The Average Operating Period of Bakery Specialty Stores is 8.8 Years

Many Stores Have Been Operating for a Long Time

[Asia Economy Reporter Park Sun-mi] There are approximately 18,000 bakery specialty stores operating nationwide, and it is predicted that the bakery market will continue to grow as bread consumption steadily increases, driven by the rising trend of single-person households.

On the 18th, KB Financial analyzed the status of bakery specialty stores and changes in consumption trends through the ‘KB Self-Employment Analysis Report,’ which provides an in-depth analysis of the domestic self-employment market.

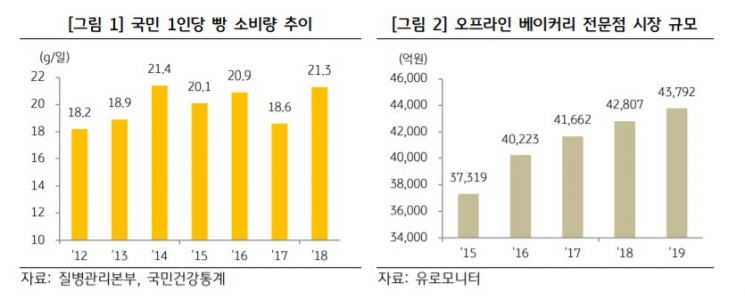

The current number of bakery specialty stores nationwide is counted at 18,000. The daily bread intake per capita increased from 18.2g in 2012 to 21.3g in 2018, and based on one 85g red bean bread, the annual consumption rose from 78 to 91 pieces. As bread consumption increased, the market size of bakery specialty stores that make bread directly or bake and sell dough grew from about 3.7 trillion KRW in 2015 to 4.4 trillion KRW in 2019, showing an annual growth rate of 4.1%.

Increase in Bread Consumption Expenditure... Monthly Average from 19,000 KRW in 2015 to 22,000 KRW in 2019

Household consumption expenditure also increased rapidly, with the average monthly spending per household on bread and rice cake-related products rising by 16.6% from 19,000 KRW in 2015 to 22,000 KRW in 2019. During the same period, total expenditure on groceries and non-alcoholic beverages increased by 8.4%, and expenditure on grains including rice increased by 1.7%, showing a higher growth rate for bread-related spending. In particular, demand for bread as a convenient meal substitute has expanded, especially among younger generations.

Bakery specialty stores have an average operating period of 8.8 years, and 56.4% of all stores have been in operation for more than five years, indicating many long-term operating stores.

Examining store operation characteristics, bakery specialty stores tend to have relatively more employees and longer business hours. Stores with three or more employees account for 60.5%, which is higher compared to coffee shops or chicken specialty stores, and 55.7% of bakery stores operate for more than 12 hours. As a result, the operating profit margin is 15.0%, which is lower than that of chicken stores (17.6%) or coffee shops (21.6%).

Domestic bread consumption is expected to continue increasing for the time being, and business conditions are also forecasted to remain relatively favorable. Researcher Kim Tae-hwan said, "Bakery specialty stores, which require professional skills and experience, have relatively high entry barriers, so if they succeed in entering the market initially, they can operate stably for a relatively long period." He added, "However, it is necessary to consider the high cost burden of labor and materials and the relatively low profit margin, and for non-franchise stores, responding to the expansion of non-face-to-face consumption is an important challenge."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)