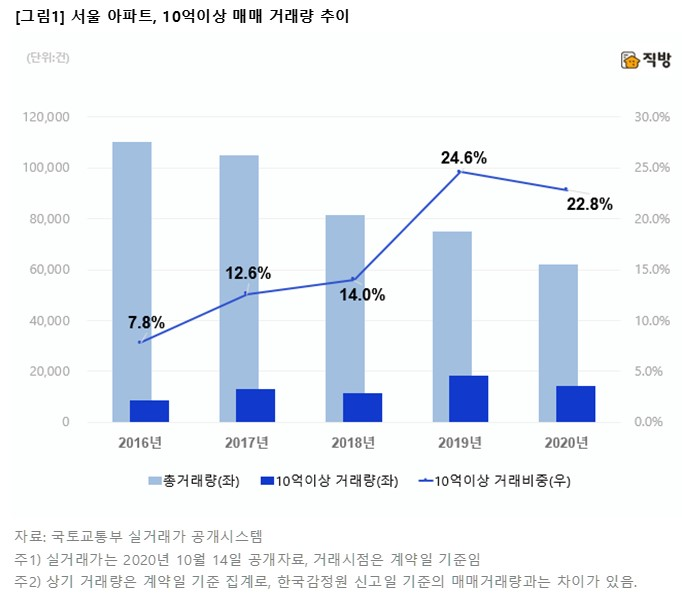

2018 14%→Last Year 24.6%→This Year 22.8%

Gangnam and Seocho Hit Amid 3-Step Regulations on Loans, Taxes, and Transactions

Trend of Upward Standardization and Metropolitan Expansion of High-Priced Housing in Seoul

[Asia Economy Reporter Onyu Lim] As the government strengthens regulations on loans, taxes, and transactions for high-priced housing, the proportion of apartment sales transactions over 1 billion KRW in Seoul, which had been rapidly increasing, has slowed down. In particular, the markets in Gangnam and Seocho districts, where high-priced housing is concentrated and which have been hit by tightened reconstruction regulations, have significantly contracted.

According to an analysis of actual transaction prices by Zigbang based on data from the Ministry of Land, Infrastructure and Transport on the 19th, the proportion of apartment sales transactions over 1 billion KRW in Seoul this year was 22.8% of the total. This is a decrease of 1.8 percentage points from 24.6% last year.

Since 2016, the proportion of transactions for apartments over 1 billion KRW, which had been around 10% annually on average, steadily increased until last year. Reconstruction-completed apartments in prime locations such as Banpo-dong and Daechi-dong led the market, and nearby relatively new apartments narrowed the gap with them, rising together.

Additionally, newly built 84㎡ (exclusive area) apartments in areas where large-scale redevelopment projects have been completed, such as Gangdong, Dongjak, Mapo, and Seongdong districts, formed the '1 Billion Club,' and even relatively lower-priced areas like Seodaemun, Dongdaemun, Geumcheon, Gwanak, and Guro districts joined the '1 Billion KRW price matching' trend centered on new apartments, raising the overall price level in Seoul.

The main reason for the shift from an increasing trend to a decline in the proportion of transactions for apartments over 1 billion KRW this year is attributed to the government's strengthened regulations on high-priced housing. A Zigbang official analyzed, "The decrease in transaction volume this year in Gangnam and Seocho areas, where high-priced housing is concentrated, seems to be influenced by loan regulations, increased holding taxes, sluggish reconstruction projects, and investigations into sources of funds."

◆Contraction of Gangnam and Seocho Transaction Markets is the Main Cause of the Decline in High-Priced Housing Transaction Proportion

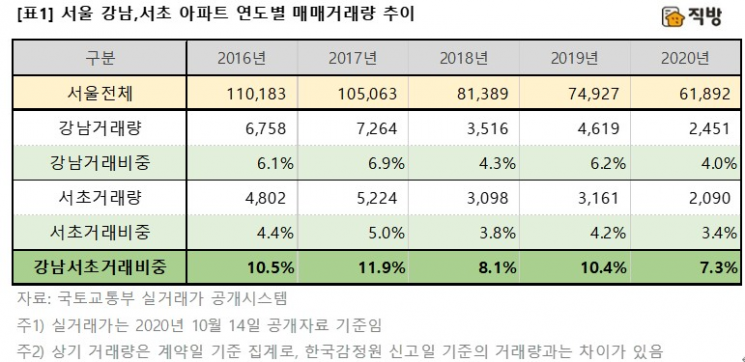

In fact, the areas most affected by the government's strong regulations targeting high-priced housing are Gangnam and Seocho districts. Over the past five years, Gangnam and Seocho districts maintained about 10% of Seoul's total transaction volume annually, but this year it decreased to 7.3%, showing a clear contraction.

