Biden Pledges to Raise Top Corporate Tax Rate

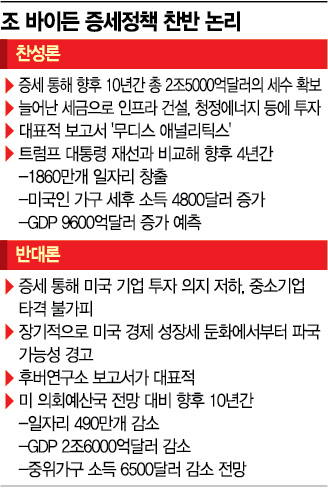

Concerns Over Impact on Business Investment and SMEs... Positive Arguments for Revenue Securing and Infrastructure Expansion

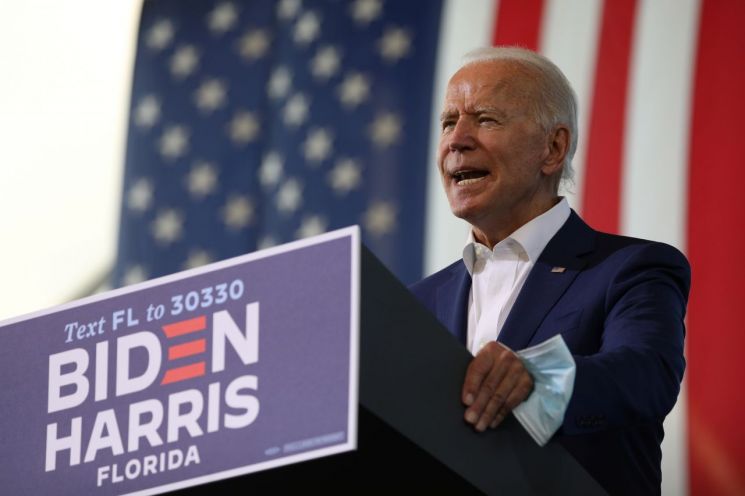

[Asia Economy Reporter Naju-seok] As the Democratic Party in the United States is gaining prospects of a so-called 'Blue Wave' victory not only in the presidential election but also in the congressional elections, interest in Joe Biden, the Democratic presidential candidate's economic policy 'Bidenomics,' is increasing. In particular, there is a heated debate within the U.S. over the effects of Biden's tax increase policy, which centers on raising the top corporate tax rate.

According to U.S. media such as The Wall Street Journal (WSJ) on the 18th (local time), Biden has placed a pledge to raise the top U.S. corporate tax rate to 28% at the forefront of his economic policy. President Donald Trump lowered the top corporate tax rate from 35% to 21% in 2017, and Biden plans to partially reverse this. On the other hand, Trump has pledged that if he wins re-election, he will further lower the corporate tax rate to make the top rate 20%.

According to WSJ, economists generally view a tax increase alone as a negative factor for economic growth. However, the effects are expected to vary depending on how the revenue from the tax increase is used and who bears the tax burden. Biden has proposed using the increased corporate taxes to invest in infrastructure construction, clean energy, and health services.

Conservative think tanks in the U.S. and Trump administration officials have warned that raising corporate taxes would hinder the U.S. economic recovery. On the 15th, during a town hall meeting, President Trump claimed, "If Biden is elected and raises taxes, American companies will try to leave the United States."

According to an analysis by the Hoover Institution, a U.S. think tank, if Biden's tax increase policy is realized, the U.S. economic recovery trend will be disrupted. This report compared the economic outlook of the Congressional Budget Office (CBO) and predicted that if Biden's tax increase policy is implemented, 4.9 million jobs will be lost by 2030, and the U.S. Gross Domestic Product (GDP) will decrease by $2.6 trillion (approximately 2,969 trillion won). The report also analyzed that the tax increase policy targeting high-income earners would not only impact small and medium-sized business owners but also reduce employment.

James Hines, a professor of economics at the University of Michigan, pointed out, "If corporate taxes are raised, U.S. companies may lose competitiveness compared to foreign companies," adding, "This could lead to wage cuts and product price increases." In particular, he said, "Corporate tax is not a good way to impose progressive taxation," and "Corporate tax is cumbersome and ineffective in taxing the wealthy." Additionally, the American Enterprise Institute (AEI) predicted that the U.S. economy will experience a negative growth rate of 0.16% over the next ten years.

On the other hand, there are also forecasts that Biden's economic policy will actively restore the U.S. economy. Moody's Analytics, a subsidiary of the international credit rating agency Moody's, analyzed expected scenarios depending on whether Trump or Biden wins and predicted that if Biden is elected, the U.S. real GDP will grow by $960 billion more by 2024 compared to if Trump wins re-election.

Progressive scholars argue that if the Democrats control not only the presidency but also both houses of Congress, they should immediately implement corporate tax increases and other measures. Austin Goolsbee, a professor of economics at the University of Chicago who has advised Biden's economic policy, stated, "The current crisis caused by COVID-19 shows an unequal pattern of economic downturn. High-income earners and many large corporations are not experiencing a recession," adding, "Increasing their tax burden does not contradict economic growth."

Biden himself emphasized that the impact of the tax increase would be limited to high-income groups. He said, "People earning less than $400,000 a year will not see their taxes go up," and added, "Corporations will pay more taxes, and you will benefit."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.