Prolonged Low Interest Rates Slash Interest Income

Defense by Increasing Available-for-Sale Bonds

"Expanded Potential for Asset Impairment"

[Asia Economy Reporter Oh Hyung-gil] The Achilles' heel of the 'Big 3' life insurers?Samsung Life, Hanwha Life, and Kyobo Life?known as the secondary negative spread, is worsening.

This means that the money paid out in insurance claims exceeds the income earned from asset management, indicating a deterioration in profitability and growth potential. The Big 3 are responding by converting bonds held in the first half of the year into available-for-sale assets, but with past high-interest products weighing them down, finding a sharp solution to the negative spread is difficult.

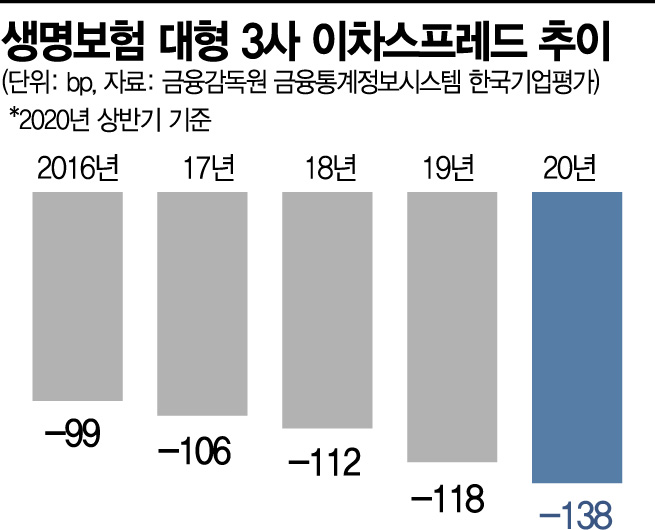

According to the insurance industry on the 7th, the spread between the interest income rate and the coupon rate of the Big 3 as of the first half of the year recorded 138 basis points. Since it first exceeded 100 basis points in 2017, it has been steadily increasing every year.

The cause is that the coupon rates on liabilities remain high due to high-interest fixed insurance contracts sold in the past, while prolonged low interest rates have significantly reduced interest income. Although insurers are lowering coupon rates by increasing the proportion of interest-linked products instead of fixed-rate products, interest income rates are falling faster due to low government bond yields.

The industry believes that if the current market interest rate level persists long-term, it will be impossible to alleviate the burden of the secondary negative spread. Insurers have a structure where the duration of liabilities is longer than that of assets, so when interest rates fall, liabilities increase more than assets.

The Big 3 are making every effort to respond, such as increasing available-for-sale financial assets. In fact, the disposal gains from available-for-sale financial assets of the three companies in the first half reached 1.5156 trillion won, about three times higher than 526.9 billion won in the same period last year.

However, the limitation is that increasing bond sales to realize disposal gains at once while purchasing lower-yield bonds inevitably expands the secondary negative spread rapidly. This increases the possibility of a long-term decline in interest income.

Recently, credit rating agencies have also been issuing negative reports on life insurers one after another.

Kim Jung-hoon, a researcher at Korea Credit Rating, warned on the 2nd, "The scale of the secondary negative spread for life insurers is around 5 trillion won annually, about 2.5 times the net income, and its size is increasing every year," adding, "There is great concern about the decline in interest rates."

Kim further stated, "As insurers expand non-traditional investment assets such as overseas investments and alternative investments for fixed investment income, the risk of asset portfolios will deteriorate over the long term," and "As the low-interest environment intensifies, the potential for latent insolvency in insurers' asset portfolios is likely to increase during the accelerated portfolio transition process."

Song Mi-jung, a senior researcher at Korea Ratings, also pointed out in last month's 'Insurance Company Interest Rate Risk Review' report, "Life insurers are pursuing various strategies such as lowering the assumed interest rate, diversifying and selling assets, and securing high-profit new contracts," but she noted, "Changes in liability structure are very slow, and temporary profit increases through asset management are likely to burden long-term profitability."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)