Government's 4th Supplementary Budget Positively Impacts Economic Outlook

[Asia Economy Reporter Kim Cheol-hyun] Recently, with the decrease in confirmed cases of the novel coronavirus infection (COVID-19) and government economic stimulus measures such as the '2nd Disaster Relief Fund,' the economic outlook index has rebounded overall for the first time in two months as the economy is expected to improve somewhat.

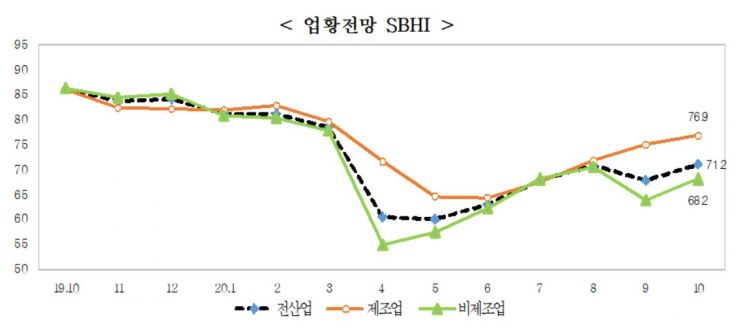

The Ministry of SMEs and Startups (Minister Park Young-sun) and the Korea Federation of SMEs (Chairman Kim Ki-moon) announced on the 28th that the 'October 2020 SME Economic Outlook Survey,' conducted from September 15 to 22 targeting 3,150 small and medium enterprises, showed that the October Business Outlook Economic Index (SBHI) recorded 71.2. This is 3.3 points higher than the September outlook index, which predicted a slowdown in business conditions due to the nationwide resurgence of COVID-19.

Overall, the manufacturing sector's October economic outlook rose 1.8 points from the previous month to 76.9, while the non-manufacturing sector increased 4.1 points to 68.2. The construction industry (73.8) rose 5.4 points, and the service industry (67.1) increased by 3.8 points.

In manufacturing, 15 industries showed increases centered on rubber and plastic products (69.6→81.3), printing and recorded media reproduction (62.8→73.9), textile products (59.5→68.8), and wood and wood products (67.6→76.1), whereas 7 industries, including beverages (100.3→84.9) and electrical equipment (74.7→67.1), declined. In non-manufacturing, construction (68.4→73.8) rose by 5.4 points, and services (63.3→67.1) increased by 3.8 points compared to the previous month. Within services, 7 industries including wholesale and retail trade (61.6→66.5) and professional, scientific, and technical services (70.9→75.8) rose, while 3 industries including education services (60.1→51.5) and transportation (69.0→66.6) declined.

Looking at the outlook by item across all industries, domestic sales (67.7→70.5), exports (76.2→80.8), operating profit (64.3→67.6), and financial conditions (62.3→66.7) improved compared to the previous month, and employment is also expected to improve somewhat.

However, when comparing the October SBHI with the average SBHI for the same month over the past three years, manufacturing is expected to worsen in overall economy, production, domestic demand, exports, operating profit, financial conditions, raw materials outlook, as well as equipment, inventory, and employment outlooks. Non-manufacturing is also expected to deteriorate in all categories.

In September, the main difficulties faced by SMEs were dominated by sluggish domestic demand (75.2%), followed by rising labor costs (38.0%), excessive competition among companies (37.4%), and delayed collection of sales proceeds (23.8%). The proportion of excessive competition among companies decreased from 40.5% to 37.4% compared to the previous month, while responses indicating rising labor costs (37.5%→38.0%) and delayed collection of sales proceeds (22.9%→23.8%) increased.

The average operating rate of small and medium manufacturing enterprises in August was 67.6%, down 0.1 percentage points from the previous month and 4.6 percentage points lower than the same month last year. By company size, small enterprises fell 0.3 percentage points from the previous month to 64.4%, while medium enterprises rose 0.2 percentage points to 70.7%. By company type, general manufacturing increased 0.1 percentage points from the previous month to 66.7%, while innovative manufacturing decreased 0.7 percentage points to 70.1%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.