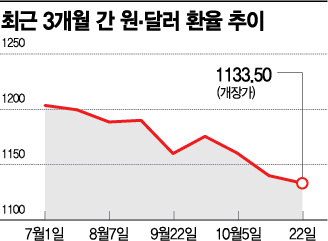

Won-Dollar Exchange Rate Falls to 1130 Won Range

Rising Anxiety Over Potential Valuation Losses

[Asia Economy Reporter Minji Lee] The won-dollar exchange rate is showing a steeper decline than expected, heightening anxiety among Seohak Gaemi investors who ventured into overseas stocks.

According to the financial investment industry and the Seoul foreign exchange market on the 22nd, the won-dollar exchange rate pointed to 1,133.50 won, slightly up from the previous day in the morning. Recently, the won-dollar exchange rate has fallen from the long-maintained 1,180 won range to the 1,130 won range. The decline is interpreted to have deepened as market expectations grew that Democratic candidate Joe Biden could win the U.S. presidential election about two weeks away.

If the won's strength continues, so-called 'Seohak Gaemi' investors who ventured into overseas investments are expected to face valuation losses. The most important factor to consider in overseas investment is the exchange rate, as changes in the exchange rate directly affect returns. According to the Korea Securities Depository's securities information system SaveRo, as of the 3rd of last month when the Nasdaq index (11,484.69) was at a similar level, domestic investors' foreign currency holdings amounted to $33.991 billion, of which the balance of U.S. stock holdings was $249.16 billion. Considering the exchange rate was 1,190 won at that time, the valuation of U.S. stock holdings decreased by 1.3952 trillion won from 29.65 trillion won to 28.2547 trillion won due to exchange rate fluctuations alone.

In the case of Tesla, as of the 3rd of last month, the valuation of 1,000 shares of Tesla (at $402) was 484.33 million won applying the exchange rate of 1,190 won. Assuming these shares are still held at the current price ($422), the valuation of 1,000 shares is calculated at 478 million won. Although Tesla's stock price rose about 5%, the decline in the exchange rate caused a loss of about 10 million won.

Since the won is linked to the yuan, a strong won is expected to be inevitable for the time being. Seonghyun Park, a researcher at Hi Investment & Securities, explained, "As the likelihood of Biden's election increases, expectations for easing the U.S.-China trade dispute are growing, while the yuan's appreciation trend continues. The visible policy push focusing on China's economic recovery trend, domestic demand stimulus, and technological independence is also influencing the yuan's appreciation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.