Common Banking Sector ... Total Loan Limit Set at 900 Billion Won

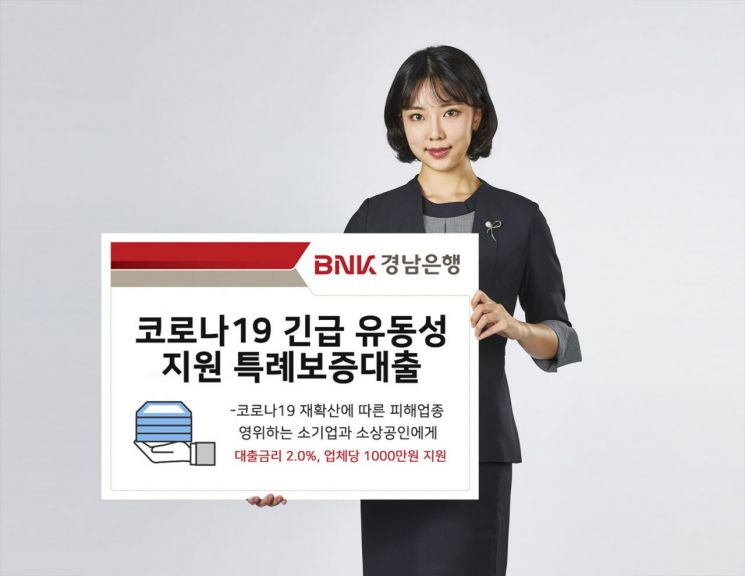

BNK Gyeongnam Bank announced on the 29th that it will implement the 'COVID-19 Emergency Liquidity Support Special Guarantee Loan' for small businesses and small merchants facing operational difficulties due to the resurgence of the novel coronavirus infection (COVID-19). (Photo by BNK Gyeongnam Bank)

BNK Gyeongnam Bank announced on the 29th that it will implement the 'COVID-19 Emergency Liquidity Support Special Guarantee Loan' for small businesses and small merchants facing operational difficulties due to the resurgence of the novel coronavirus infection (COVID-19). (Photo by BNK Gyeongnam Bank)

[Asia Economy Yeongnam Reporting Headquarters, Reporter Hwang Choi Hyun-joo] BNK Gyeongnam Bank announced on the 29th that it will implement the 'COVID-19 Emergency Liquidity Support Special Guarantee Loan' to stabilize the management of small business owners.

According to BNK Gyeongnam Bank, the COVID-19 Emergency Liquidity Support Special Guarantee Loan, with a common bank limit of 900 billion KRW, is structured so that the Korea Credit Guarantee Fund supports the interest difference through secondary compensation.

The current interest rate applied to BNK Gyeongnam Bank customers is 3.0%. Since the Korea Credit Guarantee Fund provides 1.0% secondary compensation, the effective loan interest rate for small enterprises and small business owners is about 2.0%.

The special guarantee loan support targets small enterprises and small business owners operating in industries affected by the resurgence of COVID-19, such as restaurants, educational services like academies, pubs, karaoke room operations, other sports facilities, performance facility operations, computer game rooms, and door-to-door sales.

The loan limit is 10 million KRW per business without differentiation. The guarantee ratio is 100% full guarantee, and the loan period is 3 years. It can be extended annually for up to 2 years after maturity.

Kang Sang-sik, Executive Director of the Credit Sales Headquarters, said, "The emergency liquidity support special guarantee loan targets high-risk facilities and businesses subject to gathering bans that have been severely affected by the resurgence of COVID-19," adding, "We hope small business owners in these industries overcome difficulties by utilizing the COVID-19 Emergency Liquidity Support Special Guarantee Loan."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.