Uncertainties Surround US Presidential Election and More

KOSPI Expected to Fluctuate Between 2200 and 2400

October Shifts to Fundamental Market

Search for Solid Earnings Companies Heats Up

[Asia Economy Reporters Song Hwajeong and Oh Jooyeon] As market volatility expanded in September, leading to a correction phase, interest in the stock market trend in October after the holiday has increased. Since the volatility that shook the market in September is expected to continue affecting the market in October, the prevailing forecast is that the market will show a box range movement.

According to the Korea Exchange on the 29th, the KOSPI fell 0.78% from the beginning of this month to the previous day. The KOSPI, which had recovered the 2400 level at the beginning of the month, lost the 2400 level due to global volatility expansion and even broke below the 2300 level on the 24th. During the same period, the KOSDAQ fell 1.45%. The KOSDAQ also touched the 900 level intraday, raising expectations of breaking through 900, but soon turned weak and was threatened below the 800 level.

The market is closely watching whether the volatility that caused the September correction will continue into October. Kim Hyung-ryeol, head of the Kyobo Securities Research Center, said, "The October stock market is expected to reach the peak of confusion due to many events," adding, "Various variables such as political events in the U.S. and Japan, the process of confirming Q3 fundamentals, and valuation of growth stocks will affect investment sentiment and stock price fluctuations."

Box Range Movement Forecast: "Even if Additional Declines Occur, They Will Be Limited"

From Liquidity Market to Fundamental Market

The U.S. presidential election is the biggest factor increasing volatility. With the U.S. presidential election scheduled for November 3, political uncertainty is higher than ever as President Donald Trump mentioned the possibility of contesting the results if defeated. Seo Sang-young, a researcher at Kiwoom Securities, diagnosed, "U.S. political uncertainty increases the possibility of delays in additional stimulus measures," adding, "Especially, the burden of a fiscal spending gap until the November 3 election could increase the likelihood of investment sentiment contraction." Kiwoom Securities forecast the KOSPI range for October to be between 2200 and 2350.

Due to increased volatility, a box range movement is expected to continue. Oh Tae-dong, head of the investment strategy team at NH Investment & Securities, said, "Given that the market capitalization of the Korean stock market relative to GDP approached an all-time high in September, it will not be easy to break the highs of August and September immediately, but since low discount rates are maintained and abundant domestic stock buying funds are waiting, the additional decline will also be limited," adding, "The KOSPI will digest the U.S. presidential election event and continue to fluctuate within the 2200 to 2450 box range while waiting for clearer economic recovery signals."

In particular, the October stock market is expected to shift from a liquidity-driven market to a fundamentals-driven market, so attention should be paid to corporate earnings. Researcher Seo said, "The Korean stock market is changing from a liquidity market to a fundamentals market after the U.S. Federal Open Market Committee (FOMC) meeting in September," adding, "Since Q3 earnings announcements will be in full swing in October, if earnings exceed expectations, it will raise hopes for volatility easing."

7 out of 10 Domestic Listed Companies

Expected to Increase Operating Profit in Q4

All Top 10 by Market Cap Show Growth

The market is already busy searching for 'solid earnings stocks' that can shine after the correction. Analysis suggests that if the risk asset rally resumes from Q4, the domestic stock market will also show strength. It is noteworthy that 7 out of 10 domestic listed companies are expected to increase operating profit in Q4 compared to the same period last year.

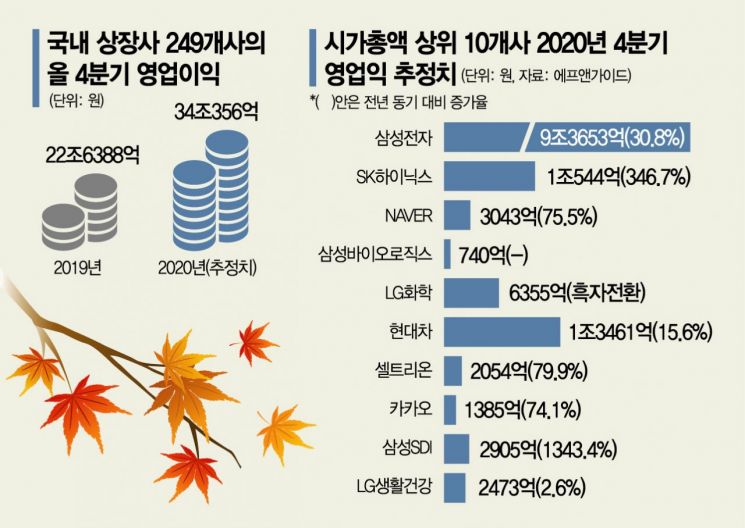

According to financial information provider FnGuide, the estimated operating profit for Q4 of this year for 249 listed companies, estimated by three or more securities firms, totaled KRW 34.0356 trillion. This is a 50.34% increase compared to KRW 22.6388 trillion in Q4 last year. Excluding 7 companies whose year-over-year operating profit change is unknown, 159 companies showed an increase in operating profit compared to the same period last year. Only 50 companies showed a decrease, making the difference more than threefold.

Twenty-three companies are expected to turn profitable compared to the same period last year, and two companies are expected to reduce losses, so a total of 184 companies are forecasted to improve operating profit compared to Q4 last year. The ratio is 73.90%, meaning about 7 out of 10 companies.

All top 10 companies by market capitalization are expected to show an increase in operating profit in Q4 compared to the same period last year. As semiconductor earnings strength improves, Samsung Electronics is expected to increase operating profit by 30.8% to KRW 9.3653 trillion in Q4, and SK Hynix is expected to increase by 346.7% to KRW 1.0544 trillion. Internet companies such as NAVER and Kakao, and secondary battery companies such as LG Chem and Samsung SDI are also expected to improve or increase operating profit compared to the same period last year. NAVER and Kakao are expected to continue earnings improvement in the second half, increasing by 75.5% and 74.1% respectively in Q4, and LG Chem is expected to turn profitable. Samsung SDI showed the most remarkable increase among the top 10 by market cap, with a 1343.4% increase compared to the same period last year.

Lee Jae-sun, a researcher at Hana Financial Investment, said, "The variable that determines success or failure in breaking new highs during the KOSPI recovery process after the crisis is whether earnings increase compared to the previous year," adding, "The most important thing is whether the market can transition from a liquidity-driven market to an earnings-driven market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)