Positive Outlook for Steel, Energy, and Food

Banking and Shipbuilding Stocks Also Worth Watching

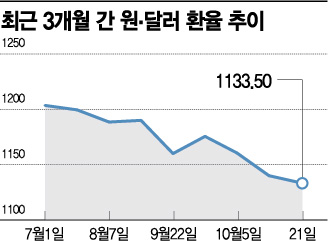

[Asia Economy Reporter Park Jihwan] Recently, the Korean won to US dollar exchange rate has sharply declined by more than 4% within a month, increasing interest in stocks that benefit from a strong won. The market expects industries such as steel, energy, shipbuilding, food, and banking to benefit from the falling exchange rate. Various financial products targeting the weak dollar are also considered investment strategies to boost returns.

According to the financial investment industry on the 22nd, the exchange rate, which was in the 1180 won range in mid-last month, has sharply dropped by 50 won within a month to the 1130 won range, showing a steep downward trend. Generally, when the won strengthens, industries highly dependent on raw material imports benefit. The reduced burden of importing materials used in finished product manufacturing directly translates into profits. Even if the selling price of goods does not increase, the cost of production becomes cheaper. Representative industries include steel, energy, and food sectors.

The stock prices of these industries have recently shown strength. The day before, Korea Electric Power Corporation closed at 21,750 won, up 3.57% from the previous trading day, and Korea Gas Corporation surged 8.17% to 32,450 won. Food and beverage companies such as Samyang Foods (2.02%), Ottogi (2.53%), CJ CheilJedang (0.39%), and Daesang (1.39%), as well as POSCO (0.24%) and Dongkuk Steel (3.03%), all showed simultaneous upward trends.

Shipbuilding companies are also expected to experience favorable conditions. Typically, in a strong won phase, foreign currency order prices rise, leading to active orders from shipowners, which in turn increases orders for shipbuilders. Park Muhyun, a researcher at Hana Financial Investment, said, "During periods when the won to dollar exchange rate declines, shipbuilders' order volumes tend to increase significantly, so we can expect shipbuilding stocks to rise. As shipbuilding stock prices increase, stocks of ship equipment companies will also show an upward trend."

Additionally, bank stocks are considered beneficiaries of a strong won due to reduced foreign currency borrowing costs and foreign currency translation gains resulting from the falling exchange rate. Interest in financial products targeting a weak dollar is also rising. According to the Bank of Korea, resident foreign currency deposits reached a record high of $88.54 billion in August. In the domestic stock market, investing in inverse products that move opposite to the dollar can maximize returns from the falling exchange rate. Products such as 'KODEX US Dollar Futures Inverse' and 'Shinhan Inverse 2X US Dollar Futures' fall into this category.

Meanwhile, the travel industry, traditionally a beneficiary of a strong won, is facing difficulties in expecting special demand due to restrictions on overseas travel caused by the COVID-19 pandemic.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)