Institutional Buying... Over 1% Rise

Anxiety Over Repeating LG Chem's Path

Market Says "Different from LG Chem,

Expecting Increased Business Value for SK Telecom"

[Asia Economy Reporter Minji Lee] As SK Telecom announced the spin-off of its mobility business division, anxiety among individual shareholders is growing. There are concerns that it might follow in the footsteps of LG Chem, which decided to spin off its battery business. However, the market views the spin-off issue as a clear positive for corporate value and advises to 'buy while it's cheap.'

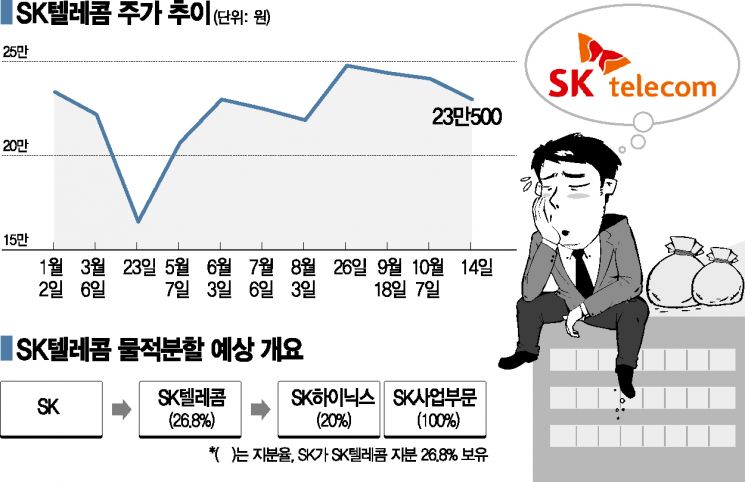

As of 10:20 AM on the 15th, SK Telecom was trading at 234,500 KRW on the KOSPI market, up 1.74% from the previous day. After a nearly 5% plunge the day before, SK Telecom is showing a rise of over 1%, driven mainly by institutional buying. Currently, foreigners have sold 440,000 shares in the market, while institutions have purchased about 3,000 shares.

The news that SK Telecom is pushing for a spin-off to foster its mobility business has increased stock price volatility. The previous day saw foreigners sell 228,000 shares in a single day, deepening the stock price decline.

After the spin-off, SK Telecom plans to expand its domain centered on T map. Given its strong commitment to securing a leading position in the global mobility market, the related industry expects that after the spin-off, SK Telecom will achieve high competitiveness in the mobility market through partnerships with other companies, attracting investments, and swift decision-making.

The spin-off method is likely to be a physical division. When splitting a company, there are two types: a physical division and a human division. A physical division means the existing company holds 100% of the shares of the newly established company. A recent example is LG Chem. LG Chem announced that it will hold 100% of the total issued shares of the new battery company (LG Energy Solution), making it a subsidiary. A human division means creating a new company where the shareholders of the existing company retain their shareholdings. Since the shareholding structure does not change in a human division, it is less likely to face strong opposition, but a physical division can cause significant backlash depending on stakeholders because the shareholder composition changes. This is why individuals prefer a human division over a physical division.

As this news spreads, opinions among individuals are divided on how SK Telecom’s physical division will affect the stock price. Some express concerns that SK Telecom might experience a prolonged stock price weakness similar to LG Chem. One shareholder who posted on the shareholder board said, "It is questionable that the spin-off is being pushed while the aftermath of LG Chem’s spin-off still lingers," adding, "It is unfair to individuals to decide on the spin-off now after explaining to shareholders that the company would not remain a simple telecom company." Furthermore, since SK Telecom is a representative long-term investment stock for individual investors, there are worries that including the mobility division might be negative news for shareholders who bought the stock with a future outlook.

On the other hand, other shareholders see it as an already anticipated scenario, viewing it as positive for corporate value. They also believe that unlike LG Chem’s battery division, the mobility business will not significantly impact the company’s value, so it should not be problematic.

Some argue that it is time to pay attention to SK’s governance restructuring. Ultimately, if there is an attempt to reorganize SK Hynix, a grandchild company, into a subsidiary, SK might raise the stock price of SK, the holding company, and lower SK Telecom’s stock price to create favorable conditions for a merger. Already, stock-related YouTube channels have analyzed that "there could be an attempt to make SK Hynix a subsidiary to avoid restrictions under the Fair Trade Act."

The securities industry views the spin-off of the mobility business as effectively increasing the company’s corporate value. Since the mobility subsidiary accounts for less than 1% of SK Telecom’s net assets and there is no clear precedent for value assessment, it is judged that the stock price will not fall significantly in the short term. Rather, by spinning off a high-growth business division and pursuing an initial public offering (IPO), it could raise the value of SK Telecom, which is excessively undervalued. Kim Hong-sik, a researcher at Hana Financial Investment, emphasized, "SK Telecom will nurture the mobility subsidiary as a business leading autonomous vehicles and the sharing economy within the SK Group," adding, "The cooperation with Uber is a strategic move considering the sharing economy business, and the spin-off of the mobility business is a clear positive."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.