Over 50% of Total Customers Use Bank Apps at 5 Major Banks

Consumer Response Increases Since Open Banking Implementation

[Asia Economy Reporter Sunmi Park] Office worker Min Joo-wan (31, pseudonym) was an owner of an analog style that did not match his age. He used to visit bank branches with paper passbooks and cards or transfer funds through telebanking and automatic teller machines (ATMs). He did not use internet banking, which is also used by people in their 40s and 50s. This was due to the difficulty of remembering passwords and the inconvenience of logging in separately for each bank. However, with the advent of an era where downloading just one bank application (app) on a smartphone allows transactions with other banks through fingerprint and facial recognition, he made up his mind and switched to mobile banking users. As the introduction of open banking erased boundaries between banks and the inconvenience of internet banking was resolved at once with a single bank app, paper passbook users like Min are switching to bank app users.

With the introduction of open banking eliminating boundaries between banks, more than half of bank customers are using bank apps. As banks have increased non-face-to-face services in response to the spread of the novel coronavirus infection (COVID-19), the volume of transactions through bank apps is also rapidly increasing.

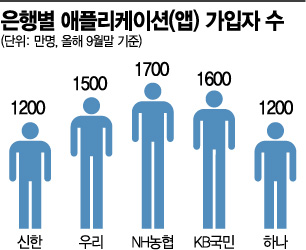

According to the banking sector on the 22nd, as of the end of September, the number of bank app users compared to the total number of customers of the five major banks?KB Kookmin, NH Nonghyup, Shinhan, Woori, and Hana?was recorded at 54%. More than half of the customers are using bank apps. By bank, Nonghyup Bank had the highest number with 17 million users. Kookmin Bank had 16 million, Woori Bank 15 million, and Shinhan and Hana Banks each had 12 million. The total number of app users for the five major banks amounts to about 72 million. In terms of the proportion of users compared to the total number of customers, Woori Bank had the highest rate, with 7 out of 10 people (68%) using the app.

Transactions through apps are also surging. In the first half of this year, the average daily amount of mobile banking usage exceeded 8 trillion won. This is a 22.9% increase from 6.7457 trillion won in the second half of last year. Based on bank remittance transactions, the total number of mobile banking transactions in the banking sector in the first half of this year was 1.368 billion, which is seven times the 198 million internet banking transactions. Starting from December, mutual finance and savings banks will participate in open banking, followed by securities and card companies next year, so the number of mobile banking users and transaction volume and scale are expected to increase further.

Since the implementation of open banking, consumer response has been positive due to increased convenience in financial transactions. For example, transferring money from rarely used accounts at other banks to the main transaction account is now possible immediately, and money in other bank accounts can be withdrawn from ATMs without passbooks or cards. Even without an account, users can sign up for a bank app, and new accounts can be opened instantly by taking a photo of an ID card non-face-to-face. With a single bank app, it has become possible to manage scattered bank accounts and integrate asset management for securities, cards, and insurance.

Intensified Competition Among Bank Apps...Promoting App Sign-ups with Events

Although mobile banking services provided through bank apps vary slightly by bank, they are generally similar. However, since app usage reflects intimate patterns such as users’ habits and daily routines, attracting new customers is difficult, and if a bank falls behind in the early competition, recovery may be challenging. This is why banks frequently hold various events and consider differentiation to promote app sign-ups.

Nonghyup Bank is currently running a special savings event offering an annual interest rate of 5% to encourage the use of its mobile platform All One Bank. KB Kookmin Bank is holding a prize event targeting customers who do not have a deposit and withdrawal account or only have such an account. Shinhan Bank offers 10,000 won in cash to customers in their 20s who sign up for the Housing Subscription Savings or Youth Preferential Housing Savings through the Sol app. Hana Bank is waiving transfer fees for life for customers who install the New Hana One Q app and register with facial recognition or simple number authentication by the end of this month. Woori Bank provides prizes to customers who receive their first salary of 500,000 won or more through the 'First Salary Woori Account' and apply via the Woori Won Banking app.

However, since most services can be easily used through bank apps, there is concern that customers may impulsively subscribe to products or use loan services without separate consultation. Another downside is that the bank app screens are packed with so many functions that they may appear complicated, making it difficult for elderly users to use them.

One user said, "Bank app usage is convenient, so I have downloaded and use apps from two banks, but I mainly use services like managing accounts and transferring money at once. I tend not to use product subscriptions or loan services often because of impulsive sign-ups and concerns about sharing personal information."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.