Financial Authorities Order Loan Speed Control

Banks Prepare Plans to Reduce Total Loan Volume

Partial Repayment Encouraged for Loan Maturity Extensions

KakaoBank Opens Rate Hike with 0.15%P Increase Today

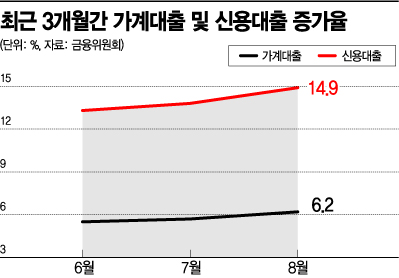

[Asia Economy Reporters Kangwook Cho, Minyoung Kim] A plan is being promoted to significantly reduce the unused limit when extending the maturity of a minus account (overdraft loan). In addition, not only will the credit loan maturity extension review be strengthened, but measures to reduce the limit are also being considered. This is in response to the financial authorities’ request for banks to independently review the status of credit loans and submit plans to reduce the total loan volume.

Significant Reduction in Loan Limit When Extending Maturity of Unused Minus Accounts

According to the financial sector on the 25th, commercial banks are expected to submit such loan volume reduction plans to the Financial Supervisory Service (FSS) on this day. Previously, the FSS requested commercial banks to report the balance of household loans by loan category until August, monthly household loan balance plans until December, credit loan limit calculation plans, maximum limit per borrower, and limit calculation methods for refinancing loans from other banks by this day.

A representative from Bank A said, "It is about submitting the current status and plans for overall household loans until the end of this year," adding, "There has been no such semi-annual or quarterly loan status reporting until now."

Banks plan to introduce a measure to significantly reduce the loan limit when extending the maturity of minus accounts that were opened but not used. For example, if a borrower has a 100 million KRW minus account limit and used only 50 million KRW in the past year, about half of the remaining 50 million KRW limit will be cut when extending the maturity.

‘Last Chance’ Before Regulation Enforcement... Surge in New Minus Account Openings

Recently, as the financial authorities announced plans to regulate credit loans, there was a rush to open minus accounts before the regulations took effect, known as the ‘last chance’ demand. From the 14th to the 17th, the new contract amount for minus accounts at the five major commercial banks?Shinhan, KB Kookmin, Hana, Woori, and NH Nonghyup?approached 800 billion KRW, surging nearly 70% in just one week. Additionally, from the 21st to the 23rd of this week, the credit loan balance at these five banks increased by a whopping 1 trillion KRW, a scale similar to the surge in credit loan balances from the 14th to the 16th.

However, the financial authorities emphasize that maturity extensions of credit loans should be monitored as closely as new loans. Although the limit cannot be reduced to less than half as with new loans, measures to reduce the limit each time the maturity is extended should be devised.

A representative from Bank B said, "We are reviewing measures to reduce non-face-to-face loan limits, minus accounts for professionals and high-income earners, and credit loan limits," adding, "Since most borrowers end up using the full limit once a minus account is opened, simply reducing the remaining limit can help control the increase in credit loans."

Stricter Review for Credit Loan Maturity Extensions

The review process for credit loan maturity extensions is expected to become stricter. The plan is to reduce the borrower’s loan limit and encourage partial repayment through this. Typically, credit loan maturity extensions are conducted on a one-year basis. Since the loan is renewed, the limit can be adjusted like a new loan, but banks have traditionally treated it as an already ongoing loan and did not reduce the limit. Maturity extensions could be easily done via phone calls or mobile applications, and limits were maintained if the borrower had no particular issues.

Interest Rate Increase Imminent... KakaoBank Raises by 0.15 Percentage Points

There is a possibility that interest rate adjustments for new credit loans will be made soon. Internet bank KakaoBank opened the door by raising the minimum interest rate for salaried worker credit loans from 2.01% to 2.16%, an increase of 0.15 percentage points. The increased rate applies from this day.

A representative from Bank C said, "We are considering adjustments to preferential interest rates, reducing benefits for subscription savings accounts, and reducing preferential benefits for main transaction customers."

Credit Loan Reduction Measures to Be Implemented After Chuseok Holiday

The financial authorities plan to review the loan reduction measures submitted by banks, supplement some parts, and provide guidelines. These credit loan reduction measures are expected to be implemented after the Chuseok holiday.

A financial sector official said, "We are internally reviewing adjustments to preferential interest rates based on salary transfers, savings subscriptions, and card usage performance after Chuseok."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)