Political Uncertainty Grows but Stimulus Package Agreement Progresses

Attention Expected to Focus on Future Additional Policy Measures

[Asia Economy Reporter Minwoo Lee] Political uncertainty is escalating as U.S. President Donald Trump tested positive for COVID-19. Consequently, the U.S. stock market, which had been steadily rising during the domestic holiday period, reversed and declined across the board. In this situation, the key is expected to be the additional economic stimulus package currently under negotiation in the political arena.

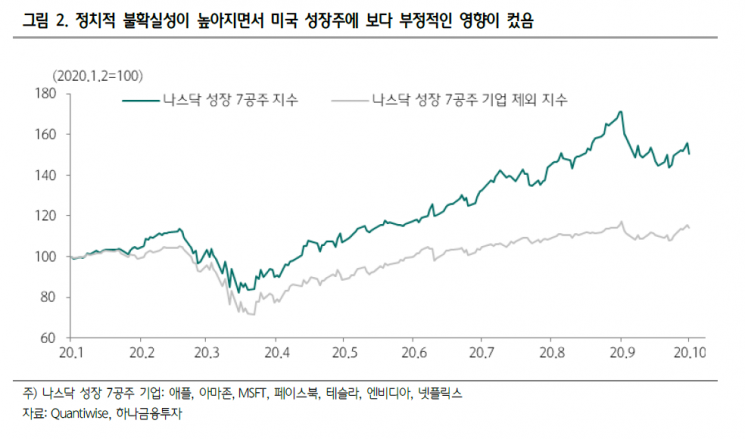

President Trump, who is facing re-election, was diagnosed with COVID-19 on October 2 (local time) and is currently hospitalized and receiving treatment at Walter Reed Military Hospital. This is a double blow following a drop in his approval rating from the 40% range to the high 30% range after the first TV debate. His competitor, Democratic presidential candidate Joe Biden, maintained support in the 60% range even after the TV debate. As political uncertainty increased, the tech-heavy Nasdaq and S&P growth stocks, which had steadily risen during the domestic holiday period, closed down 2.2% and 1.7%, respectively, on the day of Trump's positive diagnosis.

However, not all markets plunged. The dollar index (currently 93.8 points / end of September 93.9 points) and the offshore yuan exchange rate (currently 6.75 yuan / end of September 6.78 yuan) did not experience significant spikes. Lee Jae-man, a researcher at Hana Financial Investment, said, "The high-yield spread also maintained a downward trend at 510 basis points (bp = 0.01 percentage points), and the Russell 2000 index, which tracks small and mid-cap stocks, rose for three consecutive days," adding, "It is difficult to conclude that risk appetite has particularly deteriorated."

Rather, the stock market is focusing on the policy cards that President Trump, whose approval rating has declined, might present. Although the unemployment rate decreased last month, the number of new private sector jobs has steadily declined since peaking in June. Permanent unemployment has actually increased. This is why there is a view that the labor market recovery is still insufficient. Therefore, the need for fiscal spending is likely to be emphasized. Negotiations on fiscal stimulus between the U.S. Republican and Democratic parties are also showing signs of breaking the deadlock. On October 2, U.S. House Speaker Nancy Pelosi said, "Stimulus negotiations are optimistic," and U.S. Treasury Secretary Steven Mnuchin also stated, "We are in mutual agreement."

Although the U.S. government spending growth rate has declined year-on-year this year, the leading indicator, capital goods (excluding defense) orders growth rate, has continued to rise year-on-year for two consecutive months. The Dow Transportation Index is also maintaining an upward trend, buoyed by the turnaround in capital goods orders growth and expectations for a fiscal stimulus agreement. While funds are flowing out of the S&P 500 growth stock exchange-traded funds (ETFs), funds have been steadily flowing into Dow Transportation Index ETFs since August.

Researcher Lee judged that the high possibility of a U.S. fiscal stimulus agreement will serve as a support for the stock market amid heightened political uncertainty. He explained, "Although there is still a difference in the amount of fiscal stimulus between the Democrats and Republicans, interest will increase in the green investments emphasized by Democratic candidate Biden and the traditional infrastructure and 5G investments emphasized by Republican President Trump," adding, "The continued inflow of funds into Nasdaq clean energy and S&P 500 tech ETFs is evidence of this."

In the domestic stock market, representative companies that could be linked to the U.S. fiscal stimulus and bipartisan investments are Samsung Electronics (5G) and Hyundai Motor Company (hydrogen and electric vehicles). Last month, the year-on-year growth rate of domestic semiconductor exports was +12%, and automobiles +23%, leading the improvement in domestic exports (year-on-year comparison: August -7.5% → September +3.6%). Both items recorded the highest growth rates since last year. Researcher Lee predicted, "The improvement in domestic semiconductor and automobile exports will increase confidence in the profit improvement of Samsung Electronics and Hyundai Motor Company," and added, "It will also have a very positive impact on the improvement of foreign investors' views on these two companies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.