KERI Economic Trends and Outlook Q3·Q4 2020 Report

[Asia Economy Reporter Dongwoo Lee] Due to the prolonged impact of the novel coronavirus infection (COVID-19), there is a forecast that the economic growth rate in the second half of this year will drop significantly compared to the first half.

The Korea Economic Research Institute (KERI) stated in its report "KERI Economic Trends and Outlook: Q3 and Q4 2020" on the 24th that it is virtually impossible for the Korean economy to rebound within the year due to economic contraction caused by the resurgence of COVID-19.

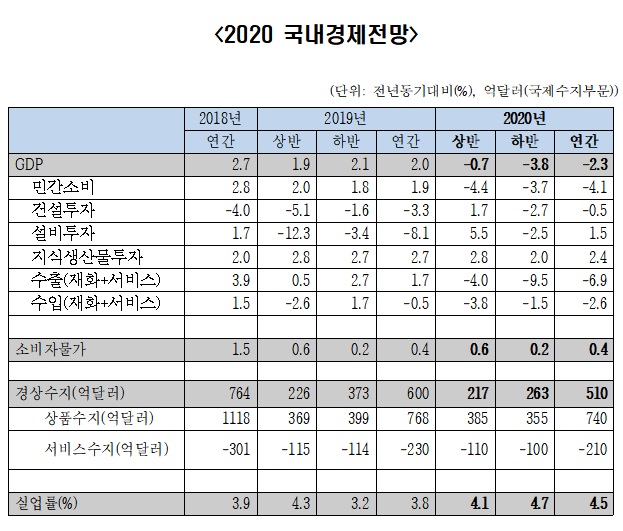

KERI projected this year's economic growth rate at -2.3%, the same as in the Q1 and Q2 report, forecasting -0.7% for the first half and -3.8% for the second half. Previously, in the Q2 report, KERI predicted a -2.9% growth rate for the second half, but lowered it by 0.9 percentage points within one quarter.

Although the government injected the largest-ever supplementary budget to support overcoming COVID-19, the gradual deterioration of economic conditions and sluggishness in major export countries make economic recovery in the second half virtually difficult, according to the analysis.

The growth rate of private consumption, which holds the largest share in domestic demand, is forecasted at -4.1%. Private consumption showed a temporary rebound in the first half of this year due to emergency disaster relief payments, but KERI explained that downward pressure has intensified due to the resurgence of COVID-19, a decline in nominal wage growth, and restrictions on consumption activities caused by strengthened social distancing measures.

Additionally, the burden of repayment due to a surge in credit loans and rent increases caused by soaring jeonse and monthly rents are also expected to pull down private consumption.

Facility investment is expected to grow by only 1.5% due to domestic demand stagnation and economic contraction in major export destinations. Construction investment is predicted to grow by -0.5%, despite improvements in civil engineering performance and announcements of large-scale supply measures, due to construction delays in the building sector and the effects of the government's real estate suppression policies.

Real exports are also forecasted to contract by -6.9%. This is because the spread of COVID-19 has not subsided in major countries, and the US-China trade conflict is intensifying. KERI expects the consumer price inflation rate to remain at around 0.4%, similar to last year.

The rise in agricultural product prices caused by the prolonged rainy season and increased housing costs due to soaring jeonse and monthly rents are expected to limit the extent of price declines caused by the economic recession.

The current account balance is forecasted to reach about $51 billion (59.7 trillion won), down $9 billion (10.5 trillion won) from last year, as the surplus in the goods balance shrinks and the deficit trend in the services balance continues.

KERI advised, "We must strengthen monitoring focusing on vulnerable sectors of the economy to prevent unfortunate incidents where the economic system could suddenly collapse due to unexpected domestic and external shocks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)