Increase of 2.5 trillion compared to Q1

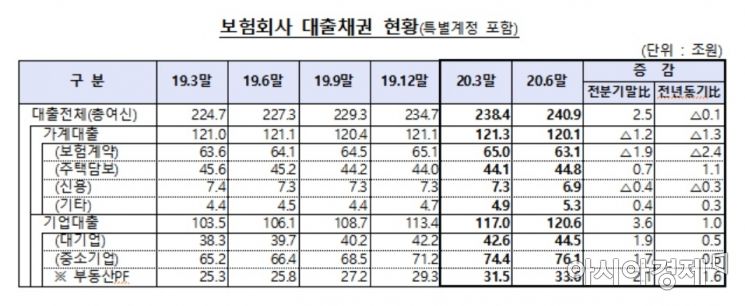

According to the status of insurance company loan receivables released by the Financial Supervisory Service on the 28th, the balance of insurance company loan receivables at the end of June was 240.9 trillion won, an increase of 2.5 trillion won from 238.4 trillion won in the first quarter.

According to the status of insurance company loan receivables released by the Financial Supervisory Service on the 28th, the balance of insurance company loan receivables at the end of June was 240.9 trillion won, an increase of 2.5 trillion won from 238.4 trillion won in the first quarter.

[Asia Economy Reporter Oh Hyung-gil] Insurance companies' loan receivables increased by 2.5 trillion KRW in the second quarter compared to the first quarter.

According to the status of insurance companies' loan receivables released by the Financial Supervisory Service on the 28th, the balance of insurance companies' loan receivables at the end of June was 240.9 trillion KRW, an increase of 2.5 trillion KRW from 238.4 trillion KRW in the first quarter.

Household loans decreased by 1.2 trillion KRW to 120.1 trillion KRW compared to the first quarter, while corporate loans increased by 3.6 trillion KRW to reach 120.6 trillion KRW.

Among household loans, insurance policy loans (contract loans) decreased by 1.9 trillion KRW to 63.1 trillion KRW, and credit loans also decreased by 400 billion KRW to 6.9 trillion KRW.

On the other hand, mortgage loans increased by 700 billion KRW to 44.8 trillion KRW.

Among corporate loans, large corporations accounted for 44.5 trillion KRW and small and medium enterprises for 76.1 trillion KRW, each increasing by 500 billion KRW compared to the first quarter. In particular, real estate project financing (PF) loans increased by 2.1 trillion KRW to 33.6 trillion KRW.

The delinquency rate of insurance companies' loan receivables was 0.22%, down 0.04 percentage points from the first quarter. Household loans decreased by 0.09 percentage points to 0.48%, and corporate loans decreased by 0.01 percentage points to 0.10%.

The ratio of non-performing loans also fell by 0.01 percentage points to 0.16%. Household loans decreased by 0.02 percentage points to 0.19%, and corporate loans decreased by 0.01 percentage points to 0.12%.

A Financial Supervisory Service official stated, "We will continue to strengthen monitoring of the soundness of insurance companies' loans, such as delinquency rates, and induce the enhancement of loss absorption capacity through sufficient provisioning for loan losses in response to the COVID-19 pandemic and other situations."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.