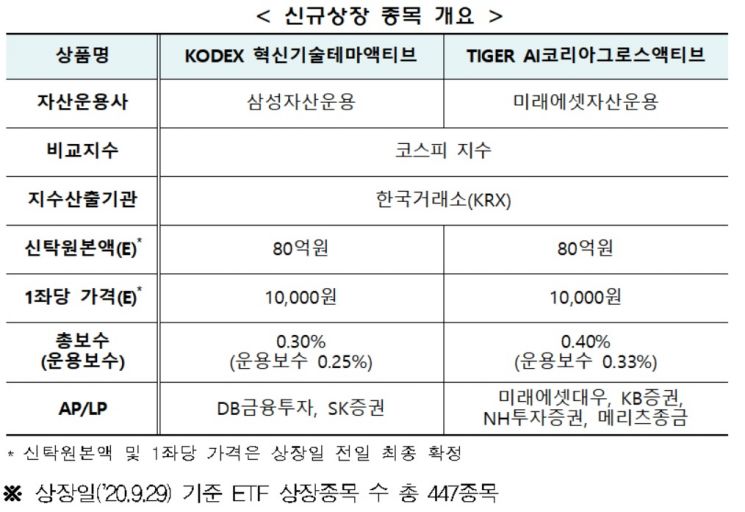

[Asia Economy Reporter Song Hwajeong] The Korea Exchange announced on the 25th that it will list the first equity active exchange-traded funds (ETFs), Samsung Asset Management and Mirae Asset Management's 'KODEX Innovation Technology Theme Active' and 'TIGER AI Korea Growth Active,' on the KOSPI market on the 29th.

The background for listing these equity active ETFs is the expansion of the active ETF scope from bond-type only to equity-type through the revision of the KOSPI market listing regulations enforcement rules, aiming to broaden the base of public fund investors and meet diverse investment demands.

The ETFs to be listed this time are managed by deciding stocks and trading timing through artificial intelligence (AI) analysis and the discretion of the managers, targeting excess returns compared to the KOSPI index. They combine the institutional advantages of ETFs such as low cost and accessibility with the characteristics of active funds that can achieve excess performance over market returns.

The KODEX Innovation Technology Theme Active ETF invests 70% of its assets in KOSPI constituent stocks and the remaining 30% in an innovation technology theme portfolio. The innovation technology theme portfolio is composed of the top seven representative themes based on the number of patent applications in each of the 16 technology fields related to the 4th Industrial Revolution, as defined by the Korean Intellectual Property Office (over the past three years). Using the big data engine of DeepSearch, a financial big data company, related keywords for each theme are extracted, and stocks are selected and scored by considering the frequency of keyword appearances in the business reports of listed companies. The final investment weights for each stock are determined by considering market capitalization, the final aggregated score, and incorporating opinions from Samsung Asset Management's Research Center.

The TIGER AI Korea Growth Active ETF invests more heavily in stocks with higher expected returns predicted by Mirae Asset Management's proprietary AI than their weighting in the KOSPI, aiming for excess returns relative to the index. The AI builds a model that predicts the expected returns of individual stocks for the following month using data generated in the current month based on various financial models, and constructs an algorithm to minimize the difference between expected and actual returns. The portfolio manager will additionally consider risk management and operational constraints (such as low liquidity and excessive market capitalization weight) when selecting stocks for the final investment portfolio.

A Korea Exchange official stated, "There may be discrepancies between index performance and management performance due to investment weights and changes in constituent stocks, and active ETFs may show greater performance differences compared to passive ETFs that simply track the index." The official added, "To help investors understand, the daily asset composition details will be provided on check terminals, the exchange, and asset management company websites, similar to passive ETFs."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.