Extension of Loan Maturity and Interest Repayment Deferral Postpones Recognition of Non-Performing Loans

[Asia Economy Reporter Park Sun-mi] As corporate and household loans are expected to continue increasing next year, the banking sector is anticipated to face soundness risks due to the deferral of recognizing non-performing loans.

According to the '2021 Financial Industry Outlook Report' published on the 17th by Hana Financial Management Research Institute, next year bank soundness is expected to show a phenomenon where the recognition of non-performing loans is deferred due to the denominator effect from the increase in total loans driven by government and bank financial support, along with loan maturity extensions and interest payment deferrals. This means that delinquency rates and non-performing loan ratios may appear to improve.

Currently, banks are proactively setting aside loan loss provisions following financial authorities' guidance to strengthen capital soundness in the banking sector. Commercial banks have extended loan maturities worth 51.3 trillion KRW across 178,000 cases and deferred interest payments amounting to 39.1 billion KRW in 3,500 cases. Including policy financial institutions and the secondary financial sector, loan maturity extensions total 75.8 trillion KRW (246,000 cases), and interest payment deferrals reach 107.5 billion KRW (9,400 cases).

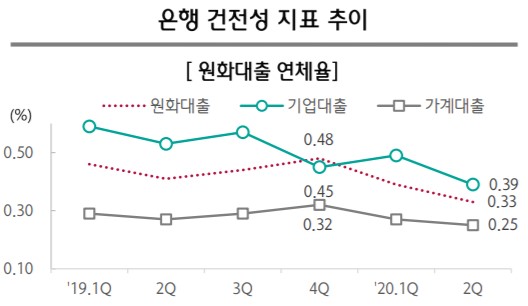

In fact, due to the effect of deferred recognition of non-performing loans, the delinquency rate and non-performing loan ratio of won-denominated loans in the banking sector are declining. As of the end of Q2 this year, the delinquency rate for won loans was 0.33%, down from 0.48% at the end of Q4 last year. The non-performing loan ratio was 0.71% at the end of Q2 this year, down from 0.77% at the end of Q4 last year.

Soundness Threats from Loan Maturity Extensions and Interest Payment Deferrals

However, factors worsening bank soundness abound, such as the proportion of marginal companies expected to exceed 20% due to the impact of COVID-19. The institute forecasts that the credit scale of marginal companies will grow from 105 trillion KRW in 2018 and 116 billion KRW in 2019 to 176 billion KRW in 2020, an increase of about 52% compared to last year. It advised that banks need to take preemptive measures in preparation for the potential expansion of marginal company risks, especially in service industries like tourism and hotels, and transportation.

Additionally, concerns about increased risks in self-employed loans after COVID-19 have been raised. Self-employed loans have continued to grow due to policy funds after the pandemic, but the vulnerable business structure concentrated in domestic sectors and borrower aging raise concerns about expanding non-performing loans if shocks persist. Due to the economic shock from sharp sales declines, 20% of self-employed households respond by disposing of assets, but their endurance period is less than six months. If severe sales shocks continue, there is concern that defaults will surge due to deteriorating debt repayment ability.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)