[Asia Economy Honam Reporting Headquarters Reporter Kim Chunsu] Amid growing concerns over real estate price stabilization, a national petition has been raised highlighting the residents' distress over the exorbitantly high sale prices set for a public rental housing complex in Gwangju Metropolitan City that is currently undergoing a sale conversion.

The petitioner, who identified themselves as a tenant of a government-commissioned public 10-year rental apartment in Buk-gu, Gwangju Metropolitan City, stated through the national petition that the construction company is trying to exploit low-income, non-homeowners with unreasonable sale prices.

He said, “This apartment complex attempted a sale conversion once in 2018, halfway through the 10-year public rental period. Tenants waited with hopeful anticipation for the sale prices to be announced, but after about two months of silence, the sale was abruptly withdrawn with just a single notice posted.”

He continued, “On June 8, two years later, a notice was posted again announcing the intention to proceed with the sale. However, the appraisal value in 2020 was presented as a total amount for the entire complex, which was 50 billion KRW higher than the appraisal value at the time of the first sale, resulting in inexplicable increases of 30 to 40 million KRW per unit depending on the size.”

Regarding the initial move-in in 2013, the petitioner explained that the original sale price was set at 218 million KRW, but no buyers came forward. They then tried to attract buyers by offering prizes such as TVs and refrigerators, but still failed to find any purchasers.

Subsequently, the price was lowered to 215 million KRW, but even at that price, the apartment failed to sell, according to the petitioner.

He analyzed, “If we consider the sale price of 215 million KRW and estimate a profit of about 75 million KRW, the construction cost would be approximately 140 million KRW. Of this, the government provided long-term low-interest housing loans exceeding 70 million KRW per unit with priority claims, so the pure equity capital for the main housing would have been around 70 million KRW.”

He added, “The construction cost of 140 million KRW likely applied standard costs, and the actual construction cost would be estimated to be lower. Furthermore, if one examines the acquisition cost documents submitted for acquisition tax purposes, it is clear that the construction cost was deliberately understated to reduce tax payments.”

He emphasized, “Demanding over 290 million KRW for apartments built at a cost below 140 million KRW tramples on the housing dreams of low-income non-homeowners and exploits them.”

He also stated, “The government, while receiving numerous benefits such as land purchase, tax, and financial approvals, is unable to fully manage rental businesses. Meanwhile, rental business operators are greedily monopolizing the fruits of housing welfare instead of sharing them with the government or tenants. Currently, many media outlets are filled with praise articles about the social contribution activities of these housing units, deceiving countless citizens.”

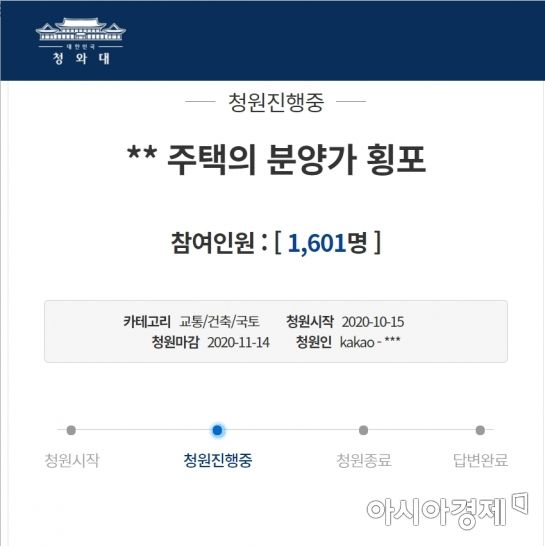

Meanwhile, this petition started on the 15th and has garnered 1,600 supporters as of the 20th.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.