SK Securities Report

Performance Expected to Improve Until 2021

[Asia Economy Reporter Minji Lee] Considering the increasing automobile production volume from the second half of the year, there is an opinion that interest in automobile parts stocks should be expanded. On the 4th, SK Securities stated that given the recovery of the Chinese market and the emergence of new finished car manufacturers, a stock price alignment between parts companies and finished car manufacturers is expected, recommending Mando and Hyundai Mobis as top picks.

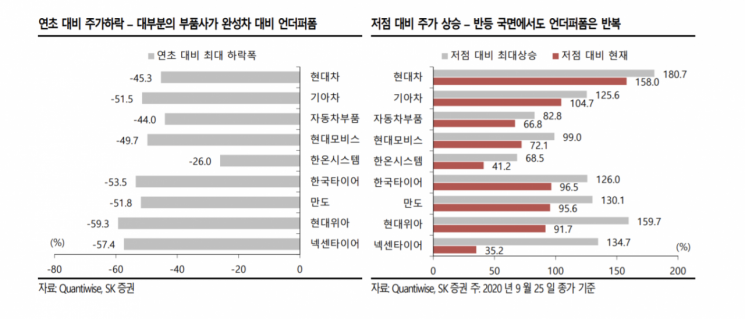

The automobile sector has shown a sharp recovery in both performance and stock prices since the COVID-19 pandemic. Finished car manufacturers such as Hyundai and Kia showed a rapid recovery, but parts companies' stock prices fell more and rose less. This is because finished car companies could benefit from inventory depletion, reduced incentives, and new car effects, unlike parts companies. On the other hand, parts companies' performance slumped directly due to the impact of decreased production volume.

Researcher Kwon Soon-woo of SK Securities explained, “It is true that there were positive factors for the stock price rise of finished car companies, but even considering this, a significant price gap has occurred,” adding, “It is time to pay attention to parts companies whose stock prices have risen less.”

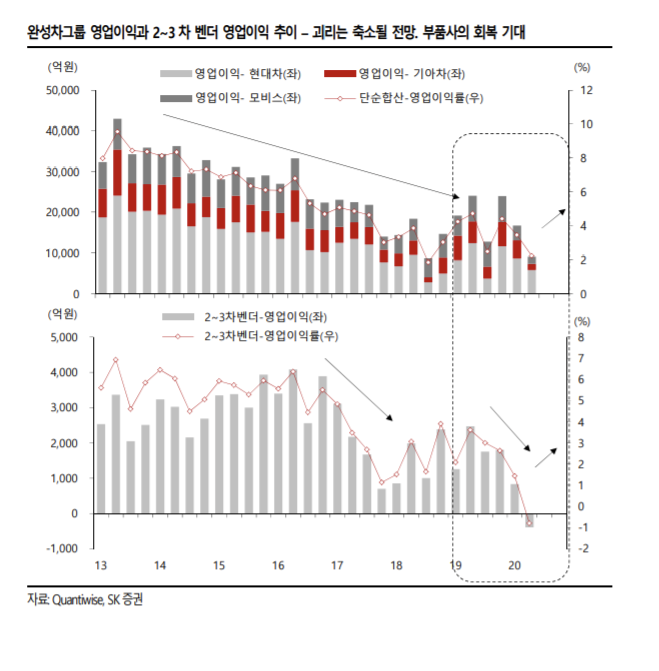

Opportunity factors for parts companies include △ production increase △ recovery of the Chinese market △ emergence and growth of new finished car manufacturers centered around Tesla. Unlike the first half of the year, automobile production volume in the third quarter showed improvement compared to the previous quarter as it escaped the impact of COVID-19. Volume increase is expected in the fourth quarter as well, and if there are no external variables, this trend is expected to continue until 2021.

The rapid recovery in China is also positive. In fact, weekly reported retail and wholesale sales in China are showing levels similar to or increasing compared to the previous year. If demand remains sluggish, economic stimulus measures can also be expected. Although Hyundai Motor Group's sales and production are sluggish, the low base effect is expected to improve over time, which is another factor to consider. Given that there are no additional production cut plans in the current Korea Automobile Parts Association (CAPA) plan, the Chinese market is expected to focus more on recovery rather than further deterioration.

New manufacturers are also expected to achieve external growth surpassing existing finished car manufacturers. Tesla is actively expanding not only in the US and China but also into Europe, including Germany. Chinese electric vehicle startups are also reportedly considering entry into Europe. Researcher Kwon Soon-woo analyzed, “The emergence and growth of new finished car manufacturers will act as factors for customer diversification and mix improvement in the parts market,” adding, “An oligopoly of competitive parts companies will appear and be reflected in stock prices.”

Among parts companies, 2nd and 3rd tier vendors are expected to show a rapid performance recovery. Although 2nd and 3rd tier vendors recorded losses in the second quarter, marking their worst performance since 2013, a stock price rebound through performance recovery is expected in the second half of the year. Researcher Kwon Soon-woo advised, “Among the parts sector, we recommend Mando and Hyundai Mobis as top picks,” adding, “It is also necessary to broaden interest to SL, Sebang Battery, and Sungwoo Hitech.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![A Woman with 50 Million Won Debt Clutches a Stolen Dior Bag and Jumps... A Monster Is Born [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)