Significant Base Rate Cut Due to COVID Impact

Regular Deposit Rates Drop to 0% Range

Prices Rise Amid Rainy Season and Typhoons, Consumer Perceived Interest Rates Enter Negative Territory

Funds Shift from Deposits to CMA and MMF

Immediate Movement When Investment Opportunities Arise

Concerns Over Financial Market Instability if Overvalued Asset Price Bubble Bursts

Negative Real Interest Rates

Effect of Accommodative Monetary Policy

Positive Interpretation for Economic Stimulus Perspective

[Asia Economy Reporter Kim Eunbyeol] The reason why large sums of money are flocking to demand deposits, which can be cashed out at any time, is precisely because of the 'negative real interest rate.' Since the beginning of this year, the economic shock caused by the novel coronavirus disease (COVID-19) has intensified, and in response, the Bank of Korea drastically lowered the base interest rate, causing the interest rate on time deposits to fall below 1% for the first time. Meanwhile, due to the recent rise in prices influenced by this summer's rainy season and typhoons, the real interest rate perceived by consumers has entered a negative era. Since locking money in time deposits for one year results in a loss when considering inflation, people no longer find time deposits attractive.

Era of Negative Real Interest Rates

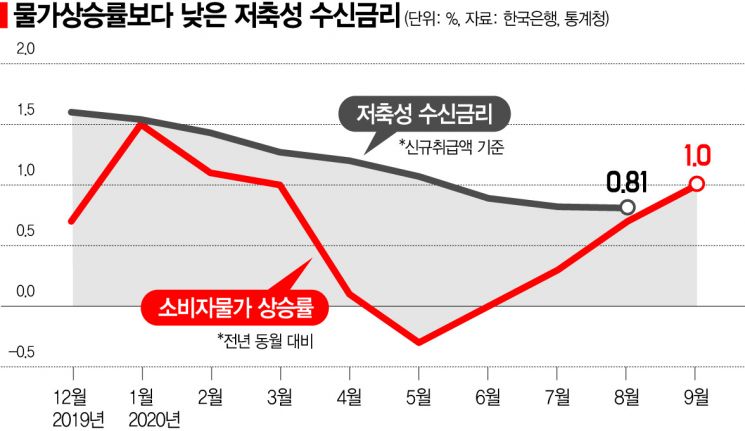

According to the Bank of Korea on the 7th, the bank savings deposit interest rate (based on new contracts) in August recorded 0.81%. The savings deposit interest rate, which was 1.60% at the end of last year, has steadily declined this year and entered the 0% range for the first time in June (0.89%).

On the other hand, consumer prices have recently been on the rise. According to Statistics Korea, the consumer price index increase rate compared to the same month last year was 0.3% in July, 0.7% in August, and rose to 1.0% last month. Assuming the savings deposit interest rate remains in the 0.8~0.9% range in September, the real interest rate on deposits excluding inflation would have entered negative territory.

An official from a commercial bank explained, "When you put 10 million won into a time deposit, after taxes, you only receive about 70,000 won in interest," adding, "Considering inflation, the return is at a negative level, and since the subscription process for time deposits is more cumbersome compared to checking accounts, customers do not find time deposits particularly attractive."

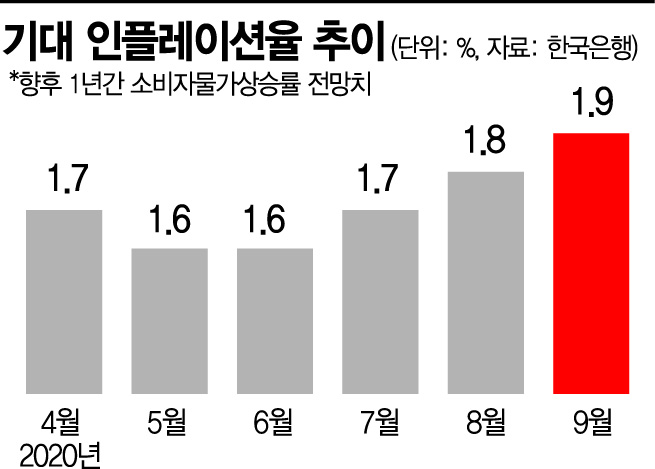

The real interest rate based on the policy rate is also negative. According to the Bank of Korea, the real policy rate last month was -1.4% per annum, calculated by subtracting the expected inflation rate (1.9%) for the next year from the Bank of Korea's base rate (0.50% per annum). This is the lowest level since October 2017 (-1.4%). While many expect prices to continue rising, the economy, hit by COVID-19, shows no signs of recovery, forcing the base rate to remain low. Therefore, the interest rate perceived by people is expected to continue its downward trend.

"Concerns Over Asset Bubble" VS "Transitional Phenomenon, Different from Japan"

People who have put money into checking accounts, comprehensive asset management accounts (CMA), and money market funds (MMF) instead of time deposits tend to withdraw and invest immediately when suitable investment opportunities arise. Typical examples include buying real estate by pooling cash and loans or funds flowing into public offering subscriptions. There are concerns about overheating due to excessive concentration. If an asset price bubble, overvalued compared to actual value, bursts at some point, financial market volatility could increase.

However, excluding the rapid rise in asset prices, some view the negative real interest rate as a sign that the effects of an accommodative monetary policy are manifesting. A government official said, "Currently, we need to stimulate the economy by causing inflation," adding, "People must perceive that prices will rise in the future to increase current consumption, so the recent rise in prices can be seen as monetary policy working effectively." The Bank of Korea's inflation target is 2%. Although the immediate rise in grocery prices may be viewed negatively, it is positive from the perspective of economic stimulus.

Professor Kim Soyoung of Seoul National University's Department of Economics also said, "Although funds have flowed into the asset market during the COVID-19 era, some effects are reflected in the real market as well," adding, "The lower the real interest rate, the greater the economic stimulus effect." She also noted that when the government began expansionary policies, the rapid rise in asset prices was somewhat accepted.

The Bank of Korea explained that the situation differs from Japan, where the economy stagnated despite low interest rate policies. A Bank of Korea official said, "This year, as interest rates were lowered, not only household loans but also corporate loans increased significantly," adding, "In the 1990s in Japan, interest rates were lowered but loans did not increase, so there was no ripple effect in the financial market, making it difficult to compare Korea's situation one-to-one with Japan's."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)