SK Inno's Refinery Operating Rate Hits Record Low... Stays in 70% Range

Slow Demand Recovery Due to COVID-19 Impact

Reducing Operating Rate to Minimize Inventory

[Asia Economy Reporter Hwang Yoon-joo] The oil refining industry has lowered the operating rate of crude oil refineries to the lowest level ever, in the 70% range. This is interpreted as a desperate measure to defend profitability as much as possible amid the resurgence of the novel coronavirus infection (COVID-19).

According to the oil refining industry on the 16th, SK Energy has confirmed that it lowered the operating rate of its plant located in Ulsan to the 70% range. Although the operating rate was lowered to 83% during the 2009 global financial crisis, this is the first time it has dropped to 70%. This is evidence that the impact of COVID-19 is more severe than ever.

SK Innovation lowered the plant operating rate to minimize losses. Due to the nature of the equipment, once a crude oil refinery starts operating, it produces all petroleum products such as gasoline, diesel, jet fuel, and kerosene. Since it is impossible to produce only the products with high sales volume, when market conditions are poor, the operating rate is lowered to reduce inventory. SK Energy plans to closely review market conditions every two weeks and adjust the operating rate accordingly. Even if the operating rate is increased, it is known to be only slightly.

An official from the Korea Petroleum Association said, "After the COVID-19 crisis, as global oil demand sharply declined and refining margins continued to fall, the global oil refining industry is precariously responding by lowering operating rates," adding, "The average operating rate of the four domestic refiners has dropped to the 70% range, and there is a limit to lowering it further."

In fact, not only in Korea but also overseas refiners have lowered their operating rates. The overall operating rate of refineries in the United States fell about 10 percentage points from 83-85% in the same period last year to 77.1%. The state-owned oil refining industry in China (Sinopec, Sinochem, PetroChina), which was the first to emerge from the COVID-19 crisis, also raised operating rates but recently lowered them to 73.6%.

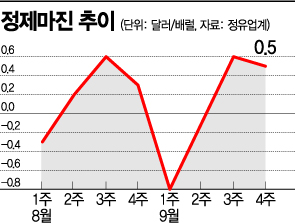

As the global oil refining industry lowered plant operating rates and supply decreased, refining margins slightly improved. Last week, the Singapore complex refining margin rose by $0.5 from the previous week to $2.

An oil refining industry official said, "Due to weak demand caused by the COVID-19 crisis, it is not easy to recover performance in the short term," adding, "If economic activities do not normalize, the actual operating profit in the refining sector will continue to be in deficit."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.