Policy-type New Deal Fund Proposes Investment Areas Including Robots, Energy Efficiency Improvement, Smart Farms, and Eco-friendly Consumer Goods

New Deal Infrastructure Fund Also Defines Investment Scope

Experts Say "How Can They Invest Without Concrete Business Plans... Some Markets Are Already Saturated"

[Sejong=Asia Economy Reporters Kim Hyunjung and Jang Sehee] As the government announced investment guidelines related to the public participation-type Korean New Deal Fund, experts expressed concerns that the fund's sustainability and incentive effects might be limited. This is because the Korean New Deal projects, which are mostly mid- to long-term, do not align with the general tendency of domestic private investors who expect short-term results, and it remains difficult to rule out the possibility of losses.

◆Guidelines Presented for Investment in Green, Digital, and Other Projects= On the 28th, at the 4th Korean New Deal Ministerial Meeting and the 17th Central Disaster and Safety Countermeasure Headquarters meeting held at the Government Seoul Office, the government finalized and announced guidelines related to New Deal Fund investments. The New Deal Fund is a government-led investment project aligned with the 'Korean New Deal Comprehensive Plan' announced by the government in July. The guidelines announced on this day pertain to policy-type New Deal Funds and New Deal Infrastructure Funds, excluding private New Deal Funds among the public participation-type New Deal Funds.

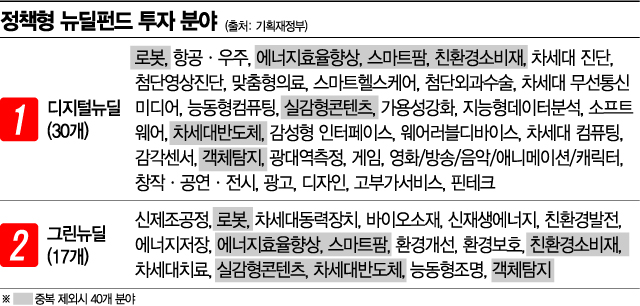

First, 40 sectors (excluding overlaps) were selected as investment targets for the policy-type New Deal Fund, which is planned to be raised at a scale of 20 trillion won over five years (3 trillion won from the government, 3 trillion won from policy finance, and 13 trillion won from the private sector). In the Digital New Deal sector, 30 fields were presented, including aviation and aerospace, next-generation diagnostics, advanced imaging diagnostics, personalized medicine, and smart healthcare. In the Green New Deal sector, 17 fields were mentioned, including renewable energy, next-generation power devices, bio-materials, and eco-friendly power generation. Seven fields such as robotics, energy efficiency improvement, smart farms, eco-friendly consumer goods, immersive content, next-generation semiconductors, and object detection were identified as overlapping investment targets for both projects.

The scope of the public offering fund, New Deal Infrastructure, was defined as ▲infrastructure (social overhead capital) that forms the basis for realizing the digital and green economy presented in the Korean New Deal Comprehensive Plan. Broadly, it is divided into ▲economic activity infrastructure such as roads, railways, and ports ▲social service provision facilities such as kindergartens, schools, and libraries ▲other public facilities such as public offices, community sports facilities, and recreational facilities. Specific projects include 5G networks, cloud and data centers, intelligent transportation systems (ITS), public WiFi, green remodeling, solar power installation, and environmental basic facilities.

Hong Nam-ki, Deputy Prime Minister and Minister of Economy and Finance, is delivering opening remarks at the "4th Korean New Deal Ministerial Meeting and 17th Central Emergency Economic Countermeasures Headquarters Meeting" held on the 28th at the Government Seoul Office in Jongno-gu, Seoul. Photo by Kang Jin-hyung aymsdream@

Hong Nam-ki, Deputy Prime Minister and Minister of Economy and Finance, is delivering opening remarks at the "4th Korean New Deal Ministerial Meeting and 17th Central Emergency Economic Countermeasures Headquarters Meeting" held on the 28th at the Government Seoul Office in Jongno-gu, Seoul. Photo by Kang Jin-hyung aymsdream@

◆Experts Express Concerns about Investment Concentration and Limited Incentives for Long-Term Projects= However, experts evaluated that the items listed on this day are unlikely to serve as practical 'guidelines' given the unclear specific business plans for investment targets. Some pointed out that sectors such as eco-friendly consumer goods, fintech, robotics, and renewable energy, which are among the investment targets of the policy-type New Deal Fund presented by the government, are already saturated in the existing market. Professor Kim Soyoung of Seoul National University’s Department of Economics said, "Some of the 197 items are saturated," adding, "Since it is unclear how individual projects will generate profits, the risk of (investors' losses) is high."

There are also concerns that the Korean New Deal, being fundamentally a mid- to long-term project, may not align with the profit expectation period and standards of domestic investors. Professor Kim said, "Looking at the general tendency of investors in our country, they usually do not wait even one year, let alone five years," and added, "If the promised returns are not significant, the incentive for long-term investment will be low." The issue of fiscal burden due to losses is also still being raised. Professor Kim said, "Companies and banks will also participate, and even if the government bears the initial burden, additional losses may occur," adding, "If public enterprises participate without clear profitability, the problem may grow over time."

Meanwhile, regarding project sustainability, Kim Yongbeom, the 1st Vice Minister of the Ministry of Economy and Finance, explained, "The New Deal Fund will not be depleted within a few months after its formation, nor will tax benefits disappear," and added, "It will be formed and executed on a fairly large scale over several years." He further stated, "By removing obstacles such as industrial promotion plans and institutional improvements, private funds without direct tax benefits are also voluntarily being proposed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.