KB Financial Group Posts 1.1666 Trillion KRW Net Profit in Q3

COVID-19 Loans Expected to Reflect Defaults Starting Next Year

Growing Risk Burden on Financial Holding Companies

Increase in Marginal Companies Unable to Pay Interest

[Asia Economy Reporters Hyojin Kim and Minyoung Kim] Despite the strong performance outlook for the third quarter, the banking sector remains unable to smile easily. Although the numbers reflected in the immediate results appear favorable due to various deferrals and relief measures related to COVID-19 and increased lending, there is uncertainty about when the accumulated triggers of bad debts might ignite. The banking sector is particularly uneasy because the COVID-19 financial support, which has far exceeded 100 trillion won, could boomerang back as a risk.

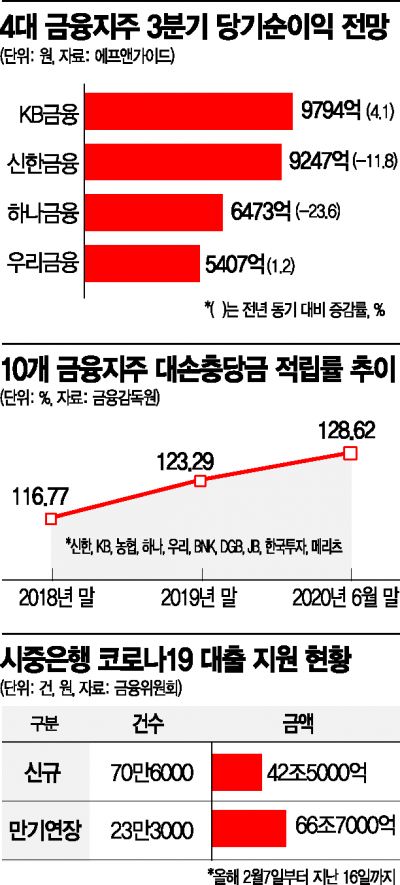

According to financial authorities and the banking sector on the 22nd, since the government's financial support plan for COVID-19 was first announced last February, commercial banks have executed approximately 706,000 new loans totaling 42.5 trillion won to small business owners and SMEs over about eight months until the 16th of this month. The loan maturity extension measure for small business owners and SMEs, extended until March next year, has resulted in 233,000 cases amounting to 66.7 trillion won. Combined, this reaches 109.2 trillion won. The banking sector expects that these newly executed and extended loans will begin to be reflected as bad debt indicators starting next year.

An executive in charge of credit at a commercial bank expressed concern, saying, "In fact, a significant portion of the COVID-19 related financial support should be regarded as loan losses," adding, "It is difficult to predict when and to what extent the burden will come." The large-scale bad debts are simply not visible now, as if covered by snow. Another senior official at a commercial bank said, "Unless the overall economy, especially the real sector, improves dramatically, loans taken by self-employed individuals affected by COVID-19 could almost directly lead to bad debts," and predicted, "If borrowers who received loan maturity extensions do not see improved financial conditions by early next year, they will likely fall into delinquency immediately after the measures end in April."

Jongho Baek, a researcher at Hana Financial Management Research Institute, diagnosed in his recently published '2021 Financial Industry Outlook' report that the overall financial industry's soundness indicators partly reflect an optical illusion and concerns about potential bad debts remain significant. Researcher Baek emphasized, "Risk management should be prepared for after June next year, when loan maturity extensions and various regulatory ratio relaxation measures come to an end."

This is why banks have been actively increasing their loan loss provisions. According to the Financial Supervisory Service, the loan loss provision coverage ratio of banks rose from 110.6% in the first quarter of this year to 121.2% in the second quarter. Banks' loan loss expenses in the first half amounted to 3.3 trillion won, an increase of 2 trillion won compared to the same period last year. In the second quarter alone, Hana Bank set aside about 350 billion won, Woori and Shinhan Banks 270 billion won each, KB Kookmin Bank 140 billion won, and NH Nonghyup Bank 180 billion won in provisions. Jungwook Choi, a researcher at Hana Financial Investment, predicted, "Additional provisioning is likely to become an issue in the fourth quarter."

The rapidly increasing trend of marginal companies, mostly SMEs that cannot even cover interest expenses with their earnings, is also pressuring the banking sector. According to the Bank of Korea, the number of marginal companies in Korea last year was 3,475, an increase of 239 (7.4%) from the previous year. This is the highest level since related statistics began in 2010. The expected default probability of marginal companies, which was 3.1% in December 2018, rose to an average of 4.1% in June this year, indicating increased credit risk.

Meanwhile, KB Financial Group announced on the same day that it recorded a net income of 1.1666 trillion won in the third quarter. This represents a 24.1% increase compared to the third quarter of last year and an 18.8% increase from the previous quarter. Other financial holding companies are also generally expected to perform well in the third quarter.

According to financial information provider FnGuide, securities firms forecast the combined third-quarter net income of the four major financial holding companies?KB, Shinhan, Hana, and Woori?to be about 3.09 trillion won. Compared to the same period last year (3.24 trillion won), this is about 4.7% lower but improved from the first and second quarters of this year, which is considered a strong performance given the COVID-19 situation.

This outlook results from improved profitability of banks, which account for about 70% of the total net income of the holding companies. Although the net interest margin (NIM) decline continued due to the ultra-low interest rate environment, the rate of decline slowed and lending increased significantly. However, a banking official explained, "Since investment demand driven by economic and market instability, such as 'Yeongkkeul' and 'Debt Investment,' has been absorbed into loans, it is difficult to view this as solid growth." The third-quarter earnings of major financial holding companies will be announced sequentially, starting with KB Financial Group.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.