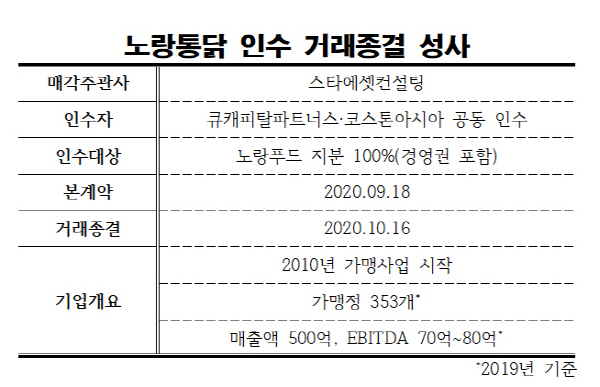

The management consulting firm ‘Star Asset Consulting (CEO Hee-Sung Lee)’ announced that it successfully closed the deal as the sales advisor for the chicken franchise ‘Norang Tongdak.’ With this, domestic private equity fund (PEF) operators Q Capital and Koston Asia have completed all procedures to become the ‘new owners’ by acquiring 100% of Norang Food’s shares.

According to the investment banking (IB) industry, on the 16th, Q Capital and Koston Asia agreed to acquire all shares of Norang Food for 70 billion KRW and made the final payment. The two GPs who completed the acquisition plan to begin joint management along with a full-scale value-up operation.

Norang Food, the operator of Norang Tongdak, appointed Star Asset Consulting as the sales advisor in April and pursued external investment attraction. Around September, they signed a share purchase agreement (SPA) for 100% of the existing shares with Q Capital and Koston Asia. After various acquisition and investment structures were discussed earlier, it was decided to acquire the entire stake including management rights.

The deal structure involved Koston Asia investing 15 billion KRW and 10 billion KRW as mezzanine and subordinated equity respectively in a special purpose company (SPC) controlling Norang Tongdak, while Q Capital invested 15 billion KRW in subordinated equity. Both GPs raised investment funds through their respective blind funds. The remaining 30 billion KRW was financed through acquisition financing provided by Yuanta Securities.

Norang Tongdak is ranked 15th in the number of franchise stores (353 stores) according to the Fair Trade Commission’s announcement at the end of 2019. The first store opened in Busan in 2009, franchising began in 2010, and the headquarters moved to Seoul in 2017. Known for its ‘low-sodium chicken’ made exclusively with 100% non-salted refrigerated chicken, the brand gained popularity, leading to a rapid increase in store numbers starting in 2018.

Corresponding to the increased number of stores, sales also surged significantly from 15 billion KRW in 2017 to 39.9 billion KRW in 2018, and 50.2 billion KRW last year. The industry analyzes that Norang Chicken’s continued growth despite intensified competition, along with increased demand for delivery food due to the COVID-19 pandemic, are key growth factors. Last year’s EBITDA is reported to be around 7 to 8 billion KRW.

Meanwhile, Star Asset Consulting is a company specializing in comprehensive corporate consulting including management advisory services for small and medium-sized enterprises. It offers total solutions from startup, growth, and leap to exit. Above all, it has established an expert platform capable of one-stop solutions through a diverse expert network.

Recently, it acquired management rights of Portwin Investment Advisory Co., Ltd., Korea’s first investment advisory firm, as a subsidiary, raising expectations for synergy between Star Asset Consulting, specializing in corporate consulting, and Portwin Investment Advisory in the future.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.