Stalled for 11 Years Due to Medical Sector Opposition

Both Ruling and Opposition Parties Support in the 21st National Assembly

[Asia Economy Reporter Ki Ha-young] Momentum is building for the passage of a bill in the National Assembly that would simplify claims for indemnity health insurance by allowing insurance claims to be made directly at the medical institution where treatment is received. Although the bill had been stalled for 11 years due to opposition from the medical community, both ruling and opposition parties in the 21st National Assembly have voiced a unified need for the bill and have been consecutively proposing related legislation.

According to the National Assembly and industry sources on the 12th, Go Yong-jin, a member of the National Assembly’s Planning and Finance Committee from the Democratic Party of Korea, officially proposed a partial amendment to the Insurance Business Act on the 8th that includes measures to simplify indemnity insurance claims. This is the third time such a bill has been proposed in the 21st National Assembly. Previously, in July, Jeon Jae-su of the Democratic Party and Yoon Chang-hyun of the People Power Party had successively introduced related bills.

The bill’s main point is that when requested by the insurance policyholder, the medical institution such as a hospital would directly transmit supporting documents like medical expense statements to the insurance industry through the Health Insurance Review and Assessment Service (HIRA) electronic network. Unlike the amendment proposed in the 20th National Assembly, this bill prohibits HIRA from using or storing the information for purposes other than document transmission. Additionally, it includes provisions to establish a committee involving the medical community regarding entrusted tasks. This measure reflects consideration of the medical community’s concerns about HIRA accumulating information or reviewing non-reimbursable medical expenses in the future.

With both ruling and opposition parties proposing bills to simplify indemnity insurance claims in the 21st National Assembly, expectations are rising that the law will be amended without partisan disagreement. An industry official emphasized, "Non-digitized indemnity health insurance claims cause inconvenience not only to consumers but also to hospitals and insurance companies," adding, "It is necessary to amend the Insurance Business Act to establish a legal basis for simplifying the claim procedures of indemnity health insurance to enhance convenience for everyone, including consumers."

Indemnity health insurance, often called the second national health insurance with two-thirds of the population enrolled nationwide, frequently sees claimants giving up on filing claims due to complicated procedures. Since 2009, following recommendations for system improvement by the Anti-Corruption and Civil Rights Commission, related legal discussions have continued in the 20th National Assembly but failed to pass due to opposition from the medical community.

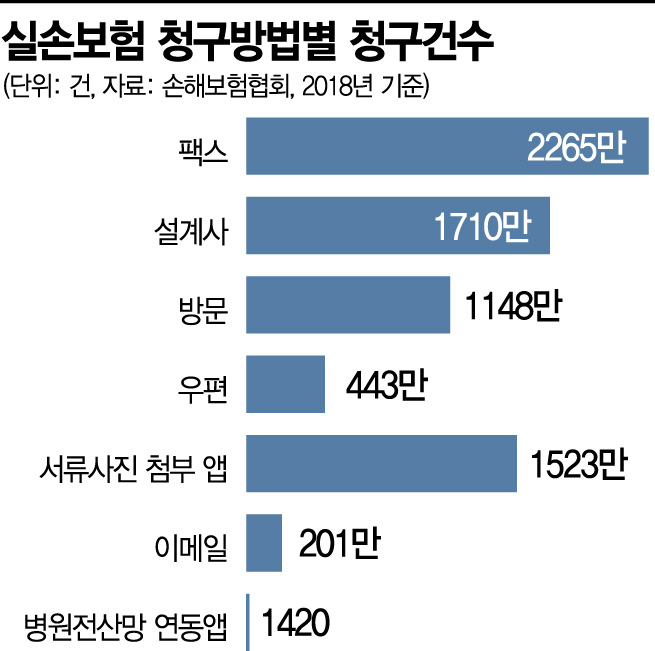

As of 2018, 76% of the 90 million annual indemnity insurance claims were made via fax, through insurance agents, or by visiting insurance agencies. The remaining 24% submitted paper documents via email or insurance company applications. Even in these cases, insurance company staff must manually input the documents into the electronic system. In effect, 99% of claims are still based on paper documents.

However, opposition from the medical community remains a significant hurdle. The medical community opposes claim simplification citing concerns such as personal information leakage. Fintech companies, including the Medical IT Industry Association, also oppose the legislation that would make HIRA an intermediary agency, raising issues such as liability in case of data transmission failures during insurance claims.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.