Korea Investment & Securities Report

"Dividends to Maintain Last Year's Level"

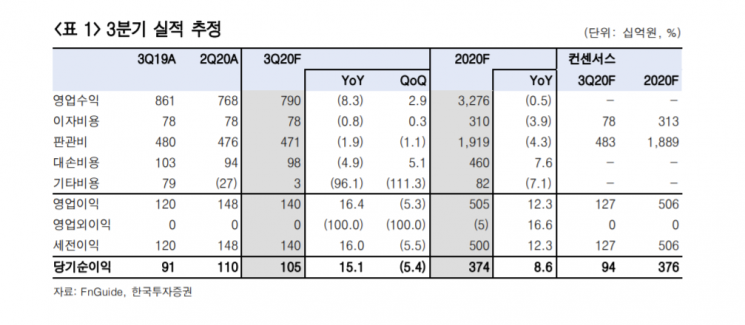

[Asia Economy Reporter Minji Lee] Samsung Card is expected to deliver better-than-expected results in the third quarter, driven by an increase in individual card usage and a decrease in marketing expenses. According to Korea Investment & Securities on the 9th, Samsung Card's net profit for the third quarter is estimated at 104.5 billion KRW, surpassing market expectations by 11%.

This is due to steady growth in individual card usage, a decline in funding cost ratio, and reduced marketing expenses. Samsung Card's individual card usage in the third quarter is estimated to have increased by 5% compared to the same period last year. The overall industry usage growth rate for the third quarter is estimated at 4%, with automobile-related usage expected to have remained robust compared to other companies.

Baek Doosan, a researcher at Korea Investment & Securities, said, “For the entire industry, individual card usage increased by 5.8% in July and 3.9% in August compared to the same period last year,” adding, “Despite the implementation of social distancing level 2.5 in September, a favorable growth rate is expected.”

By sector, food and lodging were somewhat sluggish, but usage increased significantly mainly through online channels. The industry's total online card approval amount increased by 22.2% in July and 35.5% in August compared to the same period last year, continuing the trend of contactless (untact) transactions.

The downward trend in funding cost ratio also continued. Currently, the AA+ 3-year credit card bond rate is around 1.4%, which remains lower than the total borrowing rate of 2.35% based on outstanding balance. With stable delinquency indicators, bad debt expenses showed little change. The trend of improving selling and administrative expense efficiency continued this quarter as well, following the previous quarter.

This year's estimated dividend per share (DPS) is 1,600 KRW, with an expected dividend yield of 5.6%. Even considering the possibility of increased provision expenses due to adjustments in the fourth quarter's risk component (RC) value, this year's net profit is estimated to reach 373.7 billion KRW, a 9% increase from the previous year. Researcher Baek Doosan said, “Despite the challenging environment, this year's DPS is expected to remain at the same level as last year,” and added, “We recommend a buy rating for Samsung Card with a target price of 36,000 KRW.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.