Hotel Investment Aimed at Real Estate Capital Gains

COVID Shock from Decline in Chinese and Japanese Tourists

Burden of Recovering Initial Massive Investment Costs

Increase in Management Services like Hanwha Hotels & Resorts' 'Matie'

[Asia Economy Reporter Cha Min-young] As the novel coronavirus infection (COVID-19) prolongs, the long-standing formula of 'hotel business = real estate investment' is changing. The traditional strategy of acquiring land and building hotels to create regional landmarks is shifting to a model where asset owners of land and buildings are separate, leasing these properties to operate hotels that provide only management and services.

Building Owners Separate, Only Operation and Services Provided

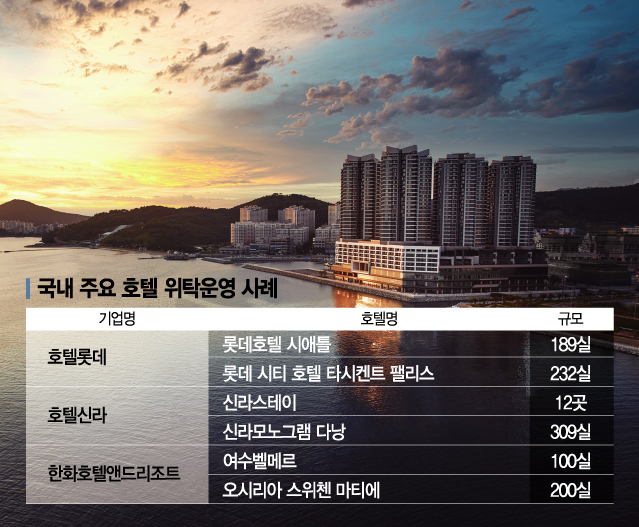

According to the hotel industry on the 8th, Hanwha Hotels & Resorts selected the residence 'Oceania Suitezen Mati?' located in Busan as the first hotel under its consignment operation specialized brand 'Mati?' in 2022. With 200 rooms, four out of five buildings are used as residences for general living purposes, and the remaining one building operates as a hotel. Following consignment operations of 'The Plaza Hotel' and 'Yeosu Belmare,' Hanwha Hotels & Resorts will also manage this hotel under consignment. Hanwha plans to expand the Mati? brand hotels to a total of 10 by 2030. The second hotel using the Mati? brand is scheduled to open in Pyeongchon, Anyang in 2024. A Hanwha official stated, "With the inbound (domestic tourism) market growing due to COVID-19, we will provide customized services tailored to local characteristics based on our extensive experience operating numerous hotels and resorts."

Major domestic luxury hotels are also actively engaging in consignment operation services. 'Lotte Hotel Seattle,' which opened last month by Hotel Lotte, was developed in collaboration with Hana Financial Investment. The hotel operates under a model where Hotel Lotte provides consignment operation services in a building owned by a private equity fund invested in by Hana Financial Investment and Hotel Lotte at a 70:30 ratio. Hotel Lotte is currently managing hotels under consignment in Russia, Vietnam, Uzbekistan, and other locations. Hotel Shilla operates 12 business hotels under the 'Shilla Stay' brand and 'Shilla Monogram Danang' in Vietnam under consignment. Shinsegae Chosun Hotel currently has no consignment-operated hotels but is reportedly considering future entry into this market.

Heavy Burden of Recovering Large Real Estate Investment Costs Leads to Consignment Shift

The reason hotels are increasingly adopting consignment operations is the growing burden of recovering initial investment costs. Traditionally, the hotel industry attracted investment demand aimed at real estate capital gains, but the number of tourists from China and Japan sharply declined several years ago, and the recent COVID-19 crisis has further deteriorated profitability. According to global research firm Euromonitor, the domestic hotel market size grew 40% from approximately 1.61 trillion KRW in 2010 to about 2.26 trillion KRW in 2014. The growth was mainly driven by luxury hotels, including 4- and 5-star hotels. However, growth stalled at 1.98 trillion KRW in 2015, and last year the market barely maintained the 2 trillion KRW level. This year, the market size is expected to shrink 12% to 1.84 trillion KRW compared to the previous year. Additionally, demand to save on expensive fees paid to global hotel chain brands and confidence derived from long-term hotel operation experience are also reasons for the expansion of consignment operations.

Experts point out that it is important to establish system competitiveness such as hygiene and quarantine rather than traditional services. Professor Han Jin-soo of Kyung Hee University’s College of Hotel and Tourism said, "It is a natural trend for local hotels to strengthen consignment operations in line with the times, just like famous operators such as Marriott Hotel, which first ventured into consignment operations in the 1970s," adding, "In the post-COVID era, only those with system-centered competitiveness will survive in the current turbulent environment."

Possibility of Increased Sales and Leaseback

There are also predictions that the sales and leaseback market will grow, centered on mid-sized and large companies and developers. This is because luxury hotels and 1- to 3-star business hotels, which were hit hard by COVID-19, are flooding the mergers and acquisitions (M&A) market. Properties such as Jeonwon Industry’s 'Le Meridien Hotel Seoul,' Seoju Industry Development’s 'Banpo Sheraton Palace Hotel,' and Daewoo Construction’s 'Sheraton Grand Incheon Hotel' are on the market awaiting new owners. HTC, a specialized hotel and resort consignment operation company, and the accommodation reservation site 'MeetEye' are undergoing corporate rehabilitation procedures.

Blind funds worth several hundred billion KRW are actively considering purchasing real estate properties offered by hotels facing difficulties. Hotels are also popular in the public REITs market. 'Shinhan Hotel Cheonan REIT,' which invests in 'Shilla Stay Cheonan,' sold out 30 billion KRW worth of shares on the first day of its public offering last September. The 'Aegis Value Plus REIT,' listed in June this year, also specifically considered incorporating 'Jeju Kensington Hotel' as a base asset before listing but ultimately failed because Shinsegae Chosun Hotel purchased Jeju Kensington Hotel aiming for a renewal opening. Cases of purchasing hotels for commercial real estate development are also expected to increase. Professor Min Sung-hoon of the Department of Architecture, Urban and Real Estate at Suwon University said, "As many business hotels facing difficult operating environments are coming onto the market, the number of sales and leaseback transactions may increase. However, there may be more demand for commercial real estate development, similar to recent trends in large supermarkets and department stores, rather than maintaining hotels."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.