Restaurant Franchise Listings Appear One After Another... Tous Les Jours, Coffee Bean, and Others in Search of New Owners

CJ Foodville Implements Voluntary Retirement for Survival... About 400 Employees with Over 5 Years Targeted

Self-Employed Restaurant Owners Face Closure Due to Sharp Sales Decline... Letting Go of Staff and Struggling Alone

[Asia Economy Reporter Lee Seon-ae] "Although social distancing was downgraded from level 2 to level 1, the golden time for the dining industry has already passed." The domestic dining industry is experiencing an unprecedented crisis. In a market saturated with fierce competition, there is no way to endure due to sluggish consumption caused by the prolonged COVID-19 pandemic. Large dining franchise businesses are flooding the market with listings, and voluntary retirements are being carried out. Self-employed restaurant owners are taking a direct hit from decreased sales and are being forced to close their businesses.

Even Large Companies Can't Endure

According to the industry on the 21st, following Twosome Place, Hollys, and Tous Les Jours, Coffee Bean has also appeared on the M&A market. Coffee Bean Korea, which holds the domestic franchise rights for the coffee brand 'Coffee Bean & Tea Leaf,' is operated by the imported brand distributor StarLux. The largest shareholder is Park Sang-bae, CEO of StarLux, holding 82.2% (16,445,000 shares). The second-largest shareholder is StarLux itself, holding 11.6% (2,330,000 shares). All shares of StarLux are owned by CEO Park. The sales advisory firm, Samil PwC Accounting Firm, has begun marketing efforts starting with domestic strategic investors (SI), and the desired sale price for 100% of Coffee Bean Korea's shares is known to be around 150 billion KRW.

However, the industry views the sale as unlikely to be easy. The intense competition in the coffee market reduces the attractiveness of the listing. Additionally, the flood of dining franchise listings due to the COVID-19 impact is expected to have a negative effect. Currently, the listings include Tous Les Jours, Popeyes, TGI Fridays, and Outback Steakhouse. An industry insider said, "As dining companies are hit hard by COVID-19, it is difficult for buyers to make investment decisions."

CJ Foodville, which is promoting the sale of Tous Les Jours, is conducting voluntary retirements. The target is about 400 employees in support organizations with more than five years of service. Voluntary retirees will be paid about 80% of their annual salary. A CJ Foodville official explained, "Due to the prolonged COVID-19 situation, we have implemented voluntary retirement as one of the self-help measures," adding, "It is one way to find a survival strategy."

CJ Foodville's sales in the first half of this year were only 291.5 billion KRW, a 32.7% decrease compared to the previous year. After the re-spread of COVID-19 and the implementation of social distancing level 2.5, buffet restaurants like VIPS and Season's Table faced operational restrictions, resulting in severe sales damage. Accordingly, restructuring is continuously being pursued. Following the sale of Twosome Place last year, in August, CJ Foodville sold the 'Bibigo' trademark, jointly held with CJ CheilJedang, to CJ CheilJedang for 16.9 billion KRW. Last month, the Jincheon plant in Chungbuk, which produced VIPS and Season's Table home meal replacements (HMR), was transferred to CJ CheilJedang for 20.7 billion KRW.

Self-Employed Dining Industry Devastated

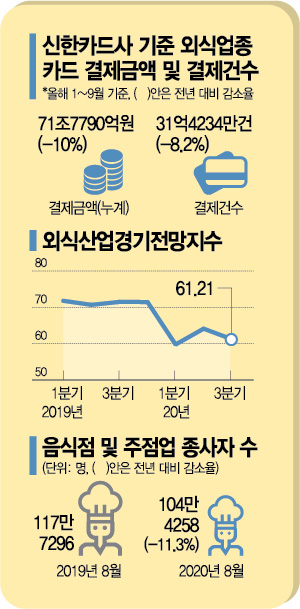

The situation for individual self-employed restaurant owners is even more severe. According to an analysis by the Korea Foodservice Industry Research Institute of the Korea Foodservice Industry Association based on statistics from the first to third quarters of this year, the impact of the prolonged COVID-19 on the dining industry shows a significant decrease in sales. From January to September this year, when COVID-19 persisted, the card payment amount (among Shinhan Card merchants in 22 food and beverage sectors and 5 major food delivery apps) decreased by 7.9655 trillion KRW (10.0%) compared to the previous year, and the number of transactions decreased by 281.51 million (8.2%) compared to the previous year.

As COVID-19 prolongs, indicators for restaurant openings and closures worsen, and the employment market is also freezing. Analyzing the number of new and closed merchants among Shinhan Card merchants shows that in 2019, except for January, the number of merchants increased monthly (new > closed), but this year, except for three months (February, April, July) out of eight, there was a net decrease (new < closed). As a result, the dining industry business index for the third quarter was 61.21, worse than the second quarter's 64.11. The Foodservice Industry Research Institute stated, "According to the COVID-19 impact survey conducted in the first and third quarters of this year, the proportion of businesses reporting decreased sales by dining service type was 90.5% in the first quarter and 89.0% in the third quarter for 'dine-in,' indicating that most businesses experienced sales declines," adding, "The situation in the dining industry has reached a serious level."

The dining employment market has also contracted. According to the Ministry of Employment and Labor's Business Labor Force Survey, as of August this year, the number of workers was 1,044,000, a decrease of 133,000 (11.3%) compared to the same month last year. This trend is consistent with figures from the Small and Medium Business Institute and Statistics Korea. Last month, the number of employees in wholesale, retail, accommodation, and food services was 5,515,000, down 432,000 from the same month last year. This is the lowest level in 7 years and 6 months since March 2013 (5,499,000). Employee layoffs also surged. Last month, self-employed businesses with employees numbered 1,330,000, down 159,000 from the same month last year. Meanwhile, self-employed without employees increased by 81,000 to 4,222,000.

Due to strengthened social distancing measures following the resurgence of COVID-19, self-employed business owners had to either suspend operations or operate only during designated hours, causing significant damage. In mid-August, social distancing level 2 was imposed in the metropolitan area, and on the 30th of the same month, it was raised to level 2.5. Accordingly, general restaurants, cafes, and bakeries in the metropolitan area were restricted from operating from 9 PM to 5 AM the next day, and PC rooms, karaoke rooms, and buffets were completely shut down, forcing self-employed owners to endure sharp sales declines. The Small and Medium Business Institute emphasized, "Although the government lowered social distancing to level 1 on the 12th, allowing self-employed business owners some breathing room, concerns about resurgence mean we cannot be optimistic," stressing, "Support to stimulate consumption for self-employed business owners is necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)