BSI Survey on Top 600 Companies by Sales

Domestic Sales, Exports, and Investment Show Largest Decline in Last 10 Years

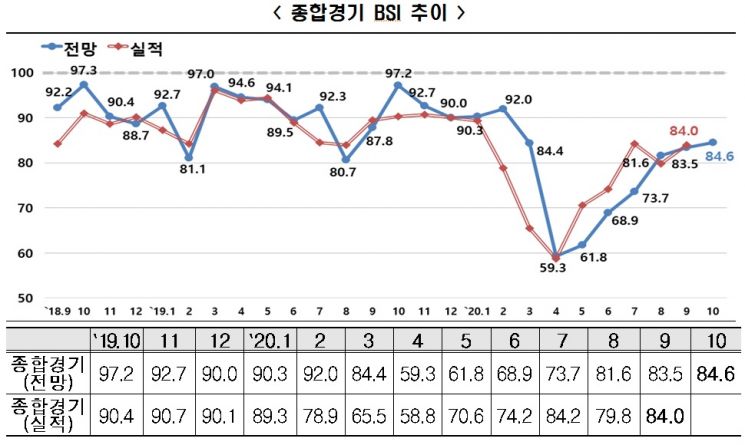

[Asia Economy Reporter Dongwoo Lee] The average Business Survey Index (BSI) performance for the third quarter of this year recorded the lowest level in 22 years since the 1998 International Monetary Fund (IMF) foreign exchange crisis.

The Korea Economic Research Institute announced on the 28th that the BSI survey conducted on the top 600 companies by sales showed that the average performance for the third quarter (July to September) of this year decreased by 4.8 points in domestic demand (84.9) and 5.3 points in exports (87.7) compared to the same period last year. Investment (85.7) also fell by 8.9 points, marking the largest decline in all three sectors in the past 10 years.

The performance index for September was 84.0, slightly up from the previous month (79.8), but still remained around the 80 level, continuing a negative outlook for 65 consecutive months. By sector, all areas including domestic demand (88.2), exports (90.5), investment (88.5), funds (90.8), inventory (102.0), employment (91.3), and profitability (88.0) recorded below the baseline. An inventory index above 100 indicates negative responses (excess inventory).

The outlook for October was 84.6, which is a 1.1-point increase from the previous month (83.5). This stagnation reflects uncertainties caused by the resurgence of COVID-19.

By sector, all areas including domestic demand (89.6), exports (90.2), investment (89.4), funds (91.6), inventory (100.8), employment (92.4), and profitability (91.9) remained below the baseline. Companies responded that concerns over worsening domestic demand and export sluggishness are significant due to local demand slowdown from the domestic and international COVID-19 resurgence and ongoing production disruptions at overseas factories.

By industry, non-manufacturing (86.2) showed a slight increase (+2.9 points) compared to the previous month, while manufacturing sentiment (83.4) stagnated (-0.2 points). Particularly, negative outlooks expanded significantly in key domestic heavy industries. The three sectors of automobiles (61.1), machinery (85.7), and petrochemicals (84.6) saw their outlooks drop by more than 10 points compared to last month. The electronics and telecommunications equipment sector (71.4), which includes semiconductors, continued its decline for the second consecutive month following last month.

The Korea Economic Research Institute analyzed that due to the COVID-19 resurgence and high external uncertainties, the domestic economy is highly likely to fall into a double-dip recession starting with the manufacturing sector.

Choo Kwang-ho, head of the Economic Policy Office at the Korea Economic Research Institute, stated, "Following the second quarter, corporate performance continued to decline in the third quarter, and the key manufacturing sector, which had been recovering since the direct hit from COVID-19 in April, is facing another crisis. This is expected to have a considerable negative ripple effect on the domestic economy." He emphasized, "It is urgent to prepare active liquidity support policies centered on key industries along with responses to internal and external risks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)