Transaction Value Soars to Triple Last Year

Profitability Superior to Domestic Market

Top Purchased Stock 'Tesla'

[Asia Economy Reporter Oh Ju-yeon] This year, the trading volume of overseas stocks has already surpassed three times the total volume traded last year. It is analyzed that individual investors, who have experienced the stronger performance of the U.S. market compared to the domestic stock market over the past decade, are turning their attention to overseas stocks.

According to the Korea Securities Depository on the 16th, as of the 13th of this month, the trading volume of overseas stocks (buy + sell) amounted to 158.63 trillion KRW (138.24 billion USD) in Korean won terms. This is 3.3 times the overseas stock trading volume of last year, marking an all-time high. The scale of overseas stock trading volume has been increasing every year. Until 2015, it was only 16 trillion KRW (13.9 billion USD), but it more than doubled to 37 trillion KRW (32.57 billion USD) in 2018 within three years, and last year it increased to 47 trillion KRW (40.985 billion USD). This year, it is expected to exceed 160 trillion KRW, meaning it has grown tenfold in the last five years.

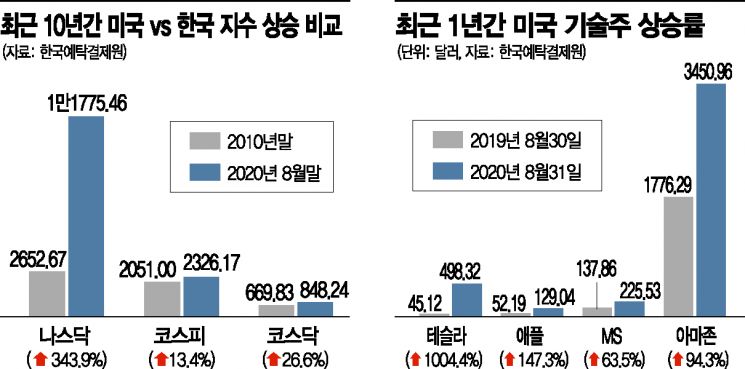

The surge in overseas stock trading volume is partly due to abundant liquidity based on low interest rates, but also because overseas markets such as the U.S. outperform the domestic market in terms of profitability. The U.S. Nasdaq index rose 343.9% from 2,652.67 at the end of 2010 to 11,775.46 as of the end of August this year. During the same period, the KOSPI increased by 13.4% from 2,051.00 to 2,326.17, and the KOSDAQ index rose by only 26.6% from 669.83 to 848.24.

This trend is also reflected in the top five overseas stocks invested in over the past six months. After the domestic and international stock markets plummeted due to the COVID-19 pandemic, the top five overseas stocks invested in by domestic investors from April to the present are dominated by U.S. tech stocks. The first place was Tesla (7.78956 billion USD), followed by Apple (4.07817 billion USD), Amazon (2.45795 billion USD), Microsoft (1.84442 billion USD), and Nvidia (1.82070 billion USD).

These stocks have seen significant price increases since last year, providing investors with at least double-digit returns. Tesla’s stock price soared from 45.12 USD on August 30 last year to 498.32 USD on August 31 this year, a rise of 1004.4%, delivering a 'jackpot' to some investors. Apple also rose 147.3% from 52.19 USD to 129.04 USD during the same period, and Amazon recorded a 94.3% return, increasing from 1,776.29 USD to 3,450.96 USD. Although Microsoft’s growth rate was lower compared to other stocks, it still rose 63.5% from 137.86 USD to 225.53 USD.

An official from the Korea Securities Depository stated, "In terms of dollar exchange rate fluctuations, the dollar exchange rate tends to fluctuate significantly depending on foreign buying and selling in the domestic securities market, but as the scale of domestic investors’ foreign securities investments increases, the fluctuation range of the dollar exchange rate is largely offset." They added, "From the perspective of domestic investors, diversifying portfolios allows for risk dispersion effects, and through internationalization of investments, the globalization of the Korean securities market can be completed."

Meanwhile, the Korea Securities Depository announced that it will establish a 'Foreign Currency Securities Information Management System' within this year to promptly respond to the increasing trend of overseas securities trading volume. In the future, through system advancement, they plan to add procedures that automatically compare information provided by foreign custodians, securities companies, and securities information providers to prevent processing errors and manage risks such as settlement delays and failures.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.