Most apartments in these areas lead the high-priced housing market by asking prices around 1 billion KRW, but factors such as reduced LTV for homes priced over 900 million KRW, prohibition of mortgage loans for homes over 1.5 billion KRW, increased comprehensive real estate tax rates, delays in reconstruction projects due to the reconstruction excess profit recovery system and price ceiling system have resulted in decreased buying demand.

◆Emergence of New Gangnam Amidst Gangnam's Transaction Slump

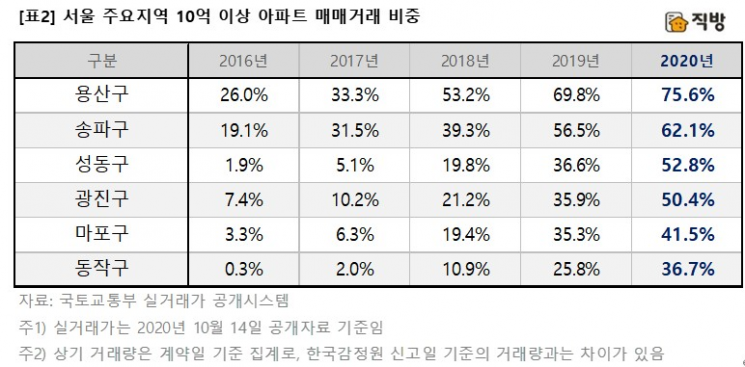

While the transaction market in Gangnam and Seocho districts is sluggish, areas with large complexes of newly built apartments such as Mapo, Dongjak, and Seongdong districts are emerging as new faces of the 1 Billion Club. Seongdong district, where the proportion of transactions over 1 billion KRW was only 1.9% in 2016, surged to 52.8% this year due to projects in Oksu-dong, Geumho-dong, and Wangsimni New Town. Mapo district also increased from 3.3% in 2016 to 41.5% this year, and Dongjak district rose from 0.3% to 36.7%.

A Zigbang official explained, "Most of these areas are along the Han River and have excellent accessibility to downtown and business districts like Gangnam, but due to many old houses, prices had been sluggish. However, with large-scale redevelopment projects progressing and the proportion of new buildings increasing, these areas are transforming into the most popular residential towns in Seoul."

◆Geumcheon, Gwanak, and Guro: The Three in the Southwest Also Enter the 1 Billion Club

The so-called southwest trio (Geumcheon, Gwanak, Guro), which had many mid-to-low-priced houses and was popular among newlyweds and those with limited financial capacity, along with the northeast trio (Nowon, Dobong, Gangbuk), have now entered the era of 1 billion KRW apartments. These six districts had a 0% proportion of transactions over 1 billion KRW in 2016, but this year, apartments priced at 1 billion KRW appeared simultaneously. Lotte Castle in Doksan-dong, Geumcheon-gu, e-Pyeonhansesang Seoul National University Entrance developed by redeveloping Bongcheon 12-1 and 2 districts in Gwanak-gu led the price increase, followed by Daerim Byeoksan and Lotte Woosung in Junggye-dong, and Mia New Town in Mia-dong.

While the decrease in the proportion of transactions for apartments over 1 billion KRW may be seen as a sign of some market stabilization, it is still insufficient to be considered a stable signal. First, the decrease in transaction proportion is due to reduced transactions in major areas like Gangnam and Seocho, not a decline in market prices.

A Zigbang official pointed out, "Areas that were previously sought after by middle-income groups or those with limited housing affordability are now producing high-priced apartments over 1 billion KRW, effectively becoming second and third Gangnams. This is a significant concern and could become another trigger in an already unstable housing market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.