Short Transmission Range Makes Network Construction Challenging

Priority Investment in Efficient 3.5GHz Band

Government 'Carrot Policy' Needed for Revenue Models

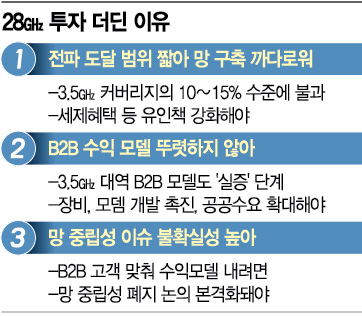

[Asia Economy Reporter Koo Chae-eun] The three major telecom companies have found themselves in a dilemma over the use of the '28 GHz frequency band.' Two years ago, they spent a total of 622.3 billion KRW (SK Telecom - 207.3 billion KRW, KT - 207.8 billion KRW, LG Uplus - 207.2 billion KRW) to acquire the 28 GHz band frequencies, but network construction is complicated and discovering B2B specialized revenue models has proven difficult.

Currently, they also lack the capacity to invest in the 3.5 GHz band, so there are calls for attractive 'carrots' to encourage infrastructure investment. It is suggested that tax benefits be further strengthened, public sector demand specialized for the 28 GHz band be identified, and discussions on abolishing net neutrality be accelerated to remove uncertainties in B2B investments.

Tax Benefits and Incentives Must Be Strengthened

According to industry sources on the 21st, SK Telecom, KT, and LG Uplus's investments in the 28 GHz band remain sluggish. According to the office of Lee Yong-bin of the Democratic Party of Korea, even though 1 year and 5 months have passed since the commercialization of 5G, there are zero 28 GHz band networks. This means that 15,000 base stations, which must be compulsorily built by next year, remain. The reason telecom companies are not accelerating investment in the 28 GHz band is that they are prioritizing investment in the 3.5 GHz band, which has higher radio wave efficiency. The spread of COVID-19 has also partially affected this. As of the end of August, there were 132,008 5G base stations nationwide, which is only 13.5% of the 4G base stations (978,313). Among these, only Seoul and Gwangju exceeded 20%, while Gyeonggi Province and metropolitan cities remained at 5-10%.

The problem is that investment in the 28 GHz band is not easy. Unlike the 3.5 GHz band, which is being built for nationwide coverage, the 28 GHz band has a short radio wave reach, making network construction complicated and costly. This is why Choi Ki-young, Minister of Science and ICT, said, "Investment in the 28 GHz band is a matter for the telecom companies that purchased the frequency to decide, and the government cannot dictate what to do."

Therefore, there are calls for strong 'incentives' related to investment in the 28 GHz band. Above all, demand sources in the public sector should be identified in the B2B field, which will become the 'market' for the 28 GHz band. Since the Korean New Deal project announced by the government in July includes 'early construction of 5G infrastructure,' an industrial ecosystem should be created so that investment in the 28 GHz band can lead to revenue models. A telecom industry official said, "Not only in the 28 GHz band but also in the 3.5 GHz band, B2B revenue models have not yet become visible, so it is difficult to easily proceed with investment in the 28 GHz band. Although many business verifications have been conducted, commercialization or orders in the private sector have not followed, so the government must open a path first for business models to settle."

B2B Revenue Models Must Be Created

There are also opinions that discussions on revising 'net neutrality' must progress for B2B investments to accelerate. The principle of net neutrality is based on the idea that no one should be discriminated against when using the internet. If the net neutrality principle is not abolished, the network slicing technique?which is a prerequisite for B2B 5G services and involves dividing a single network into multiple lines operated at different speeds for different purposes?will be restricted. For example, for Hyundai Motor's autonomous vehicles or remote medical services to be possible, telecom companies must prioritize and quickly process their data by charging a kind of '5G express lane fee,' but this is impossible if the 'net neutrality' principle is upheld. Currently, the abolition of net neutrality is stalled due to opposition from CPs (content providers) such as Naver and Kakao. Professor Shin Min-su of Hanyang University said, "For investment in the 28 GHz band to become active, the net neutrality issue must be agreed upon first to resolve uncertainties related to B2B revenue models. Since the 28 GHz band itself is a frequency band for B2B business, reducing risks in institutional and regulatory areas is necessary for telecom companies to create revenue models and actively invest."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.