'Discount system corresponds to special benefit provision?'

Financial Services Commission tells insurers "It does not apply"

[Asia Economy Reporter Oh Hyung-gil] It is expected that discounts on premiums will become possible for renewable insurance policies, which reset premiums after a certain period. Renewable insurance policies recalculate premiums every 1, 3, or 5 years, and premiums often increase due to changes in conditions such as age or health status.

According to the insurance industry on the 25th, the Financial Services Commission recently responded that a request for a legal interpretation from an insurance company to operate a 'Membership Credit' program offering premium discounts to policyholders upon contract renewal does not constitute a special benefit.

Renewable insurance policies have lower initial premiums compared to non-renewable insurance policies, which maintain the same premium throughout the payment period. This makes them easier for insurers to sell and preferred by consumers with limited financial resources. A representative product is the indemnity medical insurance, which is renewable, and recently, the types have expanded to include cancer insurance, health insurance, and children's insurance.

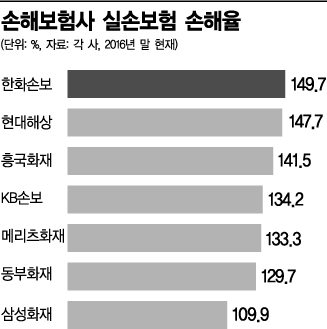

However, after a certain period post-enrollment, premiums become more expensive than non-renewable policies and tend to increase sharply, leading to high consumer dissatisfaction. Since standardization in 2009, indemnity insurance premiums have risen by about 10% earlier this year. Additionally, premium increases are expected next year due to high loss ratios.

Premium Discount Conditions Must Be Specifically Stated in Basic Documents

In particular, renewable insurance policies make it practically impossible to compare with non-renewable products because future premium increases are uncertain.

As a result, contract cancellations due to difficulty in maintaining contracts are frequently occurring. However, the industry views that enabling premium discounts for renewable insurance could enhance competitiveness.

The financial authorities judged that premium discounts are provided without discrimination to all policyholders and are not considered compensation for simple insurance solicitation or inducement benefits.

Under Article 98 of the current Insurance Business Act, persons involved in concluding or soliciting insurance contracts are prohibited from providing or promising special benefits to policyholders or insured persons related to the contract or solicitation. Special benefits include money or premium discounts not based on basic documents, promises to pay insurance benefits exceeding those specified in basic documents, and premium payments on behalf of others.

However, in the case of money, it is possible to pay the lesser of '10 percent of the premiums paid during the first year from the contract date' or '30,000 KRW.' For insurance contracts with monthly premiums exceeding 30,000 KRW, gifts can be provided up to the 30,000 KRW limit. Since the 2003 amendment of the Insurance Business Act, this limit has not changed, leading to calls for adjustment to reflect current realities.

A financial authority official explained, "Considering that the details of premium discount benefits are reflected in the basic insurance product documents, it may not be considered a special benefit," adding, "Conditions such as discount or surcharge of insurance benefits must be specifically stated in the basic documents."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.