Active Tax Support for Small-Scale Individuals and SMEs... Strengthened Verification After Reporting Non-Compliant Filers

[Asia Economy Reporter Kwangho Lee] The National Tax Service announced on the 13th that 1.01 million corporate taxpayers must file and pay the second installment of the 2020 value-added tax by the 26th of this month.

The number of taxpayers subject to this filing increased by about 70,000 compared to the 940,000 who filed the second installment last year.

Individual general taxpayers only need to pay the pre-notified estimated tax amount.

The National Tax Service excludes small-scale individual general taxpayers with a supply amount of 40 million KRW or less in the previous tax period (January to June 2020) from the estimated VAT pre-notification (569,000 people) and actively supports business operators facing management difficulties who apply for collection deferral or deadline extension.

In addition, businesses that have suspended operations due to social distancing measures and small and medium-sized enterprises will receive their refunds earlier, by the end of October.

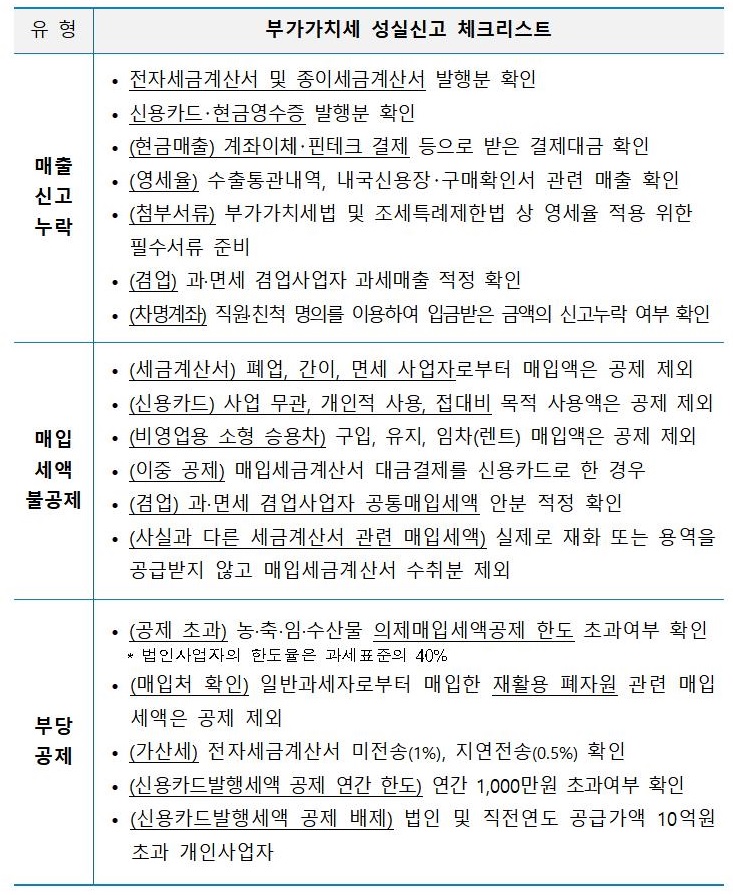

The National Tax Service expands the provision of filing precautions, customized help materials, and pre-filled (28 items) services through the Hometax 'Filing Assistance Service' to enable taxpayers to file conveniently and accurately.

In particular, using the checklist for items prone to incorrect filing can prevent disadvantages such as additional tax burdens caused by filing errors.

A National Tax Service official said, "We plan to strictly verify dishonest filers through big data analysis" and urged, "Please file honestly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.