Bank of Korea '2020 First Half Domestic Internet Banking Service Usage Status'

[Asia Economy Reporter Kim Eunbyeol] In the first half of this year, the amount of loans taken out through internet banking, including mobile banking, exceeded 200 billion KRW per day on average. This is because customers in need of funds due to the impact of the novel coronavirus infection (COVID-19) preferred to take out loans non-face-to-face.

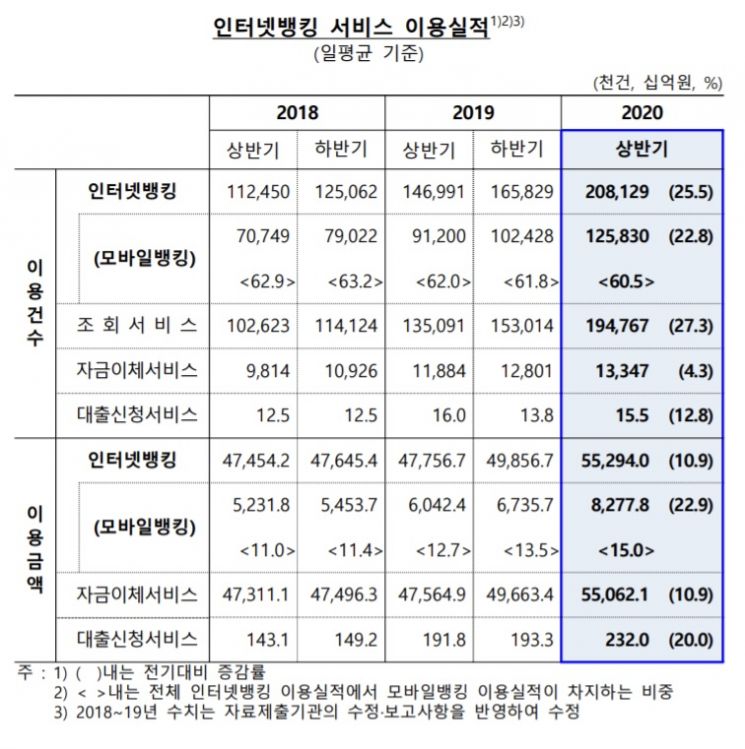

According to the "Status of Domestic Internet Banking Service Usage in the First Half of 2020" announced by the Bank of Korea on the 28th, the average daily number of internet banking loan application service cases in the first half of this year was about 15,500. This is a 12.8% increase compared to the second half of last year. The amount used for loan application services was 232 billion KRW, which increased by 20.0% during the same period.

A Bank of Korea official explained, "This is interpreted as a result of banks recently offering products that allow loans non-face-to-face, and customers also preferring non-face-to-face loans." The amount used for internet banking loan application services set a record high.

The number and amount of internet banking usage, including inquiry, fund transfer, and loan application services, also increased. The number of internet banking uses was 208.129 million cases, and the amount used was 55.294 trillion KRW, increasing by 25.5% and 10.9% respectively compared to the previous period.

Among these, the number of mobile banking uses increased by 22.8% to 125.83 million cases, and the amount used increased by 22.9% to 8.2778 trillion KRW. The share of mobile banking in internet banking was 60.5% by number of cases and 15.0% by amount.

The number of internet banking customers registered with 18 domestic banks including internet-only banks and the Korea Post was 164.79 million, an increase of 3.5% compared to the end of the previous year. The number of mobile banking registered customers increased by 6.0% to 128.25 million.

The number of people using internet banking for simple financial tasks without using counters or ATMs also increased.

The share of internet banking (including mobile banking) in deposit/withdrawal and fund transfer transactions was 64.3% in June. This is a 5 percentage point increase compared to 59.3% at the end of the previous year. Meanwhile, the share of cash dispensers (CD)/ATMs decreased from 26.4% to 22.7%, and the share of bank counters also dropped from 7.9% to 7.4% during the same period.

Based on account inquiry services, the share of internet banking was 91.5%, bank counters 5.9%, and CD/ATM 1.3%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.