth of hybrid capital securities (perpetual bonds) and 200 billion won worth of redeemable convertible preferred stocks (RCPS) to improve financial figures," adding, "Both perpetual bonds and RCPS should be regarded as borrowings with actual repayment obligations."

The official also noted, "Contingent liabilities such as total return swap (TRS) contracts signed with investors during the capital expansion of overseas affiliates could also act as financial burdens for CJ Logistics."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.