SK Biopharm Leads with 86.8 Billion KRW Purchase

Shinhan Financial Group, Celltrion, NC, and Other Stocks with Bright Future Focused

[Asia Economy Reporter Song Hwajeong] Attention is focused on the stocks that individual investors, who have led the stock market this year, have heavily bought after the Chuseok holiday. It is analyzed that individuals are changing the leading stocks in the market by purchasing a large number of stocks that had shown weakness until now.

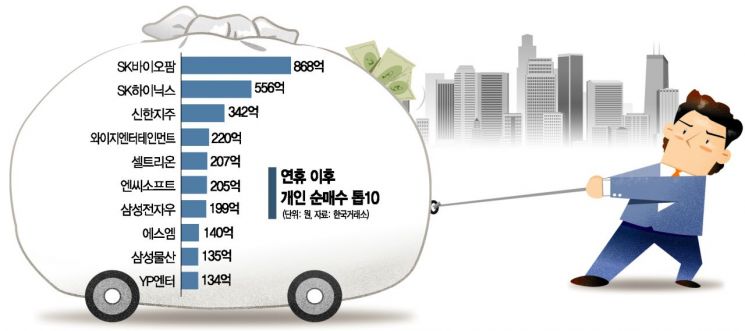

According to the Korea Exchange on the 7th, individuals bought the most SK Biopharm after the holiday. Over the past two days, individuals net purchased SK Biopharm worth 86.8 billion KRW. In particular, individuals concentrated their net buying on SK Biopharm on the 5th, when the stock price plunged more than 10%. On that day alone, they bought 75.5 billion KRW worth.

On the 5th, SK Biopharm’s stock price dropped sharply by 10.22% as about 1.7 million shares held by institutions, which had a three-month lock-up period, were released. This was the first time since its listing in July that SK Biopharm’s stock price fell more than 10%. It is interpreted that individuals saw the sharp decline in SK Biopharm as an investment opportunity.

Individuals also heavily bought Shinhan Financial Group, Celltrion, and NCSoft, which had recently shown weakness. Over two days, individuals net purchased Shinhan Financial Group worth 34.2 billion KRW, Celltrion 20.7 billion KRW, and NCSoft 20.5 billion KRW respectively. Shinhan Financial Group’s stock price fell below 30,000 KRW after announcing a third-party allotment rights offering on the 4th of last month. Researcher Choi Jungwook of Hana Financial Investment said, "Shinhan Financial Group recorded relatively poor performance in the second quarter and decided on an unexpected 1.2 trillion KRW third-party allotment rights offering in early September, causing the stock price to fall 4% in the third quarter, showing poor returns among bank stocks. Foreign investors net sold Shinhan Financial Group worth 367 billion KRW in September alone, accelerating the stock price decline, but it is estimated that individual investors absorbed all of these foreign investors’ sell orders."

Celltrion, which had maintained strength after the COVID-19 pandemic, is also undergoing a recent correction. Celltrion’s stock price fell 15.41% over the past month. NCSoft’s stock price, which was approaching 1 million KRW in July, recently dropped to the 700,000 KRW range. This weakness is attributed to accumulated fatigue from the rapid rise after COVID-19 and the recent decline in U.S. tech stocks. Individuals seem to consider this a buying opportunity given future prospects.

Researcher Kim Jiha of Meritz Securities said about Celltrion, "Since the second quarter, operating profit margin re-entered the 40% range due to cost ratio improvement from production efficiency and SG&A expense reduction effects," adding, "Good profit margins are expected to continue in the second half." In addition, the recently announced merger plan of Celltrion, Celltrion Healthcare, and Celltrion Pharm is also analyzed to have influenced individual investors’ buying momentum.

There is also speculation that NCSoft’s stock price rebound is only a matter of time. Researcher Oh Donghwan of Samsung Securities said, "Despite the continued decline in revenue from Lineage 2M, revenue from Lineage M is rebounding, so third-quarter revenue is expected to increase by 6.7% compared to the previous quarter," adding, "Although the prolonged COVID-19 pandemic has increased volatility in new game release schedules, a sharp profit increase is expected next year due to new releases, so a stock price rebound is only a matter of time."

Additionally, individual investors heavily net purchased entertainment stocks ahead of Big Hit’s listing. Over the past two days, individuals bought YG Entertainment, SM Entertainment, and JYP Entertainment (JYP Ent.) worth 22 billion KRW, 14 billion KRW, and 13.4 billion KRW respectively, ranking them among the top 10 net purchases. When entertainment stocks, which had shown strength due to anticipation of Big Hit’s listing, sharply fell on the 5th, individuals saw it as a buying opportunity and started net buying. On the 5th, YG Entertainment fell 9.4%, while SM Entertainment and JYP Entertainment dropped 5.3% and 4.7%, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.