Revenue Plunge and Fraud Scandal Involved... Industry Shocked Saying "Market Failure, Not Individual Failure"

Global Banks Like BNP Paribas Withdraw from Trade Finance Business One After Another

Concerns Over Increased Consumer Burden and Market Concentration

[Asia Economy Reporter Jeong Hyunjin] The industry is abuzz as the Dutch ABN AMRO Bank has decided to withdraw from its commodity trade finance business, which boasts a 200-year history. Commodity trade finance involves lending funds to traders in markets such as energy, agricultural products, and raw materials, and earning interest and fees. ABN AMRO’s decision to exit this long-standing business due to poor profitability is seen as highly symbolic.

According to major foreign media on the 28th (local time), ABN AMRO recently declared the termination of the related business, stating that "it has not achieved the necessary returns at an acceptable risk level for several years." The bank recorded a net loss of 5 million euros (about 680 million KRW) in the commodity trade sector in the second quarter. This marks a dramatic reversal compared to a net profit of 693 million euros in the same period last year. The losses followed the bankruptcy filing of Singapore-based commodity trading company Hin Leong in April and continued losses in various commodity trade finance operations.

Industry insiders familiar with the history of the company’s commodity trade finance business reacted with shock to the decision to withdraw. ABN AMRO traces its roots back to the Dutch bank established in 1824 by King William I of the Netherlands to finance the Dutch East Indies colony. The bank had never ceased operations even during crises such as the Great Depression. Credit rating agency S&P explained, "ABN AMRO was one of the world’s largest commodity trade finance providers alongside ING Group, Rabobank, BNP Paribas, Soci?t? G?n?rale, and Cr?dit Agricole." It is expected that about 800 employees will lose their jobs over the next 3 to 4 years due to ABN AMRO’s exit from this business.

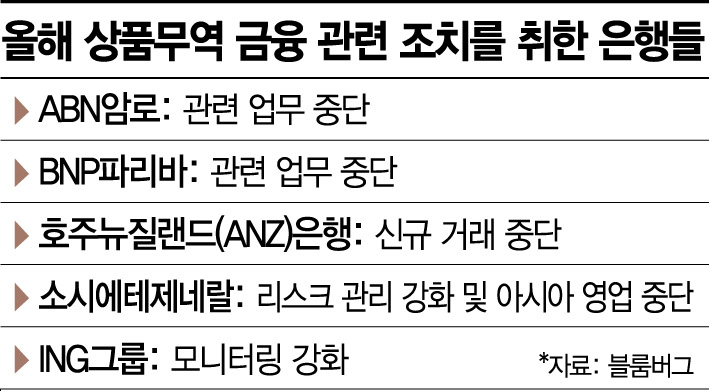

What draws the most attention, however, is that global banks are increasingly exiting the commodity trade finance business. According to Bloomberg and others, BNP Paribas of France decided to cease operations last month alongside ABN AMRO, and Australia and New Zealand Banking Group (ANZ) will maintain only existing contracts without entering new ones. Additionally, Soci?t? G?n?rale of France has strengthened risk management and halted Asia commodity trade finance operations conducted through its Singapore office. ING Group has increased monitoring of the related business. This indicates that major players are gradually withdrawing from the commodity trade finance market.

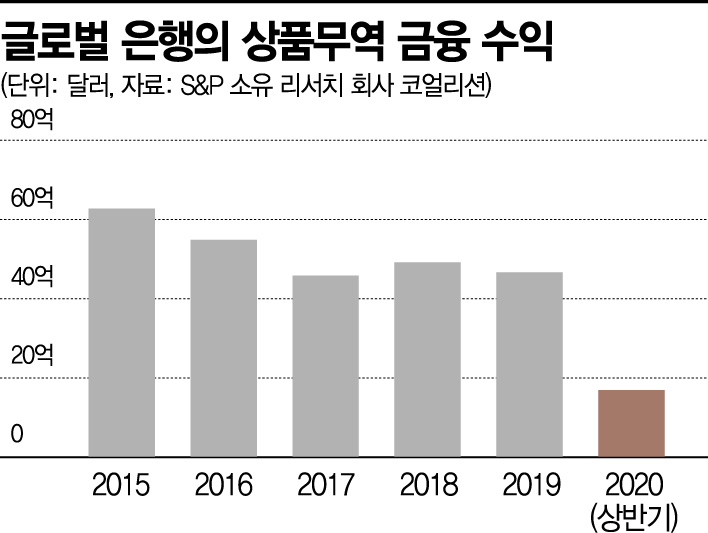

The primary reason global banks are exiting this sector is declining profitability. According to Coalition, a research firm owned by S&P, global banks’ revenue from commodity trade finance decreased from $6.3 billion (about 7.4 trillion KRW) in 2015 to $4.7 billion last year. Revenue in the first half of this year was only $1.7 billion, expected to be even lower than last year. The impact of the COVID-19 pandemic caused a 40% drop in the second quarter.

The plunge in oil prices, frozen trade, and reduced demand for raw materials due to a downturn in manufacturing have worsened the situation for major traders. Besides the bankruptcy of Singapore trader Hin Leong, UAE-based energy trader GP Global Group is also facing financial difficulties due to decreased fuel demand. Jean-Fran?ois Lambert, head of commodity trade finance at HSBC, said that profitability in this sector had significantly declined even before the pandemic due to low interest rates and stricter regulations, and predicted other banks would follow ABN AMRO’s decision.

A bigger problem is the growing distrust in the commodity trade market. Traders in commodity markets conduct transactions based on letters of credit issued by banks to guarantee credit. Especially when trading the same type of goods, transactions are based on automatically renewable, revolving credit facilities (RCF). However, Bloomberg reported that recently, financial firms inexperienced in commodity trade finance have entered the business, leading to deteriorated soundness and increased risks. This includes providing false information or unsecured loans.

John McNamara, a specialist who previously handled commodity trade finance at Deutsche Bank and now runs a related consulting firm, said, "ABN’s failure is not an individual failure but a market failure," adding that traders have long demanded cheap and unsecured RCFs.

If financial firms withdraw from the commodity market, the burden will fall entirely on consumers. This is because the cost burden on consumers who use commodities may increase. Banks still conducting related operations will take measures such as raising interest rates to compensate for risks, which leads to increased financing costs for traders. Also, as transactions are centered around large traders with substantial assets, small traders’ positions will gradually disappear, potentially reducing competition in service enhancement and cost reduction. Craig Pirrong, a finance professor at the University of Houston, explained to the Wall Street Journal (WSJ) that reduced competition will allow large traders to secure higher margins.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)