Daily Cases Exceed 800

Conditional Movement Restrictions in 5 Regions

40% of GDP Concentrated in Capital Area

Monthly Losses of 7.955 Trillion Won Inevitable

[Asia Economy Kuala Lumpur Hong Seong-a, Guest Reporter] As the daily number of new COVID-19 cases surges, the Malaysian government has once again pulled out the lockdown card for some areas including the capital region of Kuala Lumpur. However, concerns are rising that lockdown measures could negatively impact the economy, deepening the authorities' dilemma over whether to impose a lockdown.

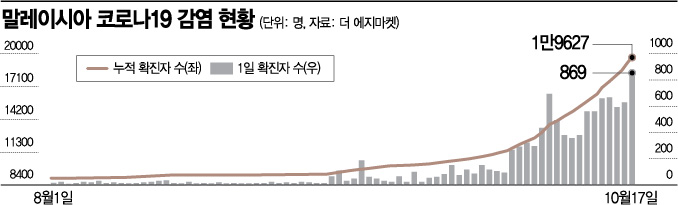

On the 20th, local media such as MalaysiaKini reported, "Since the second peak in June, when 277 new cases were confirmed due to a cluster infection among detainees at a police station and lockup in Sabah, the number of daily new cases has exceeded 800 this month," adding, "The authorities have declared conditional movement restrictions in five areas including the capital region."

The Malaysian government imposed movement restrictions in Sabah starting from the 13th, and declared a two-week conditional movement control order in the Klang Valley (Selangor, Kuala Lumpur, Putrajaya) from the 14th. The same measures were applied to the Labuan area from the 17th to the 30th. This conditional movement control order is the first since it was last implemented until June 9, four months ago.

These measures by the government came in response to the recent sharp increase in new confirmed cases. Local media cited Worldometer, reporting that Malaysia's daily new COVID-19 cases have been breaking records day after day. According to Worldometer, the daily cases reached a record high of 869 on the 17th, then broke that record the next day with 871 cases on the 18th. MalaysiaKini reported, "Since October, with more than 600 new COVID-19 cases daily, the third wave of infections has fully taken hold."

The conditional movement control order focuses on closing educational institutions and banning gatherings in religious facilities. The emphasis is on allowing economic activities as much as possible. Business operating hours are restricted, and outings are limited to two people per household for essential activities such as purchasing daily necessities and hospital visits.

The reason economic activities are not fully restricted is due to the significant impact on livelihoods. Experts express concern that since the capital region is the economic center, imposing movement restrictions would cause substantial economic damage. The Malaysian Industrial Development Finance Institute (MIDF) warned, "Since the capital region accounts for about 40% of the Gross Domestic Product (GDP), a lockdown could result in losses of 28.8 billion ringgit (approximately 7.955 trillion won) within a month," adding, "If the lockdown lasts for a month, GDP could drop by up to -6.7% year-on-year." They also predicted that the unemployment rate could rise to 5.4%. The institute based these estimates on the lockdown implemented from March 18 for about two months.

Partial lockdowns have already caused damage in some industries. With restrictions on outings and movement, sectors such as accommodation, food and beverage, retail, education, and recreation services have seen declines in sales. Additionally, with inter-state travel banned, domestic tourism in Malaysia is expected to be hit hard.

There are also calls to extend the loan repayment moratorium introduced in April as part of economic stimulus measures. The National Union of Bank Employees (NUBE) argues that since the conditional movement control order has been reinstated, the moratorium is necessary. NUBE stated, "Households and small business owners are expected to face greater difficulties," and urged, "Loan repayments for individuals and businesses should be deferred until the end of the year."

However, if the loan moratorium is extended, debts could worsen, making the government hesitant to take immediate action. Malaysia expects the national debt-to-GDP ratio to rise from 53% to 56% this year due to reduced household incomes from COVID-19 and stimulus measures. Accordingly, the government raised the debt-to-GDP limit from 55% to 60% last October.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.