Securities and Chemicals Expected to Perform Well in Q3

Economically Sensitive Sectors Like Automobiles Also Anticipated

[Asia Economy Reporters Song Hwajeong and Oh Jooyeon] As volatility in the domestic stock market increases, the market is turning its attention to finding 'performance stocks' that can offset the elevated valuations. In particular, the KOSPI operating profit for the third quarter is expected to record year-on-year growth for the first time in eight quarters since Q3 2018, drawing interest to sectors and companies that could lead the earnings recovery.

According to financial information provider FnGuide on the 5th, the securities sector is expected to continue its strong performance in the third quarter following the second quarter of this year. The consensus net profit for the securities sector in September is 759.7 billion KRW, a 51.83% increase compared to the same period last year. This figure was revised upward by 7.08% compared to a month ago.

The brokerage performance is expected to drive the overall securities firms' results as the individual investors' enthusiasm for stock investment continues into the third quarter. According to KB Securities, the average daily trading volume in Q3 surged to about 27.9 trillion KRW. The balance of margin loans also increased by 34.8% from the previous quarter to 17.1 trillion KRW. The proportion of individual trading reached approximately 80% in Q3. KB Securities forecasts that the combined consolidated controlling shareholder net profit of six securities firms?Samsung Securities, Mirae Asset Daewoo, NH Investment & Securities, Korea Financial Group, Meritz Securities, and Kiwoom Securities?will increase by 71.5% year-on-year to 1.2 trillion KRW in Q3.

Researcher Kang Seunggeon of KB Securities explained, "This strong performance is expected because brokerage-related profits will increase by 24.9% compared to the previous quarter. Although a quarter-on-quarter decline is inevitable, the trading division is also expected to record profits. The average daily trading volume increased by 28.2% quarter-on-quarter, leading to a 26.6% increase in commission income, and brokerage-related interest income and expenses will rise by 19.8% due to increases in margin loan balances and deposits."

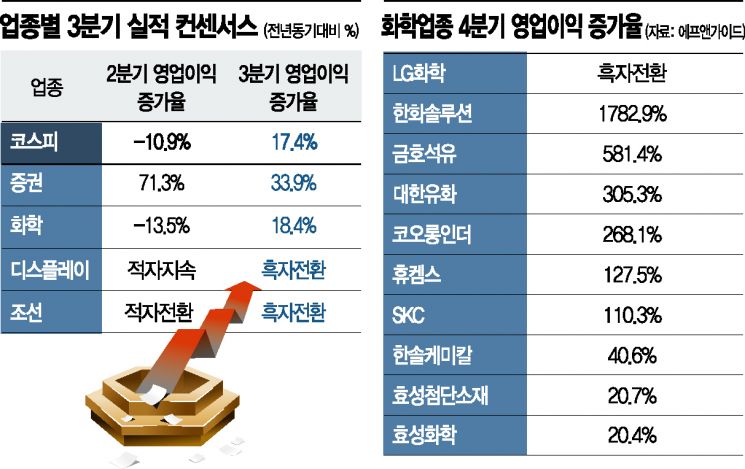

There are also sectors expected to perform better in Q4 than in Q3. The operating profit of 15 chemical companies, estimated by three or more securities firms, is projected to reach 1.4278 trillion KRW in Q4, more than three times the 416.4 billion KRW recorded in Q4 last year. Among these 15 chemical companies, 12 are expected to see an increase in operating profit compared to the same period last year, and net profit estimates show improvement in all but one of the 12 companies compared to the previous year. While the chemical sector showed earnings improvement in Q3, it was limited to about half of the companies, but most chemical firms are expected to perform well in Q4, increasing expectations for a turnaround as the second half progresses.

Among them, companies showing notable earnings improvements in both Q3 and Q4 include LG Chem, Kumho Petrochemical, and Hanwha Solutions. LG Chem's operating profit for Q3 is forecasted at 665.7 billion KRW, a 75.1% increase from 380.3 billion KRW in the same period last year, and it is expected to return to profitability in Q4 with 635.5 billion KRW, reversing a 12.6 billion KRW operating loss in Q4 last year. Kumho Petrochemical and Hanwha Solutions also show remarkable operating profit growth. Kumho Petrochemical's Q3 operating profit is estimated to increase by 113.8% year-on-year, and by 581.4% in Q4. Hanwha Solutions' operating profit growth is projected to rise from 6.3% in Q3 to 1782.9% in Q4. Additionally, Daehan Petrochemical, Kolon Industries, Huchems, and SKC are expected to see triple-digit increases of 100-300% in operating profit in Q4 compared to the same period last year.

In the securities industry, it is emphasized that earnings forecasts continue to rise not only for securities and chemicals but also for economically sensitive value stocks such as automobiles and steel, suggesting that these sectors deserve close attention. Kim Jiyoon, a researcher at Daishin Securities, said, "As the Q3 earnings season approaches, we focus on sectors and companies expected to lead the KOSPI earnings recovery with a turnaround in performance. Among sectors that shifted from a decline in growth rate in Q2 to an increase in Q3, those expected to sustain earnings growth into Q4 and see upward consensus revisions include not only chemicals but also automobiles, machinery, non-ferrous metals, and displays."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)