August Industrial Production Declines for First Time in 3 Months

Corporate Sentiment Also Falls for First Time in 5 Months

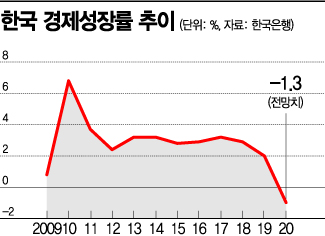

Bank of Korea Warns "Growth Rate May Drop to -2% Range if COVID Resurgence Continues Until Year-End"

Chuseok, one of the biggest holidays in South Korea, is expected to become another test that will determine this year's economic growth rate. So far this year, after holidays in May and August, there has been a tendency for COVID-19 to spread, making it inevitable to revise growth forecasts downward. This time, attention is focused on whether the 'growth rate jinx' will be broken by wisely overcoming Chuseok.

Economic Indicators Plummet Due to COVID-19 Resurgence in August

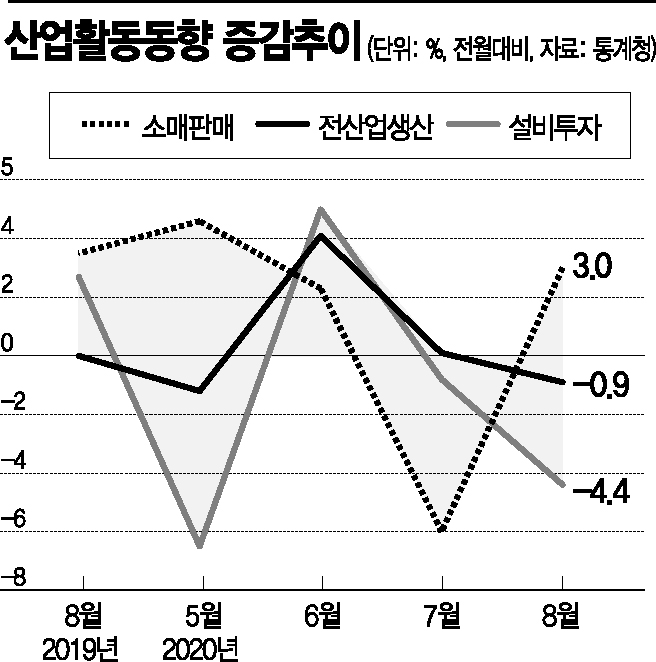

According to the 'August 2020 Industrial Activity Trends' released by Statistics Korea on the 29th, total industrial production (seasonally adjusted, excluding agriculture, forestry, and fisheries) fell by 0.9% compared to the previous month last month. This is the first decline in three months since May (-1.2%).

Service production, which had increased for four consecutive months, turned to a decrease, and manufacturing production, which had risen for two months, also declined. Service production increased in finance and insurance (3.7%) and health and social welfare (0.4%), but decreased in accommodation and food services (-7.9%) and wholesale and retail trade (-1.5%), resulting in a 1.0% decrease compared to the previous month. Mining and manufacturing decreased, although electricity and gas production increased, leading to a 0.7% decrease in mining and manufacturing production compared to the previous month. In particular, manufacturing production fell by 1.0% compared to the previous month due to declines in food products (-7.3%) and automobiles (-4.1%). This was due to reduced exports as signs of COVID-19 resurgence appeared in the United States and the European Union (EU). Manufacturing shipments decreased by 1.4%. Domestic shipments fell by 1.8% compared to the previous month, and exports decreased by 0.9%.

Economic sentiment felt by companies and the public also declined. According to the 'September Business Survey Index (BSI) and Economic Sentiment Index (ESI)' released by the Bank of Korea on the same day, the BSI for all industries this month was 64, down 2 points from the previous month. After steadily recovering since April (51), the BSI fell for the first time in five months. The non-manufacturing BSI (62, -4 points), which has a high proportion of face-to-face industries, was particularly weak due to the COVID-19 resurgence. The manufacturing BSI generally showed a recovery trend, but the manufacturing SMEs recorded 58, down 4 points from 62 in the previous month. The Economic Sentiment Index (ESI), which reflects the comprehensive economic sentiment of the private sector including companies and households, fell 6.5 points from the previous month to 73.2.

Bank of Korea to Revise Growth Rate in November... Possibility of Continued Improvement if Chuseok is Overcome Well

The Bank of Korea will revise this year's growth forecast for the last time in November. Previously, the Bank of Korea lowered the growth forecast from 2.1% to -0.2% in the May economic outlook, and further lowered it to -1.3% in August. The basic scenario of the August economic outlook assumed that the COVID-19 resurgence would begin to subside from October, meaning that whether the spread of COVID-19 calms down after Chuseok is crucial. The Bank of Korea stated in the August forecast that if the COVID-19 resurgence continues through winter, a growth rate in the -2% range cannot be ruled out.

A Bank of Korea official said, "To properly check whether the third quarter is moving as expected, we need to look not only at industrial activity trends but also export indicators," adding, "In the case of exports, since the number of working days was affected by the Chuseok holiday in early September last year, we need to compare by taking this into account, and we need to look at the components of the improved coincident index to be confident that the economy is on an improving trend."

The 'Industrial Activity Trends' released by Statistics Korea on the same day showed an improving trend in the coincident and leading index cyclical components. The coincident index cyclical component, which indicates the current economic condition, rose 0.4 points from the previous month to 97.6. The leading index cyclical component, which forecasts future economic conditions, increased by 0.6 points to 100.9. However, the economic sentiment index, which greatly influenced the leading index cyclical component, was surveyed before the COVID-19 resurgence and thus did not fully reflect the impact of COVID-19.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.