Card Gorilla Announces Survey Results on 'First COVID Chuseok, How to Choose Holiday Gifts?'

Card Industry Also Focuses on Contactless Consumption

[Asia Economy Reporter Ki Ha-young] Amid changes in Chuseok holiday scenes due to the impact of the novel coronavirus infection (COVID-19), non-face-to-face methods have also been found to be the most preferred for holiday gifts. The card industry is responding to this non-face-to-face consumption trend by launching card products.

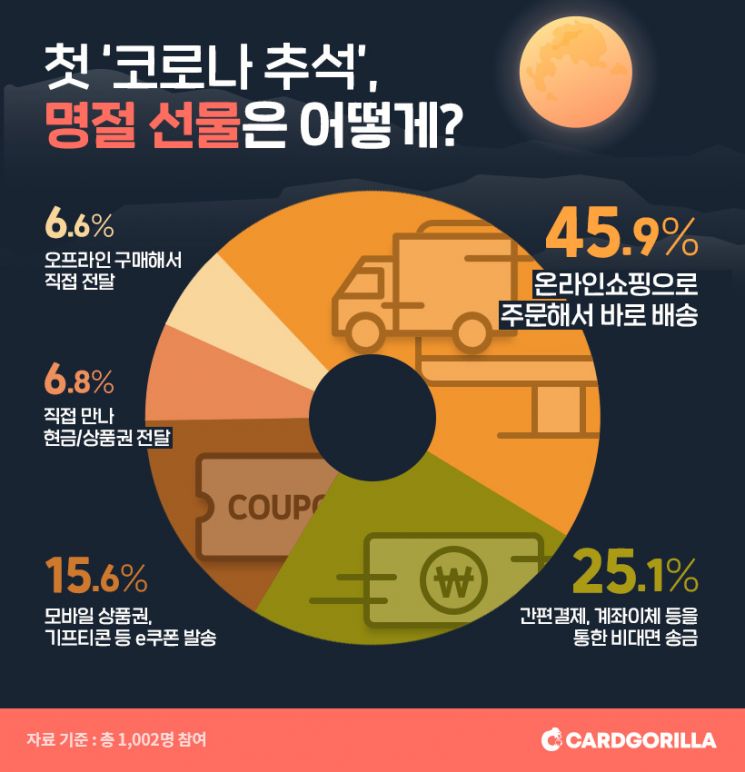

According to Korea's largest credit card specialist site, Card Gorilla, on the 26th, a survey titled "First COVID Chuseok, how about holiday gifts?" showed that 9 out of 10 people chose untact holiday gifts. The survey was conducted over two weeks from the 3rd to the 17th on visitors to the Card Gorilla website, with a total of 1,002 participants.

The first place was overwhelmingly won by "ordering through online shopping for direct delivery" with 45.9% (460 votes). Second place was "non-face-to-face remittance via simple payment or account transfer" (25.1%, 251 votes), and third place was "sending e-coupons such as mobile gift certificates and gifticons" (15.6%, 156 votes). All top three are untact holiday gifts, totaling about 86.6%.

Fourth place was "meeting in person to deliver cash or gift certificates" (6.8%, 69 votes), and fifth place was "offline purchase and direct delivery" (6.6%, 66 votes).

Go Seung-hoon, CEO of Card Gorilla, explained, "Due to concerns about the spread of COVID-19, the government designated the Chuseok holiday, including National Foundation Day and Hangul Day, as a special quarantine period, so the number of visitors returning home is expected to decrease. Accordingly, the trend of Chuseok gifts is also shifting to untact."

Card companies are presenting online shopping mall events for this Chuseok. BC Card offers a "10% discount coupon" on Chuseok gift items on Gmarket and Auction until the 27th. The discount coupon can be received twice daily per ID and can be used for same-day payments with BC Card (credit or check card).

Shinhan Card offers up to 20% discount on filial piety products such as massage chairs on Coupang until the 30th. Hana Card provides up to 15% coupon discount (up to 50,000 KRW) for purchases over 10,000 KRW on mart products at Wemakeprice until the 30th.

Woori Card also offers a 10% discount coupon on Chuseok gift items on Gmarket and Auction until the 27th. This benefit applies to special price products in the Chuseok Big Sale fresh food section, including Korean beef, fruits, traditional liquor, and Korean sweets. Additionally, until the 30th, customers can receive up to 7% discount on popular Chuseok season products on Lotte ON, and up to 10% discount coupons on Wemakeprice.

Card Industry Launches Products with Enhanced Online Benefits

The card industry is also responding to the untact trend by launching mobile-only cards and adding online benefits. Shinhan Card's 'YaY' launched in May, Hana Card's 'Modu-ui Shopping' launched the same month, and KB Kookmin Card's 'My Fit Card' launched in June are all mobile-only cards. Their benefits focus on non-face-to-face consumption.

The discontinued 'Lotte Like It Fun' as of September 1 was re-released as 'Like It Fun Plus' with added delivery app and simple payment benefits. The 'Hyundai Card Zero' series was renewed as 'Zero Edition 2,' adding simple payment and online video service (OTT) subscription services. The 'Card's Jeongseok Untact' launched in June doubled its discount rates for untact and subscription economy sectors within two months of launch, and Samsung Card also launched three digital-specialized products this month, including 'Tap Tap Digital.'

CEO Go said, "The winner in this year's card market will likely be determined by who responded fastest to the untact market," adding, "As the COVID-19 situation prolongs, middle-aged consumers in their 40s and above, who are major spenders, are increasing their non-face-to-face consumption such as online shopping and simple payments, so there is a noticeable trend of quickly launching related new cards or renewing benefits."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.