[Sejong=Asia Economy Reporter Kim Hyunjung] The ruling party and the government are facing a dilemma over temporary two-homeowners who can no longer receive capital gains tax exemptions due to the government's introduction of the right to request renewal of jeonse contracts. Since the capital gains tax exemption conditions have become stricter and more complicated under the Moon Jae-in administration, it is burdensome to additionally amend related tax laws to prepare relief measures.

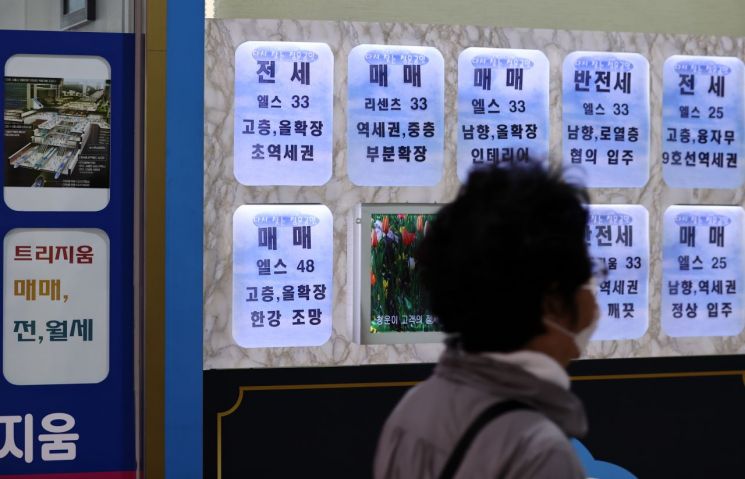

According to the National Assembly and the Ministry of Land, Infrastructure and Transport on the 22nd, cases have occurred where temporary two-homeowners who purchased a new house and intended to sell their existing house could not receive tax exemption benefits due to the tenant of the sold house exercising the right to request renewal of the jeonse contract. Currently, both ruling and opposition parties and the Ministry of Land are receiving reports of market confusion and complaints following recent amendments to the lease law, and are reportedly considering relief measures for cases where capital gains tax or acquisition tax is heavily imposed for the above reasons.

According to the current Income Tax Act, among temporary two-homeowners, if the existing house is sold within three years after acquiring a new house, capital gains tax exemption applies up to 900 million KRW. For designated regulated areas, if the new house was purchased between the 9.13 measures in 2018 and before the 12.16 measures last year, the disposal period is shortened to two years. For those who switched houses after the 12.16 measures, the disposal deadline is one year.

Among these, the case with a two-year disposal deadline is the most complicated because the tenant's right to request contract renewal coincides with the existing house disposal deadline. If the tenant exercises the contract renewal right, the buyer for actual residence is excluded from the sale target during the extended contract period. Of course, if the price is significantly lowered below market value, the house can be sold on schedule to receive tax exemption benefits, but in this case, there is a high possibility of a gap in the funds needed for actual residence.

Even if the tenant of the sold house amicably agrees on the contract period, if there is a tenant in the newly purchased house, there is another variable. If the tenant exercises the right to request renewal of the jeonse contract and cannot move out, the deadline to move into the newly purchased house (two years) may be exceeded. If the deadline is not met on time, capital gains tax jumps from exemption to heavy taxation. The capital gains tax rate for two-homeowners in regulated areas is up to 52%, and it will rise to 62% starting next year.

The problem is that it is already difficult to fix this issue by amending the Income Tax Act because the related laws are already in a 'patchwork' state. Originally, the exemption applied if the existing house was sold within three years, but the Moon Jae-in administration changed it to two years in the 9.13 measures (2018), and then to one year in the 12.16 measures last year. Additionally, as successive real estate policies were announced, the tax system became more complicated, and the National Tax Service released '100 Questions and Answers on Housing Taxes' last month with examples. However, even among the 100 Q&As, answers related to capital gains tax heavy taxation conflicted, causing confusion even within the tax authorities.

So far, the only discussed measure to minimize uncertainty is revising the Enforcement Rules of the Licensed Real Estate Agents Act to specify whether the tenant has exercised the contract renewal right in the house sale contract at the time of signing. However, there is no clear plan yet on how to resolve conflicts that have already surfaced. Related ministries are also discussing measures to review cases by applying transitional measures under the Housing Lease Business Act rather than tax law. The ruling party recently decided to discuss solutions to real estate-related issues within its internal body, the Future Housing Promotion Group, but the members other than the head, Jin Sunmi, a member of the Democratic Party of Korea and Chairperson of the National Assembly Land, Infrastructure and Transport Committee, have not yet been finalized.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)